State Treasury of Vietnam operates under a two-tier model from March 1, 2025: What is the management of the state budget by the State Treasury of Vietnam?

State Treasury of Vietnam operates under a two-tier model from March 1, 2025

On February 26, 2025, the Ministry of Finance of Vietnam issued Decision 385/QD-BTC of 2025...Download to specify the functions, tasks, powers, and organizational structure of the State Treasury as follows:

According to Article 3 of Decision 385/QD-BTC of 2025...Download, the State Treasury is organized from the Central to the local level following a two-tier model, specifically:

(1) Central Level

The State Treasury has 10 units at the Central level as administrative organizations assisting the Director of the State Treasury in executing state management functions, including:

- Policy-Legal Department;

- State Accounting Department;

- Treasury Management Department;

- Human Resources Department;

- Finance-Administration Department;

- Payment System Management Department;

- Information Technology and Digital Transformation Department;

- Transaction Department;

- State Treasury Inspectorate;

- Office.

Among them:

- Payment System Management Department; Information Technology and Digital Transformation Department; Transaction Department; State Treasury Inspectorate; Office are organizations with legal status, separate seals, and accounts as prescribed by law.

- Payment System Management Department has 3 teams, State Accounting Department has 4 teams, Treasury Management Department has 4 teams, Information Technology and Digital Transformation Department has 5 teams, Transaction Department has 2 teams, State Treasury Inspectorate has 4 teams, and the Office has 5 teams.

(2) Local Level

- The State Treasury at the local level is organized into 20 regions.

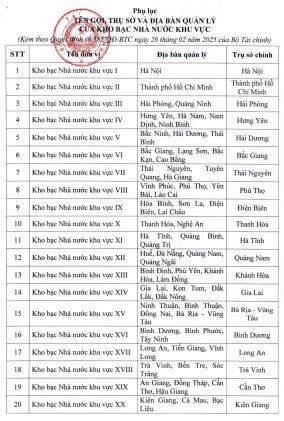

- The name, headquarters, and jurisdiction of the regional State Treasuries are according to the Appendix attached to Decision 385/QD-BTC of 2025 as follows:

- The regional State Treasury is organized with an average of no more than 10 advisory rooms, assisting, and 350 Transaction Offices.

- The regional State Treasury and Transaction Offices have legal status, separate seals, and accounts as prescribed by law.

State Treasury of Vietnam operates under a two-tier model from March 1, 2025 (Image from the Internet)

What is the management of the state budget by the State Treasury of Vietnam from March 1, 2025?

Pursuant to Clause 6, Article 2 of Decision 385/QD-BTC of 2025...Download, the management of the state budget by the State Treasury is specified as follows:

Managing the state budget fund, financial reserve fund, state financial funds outside the budget, and money and assets assigned for management as prescribed by law specifically:

- Collecting and fully reflecting all state budget revenue promptly; organizing the collection into the state budget fund of monies from units, organizations, and individuals via the State Treasury system; accounting for state budget revenue for different budget levels as prescribed by the State Budget Law and other competent state authorities;

- Guiding and executing payments and disbursements of state budget expenditures and other assigned funds as prescribed by law;

- Depositing all foreign currency of the State Treasury at the State Bank of Vietnam; executing purchases and sales of foreign currency to meet treasury needs as prescribed by law; periodically determining and announcing accounting exchange rates for accounting budget revenues and expenditures in foreign currency;

- Managing, controlling, and executing the import and export of the state financial reserve fund and state financial funds outside the budget managed by the State Treasury; managing temporary receipts, holds, confiscations, deposits, escrow, mortgage as decided by competent state authorities;

- Managing cash (Vietnamese Dong, foreign currency), securities, gold, silver, precious stones, precious metals, and other assets of the State and units deposited at the State Treasury as prescribed by law.

Is the State Treasury of Vietnam a state budget revenue agency?

According to Article 55 of the State Budget Law 2015 regarding the organization of state budget revenue:

State Budget Revenue Organization

1. Revenue agencies are financial agencies, taxation agencies, customs agencies, and other agencies authorized or delegated by competent state authorities to organize and execute state budget revenue tasks.

2. Only revenue agencies are organized to collect the budget.

- Revenue agencies have the following tasks and powers:

a) Collaborate with relevant state agencies to organize accurate, sufficient, and prompt collections as prescribed by law; subject to direction and inspection by the Ministry of Finance of Vietnam, superior management agencies, People’s Committees, and supervision by People's Councils in terms of budget collection at localities; cooperate with the Vietnam Fatherland Front and member organizations to educate, motivate organizations and individuals to strictly fulfill tax obligations as prescribed by this Law and other related legal provisions;

b) Organize the management and collection of taxes, fees, charges, and other revenues paid directly into the State Treasury. In case of collection through authorized collection, compliance with full and timely remittances into the State Treasury as prescribed by the Ministry of Finance of Vietnam is required;

c) Revenue agencies must urge, inspect agencies, organizations, units, and individuals to fully and timely remit collectible revenues into the state budget;

d) Inspect and control the sources of budget revenues; inspect and audit the compliance in declarations, collections, remittance of the budget and handle violations as prescribed by law.

- The State Treasury is permitted to open accounts at the State Bank of Vietnam and commercial banks to centralize state budget revenues; fully and promptly account revenues into the budget, allocate revenue to budget levels in conformity.

Thus, the State Treasury is not a state budget revenue agency. The revenue agency comprises financial agencies, taxation agencies, customs agencies, and other agencies authorized or delegated by competent state authorities to organize and execute state budget revenue tasks.

- How to check for camera fines 2025? What are 02 ways to check camera fines in Vietnam? Which types of motorcycles and cars are subject to excise tax in Vietnam?

- What are regulations on deferment of registration fees in Vietnam in 2025? What is the procedure for deferment of registration fees in Vietnam in 2025?

- Vietnam issues Official Dispatch 1767 BTC TCCB of 2025 on principles for resolving policies on early retirement, termination of employment as per Decree 178?

- What is the download link for software HTKK 5.3.0? What is the latest update for related-party transaction declaration in Vietnam?

- HTKK 5.3.0 software update: Related-party transaction declaration in Vietnam according to Circular 132

- What are 06 changes in the 2025 Law on organizing the local government of Vietnam? Does the merger and change of administrative units at the commune level in Ho Chi Minh City require re-registration of electronic invoice usage information?

- Vietnam issues the Law on organizing the local government 2025: What are the regulations for the organizational structure of the Tax Department of Vietnam from March 1, 2025?

- Vietnam issues Decree 34 of 2025 amending Decrees in the maritime in Vietnam: What is the VAT rate applicable when a vessel is sold to a foreign organization?

- Is land used for building private schools in urban areas subject to non-agricultural land use tax in Vietnam?

- Are incomes from organizing extra class exempt from income tax in Vietnam?