Vietnam: Is it required to have income verification for dependants whose income does not exceed 1,000,000 VND?

Vietnam: Who is considered as a dependant whose income does not exceed 1,000,000 VND?

Based on point dd, clause 1, Article 9 of Circular 111/2013/TT-BTC, the provisions are as follows:

Deductions

...

dd) An individual counted as a dependant according to the guidance in items d.2, d.3, d.4, point d, clause 1, of this Article must meet the following conditions:

dd.1) For individuals of working age, they must simultaneously meet the following conditions:

dd.1.1) Having a disability, unable to work.

dd.1.2) Having no income or having an average monthly income in a year from all sources not exceeding 1,000,000 VND.

dd.2) For individuals beyond working age, they must have no income or average monthly income in a year from all sources not exceeding 1,000,000 VND.

e) Disabled individuals unable to work as guided in item đ.1.1, point đ, clause 1, of this Article pertain to those covered by the laws on persons with disabilities, individuals with illnesses rendering them unable to work (such as AIDS, cancer, chronic kidney failure,...).

...

Individuals whose income does not exceed 1,000,000 VND qualify as dependants including:

- The taxpayer's spouse

- Biological father, biological mother; father-in-law, mother-in-law (or mother-in-law, father-in-law); stepfather, stepmother; lawful adoptive father, lawful adoptive mother of the taxpayer

- Other individuals without support whom the taxpayer has to directly maintain:

+ Biological siblings of the taxpayer.

+ Paternal grandparents, maternal grandparents; paternal aunt, maternal aunt, paternal uncle, maternal uncle of the taxpayer.

+ Niece or nephew of the taxpayer including: children of biological siblings.

+ Other individuals the taxpayer must directly maintain as stipulated by law.

Vietnam: Is it required to have an income verification for dependants whose income does not exceed 1,000,000 VND? (Image from the Internet)

Vietnam: Is it required to have income verification for dependants whose income does not exceed 1,000,000 VND?

Based on point g, clause 1, Article 9 of Circular 111/2013/TT-BTC, amended by Article 1 of Circular 79/2022/TT-BTC, regarding documents proving dependants as follows:

Deductions

Deductions according to the guidance in this Article are amounts deducted from the taxable income of individuals before determining taxable income from salaries, wages, from business. Specifically: as follows:

1. Family circumstances deduction

...

g) Documents proving dependants

g.1) For children:

g.1.1) Children under 18 years of age: Proof documents include a copy of the birth certificate and a copy of the ID card or Citizen ID (if any).

g.1.2) Children aged 18 or older who are disabled and unable to work, proof documents include:

g.1.2.1) A copy of the birth certificate and a copy of the ID card or Citizen ID (if any).

g.1.2.2) A copy of the disability certification as stipulated by the law on persons with disabilities.

g.1.3) Children studying at educational levels as guided in item d.1.3, point d, clause 1, of this Article, proof documents include:

g.1.3.1) A copy of the birth certificate.

g.1.3.2) A copy of the Student Card or a statement confirmed by the school or other documents proving they are studying at a university, college, professional secondary, high school, or vocational school.

g.1.4) In the case of adopted children, children born out of wedlock, stepchildren, besides the aforementioned documents for each specific case, the proof documents need additional documents to prove the relationship such as: a copy of the decision recognizing the adoption, the decision recognizing the acceptance of the father, mother, child by the competent state agency...

g.2) For a spouse, proof documents include:

- A copy of the ID card or Citizen ID.

- A copy of the Certificate of Residence Information or Notice of Personal Identification Number and information in the National Population Database or other documents issued by the Police Office (proving the marital relationship) or a copy of the Marriage Certificate.

In cases where the spouse is of working age, besides the aforementioned documents, the proof documents need additional documents proving the disability of the dependant such as a copy of the disability certification as regulated by the law on persons with disabilities for individuals who are disabled and unable to work, a copy of the medical record for those suffering from illnesses rendering them unable to work (such as AIDS, cancer, chronic kidney failure, etc.).

g.3) For biological parents, parent-in-law (or mother-in-law, father-in-law), stepfather, stepmother, lawful adoptive parents, proof documents include:

- A copy of the ID card or Citizen ID.

- Legal documents to identify the relationship of the taxpayer with the dependant, such as a copy of the Certificate of Residence Information or Notice of Personal Identification Number and information in the National Population Database or other documents issued by the Police Office, the birth certificate, the decision recognizing the acceptance of the father, mother, child by the competent state agency.

In cases where the dependant is of working age, besides the aforementioned documents, the proof documents need to include additional documents proving they are disabled and unable to work such as a copy of the disability certification as regulated by the law on persons with disabilities for individuals who are disabled and unable to work, a copy of the medical record for those suffering from illnesses rendering them unable to work (such as AIDS, cancer, chronic kidney failure, etc.).

g.4) For other individuals as guided in item d.4, point d, clause 1, of this Article, proof documents include:

g.4.1) A copy of the ID card or Citizen ID or Birth Certificate.

g.4.2) Legal documents to determine the responsibility of maintenance according to the law.

