Vietnam: Shall a person signing an employment contract under 3 months have his/her taxable income deducted?

Vietnam: Shall a person signing an employment contract under 3 months have his/her taxable income deducted?

According to the provisions in Article 25 of Circular 111/2013/TT-BTC, the tax deduction is outlined as follows:

Tax Deduction and certificate of tax deduction

1. Tax Deduction

...

b) Income from salaries and wages

b.1) For resident individuals signing employment contracts of three (03) months or more, the organization or individual paying the income shall deduct tax according to the progressive tariff schedule, including cases where individuals sign contracts of three (03) months or more at multiple places.

b.2) For resident individuals signing employment contracts of three (03) months or more but resigning before the contract ends, the organization or individual paying the income shall still deduct tax according to the progressive tariff schedule.

...

i) Tax Deduction for Other Specific Cases

Organizations or individuals paying compensation, remuneration, or other payments to resident individuals who do not sign employment contracts (as instructed at points c, d, Clause 2, Article 2 of this Circular) or sign employment contracts under three (03) months with a total income payment from two million (2,000,000) VND per payment or more must deduct tax at a rate of 10% on the income before paying the individual.

In cases where individuals have only one source of income subject to tax deduction at the above-mentioned rate but estimate that the total taxable income of the individual, after subtracting family deductions, does not reach the taxable threshold, they can make a declaration (using the form enclosed with the tax management guidance document) to the income-paying organization as a basis for temporarily not deducting personal income tax.

Based on the declaration of the income recipient, the income-paying organization shall not deduct tax. At the end of the tax year, the income-paying organization must still compile a list and income report of individuals who do not reach the tax deduction threshold (using the form enclosed with the tax management guidance document) and submit it to the tax authority. The individual making the declaration must be responsible for their declaration, and in the case of fraud, they will be handled according to the provisions of the Tax Management Law.

Individuals making the declaration as instructed in this point must have taxpayer registration and a tax code at the time of the declaration.

...

Thus, in the case of employees signing employment contracts from 1 month to less than 3 months with a total income of two million (2,000,000) VND per payment or more, the enterprise will deduct 10% of the tax from the employee's income before paying it.

However, for employees who only have such income subject to tax deduction at the specified rate but estimate that their total taxable income, after family deductions, does not reach the taxable threshold, they can make a declaration to the income-paying enterprise as a basis for not temporarily deducting income tax for these employees.

Note that employees signing contracts under 3 months with a salary below 2 million VND each month are not subject to tax deduction.

Vietnam: Shall a person signing an employment contract under 3 months have his/her taxable income deducted? (Image from Internet)

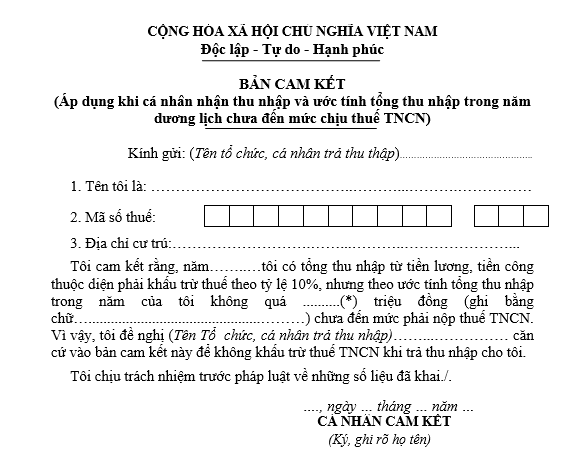

What is the current form for temporary non-deduction of personal income tax in Vietnam?

The latest form for temporary non-deduction of personal income tax is Form 08/CK-TNCN, issued with Circular 80/2021/TT-BTC.

>> Download Download Form 08/CK-TNCN Commitment Declaration Not to Arise Personal Income Tax

Taxpayers can refer to how to fill out the latest tax commitment form according to Form 08/CK-TNCN below:

(1) Respected: Enter the name of the organization or individual paying the income, do not enter the name of the tax authority (such as a company, enterprise, etc.).

(2) Enter your full name.

(3) Enter the tax code.

(4) Enter the residential address (permanent or temporary).

(5) Enter the estimated total income for the calendar year that does not reach the taxable threshold (write both the number and the words).

Individuals can refer to the table below to know the income subject to personal income tax.

(6) Request: Enter the name of the organization or individual paying the income.

Note: Tax code section: If the individual is assigned a 10-digit tax code, fill in all 10 digits, leaving the remaining 3 boxes blank.

- The * part: The amount declared in this section is determined by the family deduction calculated in the year.

What are procedures for issuance of certificate of tax deduction for employees signing employment contracts under 3 months in Vietnam?

According to Clause 2, Article 25 of Circular 111/2013/TT-BTC, it is stipulated:

Enterprises must issue a certificate of tax deduction upon request of employees whose income is deducted. If individuals authorize tax finalization, no certificate of tax deduction is issued.

For individuals signing employment contracts under three (03) months: the individual has the right to request the organization or individual paying the income to issue a certificate of tax deduction for each tax deduction or issue one document reflecting the total tax deducted within a tax period.

Example 15: Mr. Q signed a service contract with company X to care for the landscape in the Company’s campus on a monthly schedule from September 2013 to April 2014. Mr. Q's income was paid monthly by the Company with an amount of 03 million VND.

Thus, in this case, Mr. Q could request the Company to issue a certificate of tax deduction monthly or issue one document reflecting the tax deducted from September to December 2013 and one document for the period from January to April 2014.

- What is the currency unit used in tax accounting in Vietnam?

- Which enterprise groups will the General Department of Taxation of Vietnam focus on inspecting and auditing in 2025?

- What are guidelines on online submission of unemployment benefits application in Vietnam in 2025? Are unemployment benefits subject to personal income tax?

- How long can the tax audit period on taxpayers’ premises in Vietnam be extended for complex matters?

- From January 1, 2025, which entities are exempted from ferry service fees from the state budget in Vietnam?

- How to determine VAT applicable to ships sold to foreign organizations in Vietnam?

- What is the maximum penalty for late submission of tax declaration dossiers in Vietnam?

- What is the duty-free allowance on gifts given for humanitarian in Vietnam?

- Are votive papers subject to excise tax up to 70% in Vietnam?

- Shall enterprises use invoices during suspension of operations in Vietnam?