In cases where the dependant is of working age, besides the aforementioned documents, proof documents need additional documents proving they are unable to work, such as a copy of the disability certification according to the law on persons with disabilities for individuals who are disabled and unable to work, a copy of the medical record for those suffering from illnesses rendering them unable to work (such as AIDS, cancer, chronic kidney failure, etc.).

The legal documents at item g.4.2, point g, clause 1, of this Article are any legal documents establishing the relationship between the taxpayer and the dependant such as:

- A copy of the documents establishing the maintenance obligation as prescribed by law (if any).

- A copy of the Certificate of Residence Information or Notice of Personal Identification Number and information in the National Population Database or other documents issued by the Police Office.

- A self-declaration by the taxpayer according to the form issued in conjunction with Circular No. 80/2021/TT-BTC dated September 29, 2021, of the Minister of Finance guiding the implementation of several provisions of the Law on Tax Administration and Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam stipulating details of several provisions of the Law on Tax Administration with the confirmation of the People's Committee of the commune where the taxpayer resides regarding the dependant living with them.

- A self-declaration by the taxpayer according to the form issued in conjunction with Circular No. 80/2021/TT-BTC dated September 29, 2021, of the Minister of Finance guiding the implementation of several provisions of the Law on Tax Administration and Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam stipulating details of several provisions of the Law on Tax Administration with the confirmation of the People's Committee of the commune where the dependant currently resides regarding the dependant's current residence in the locality and having no one providing maintenance (in cases not living together).

g.5) For foreign residents, if there are no documents as guided for each specific case above, similar legal documents must be available as proof for the dependant.

g.6) For taxpayers working in economic organizations, administrative, and non-business organizations with parents, spouse (or husband), children, and other individuals considered as dependants already stated clearly in the taxpayer's background, proof documents for dependants follow the guidance in items g.1, g.2, g.3, g.4, g.5, point g, clause 1, of this Article or only require the dependants Registration Form according to the form issued in conjunction with Circular No. 80/2021/TT-BTC dated September 29, 2021, of the Minister of Finance guiding the implementation of several provisions of the Law on Tax Administration and Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam stipulating details of several provisions of the Law on Tax Administration with confirmation from the Head of the Unit on the left of the form.

The Head of the Unit is only responsible for the following content: dependant's name, year of birth, and relationship with the taxpayer; for other content, the taxpayer declares and is responsible.

g.7) From the date the Tax Authority announces the completion of data connection with the National Population Database, taxpayers are not required to submit documents proving dependants as mentioned above if the information in these documents is available in the National Population Database.

...

The current regulation does not require income verification for dependants not exceeding 1,000,000 VND VND; it relies on the taxpayer's self-declaration.

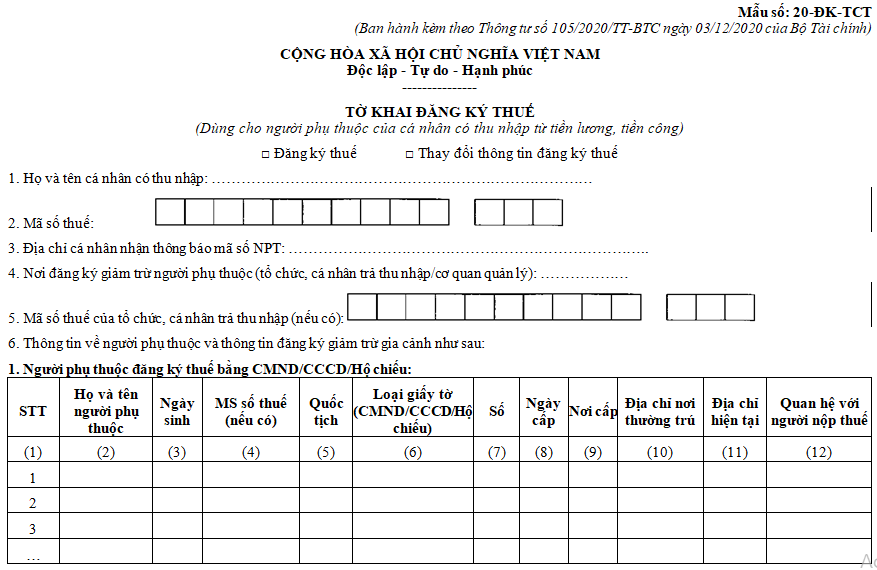

How is Form 20-DK-TC the taxpayer registration declaration for dependants in Vietnam?

The registration declaration form for dependants is stipulated in Form No. 20-DK-TCT issued in conjunction with Circular 105/2020/TT-BTC.

Download the dependant registration declaration Form 20-DK-TCT here.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?