HTKK 5.3.0 software update: Related-party transaction declaration in Vietnam according to Circular 132

HTKK 5.3.0 software update: Related-party transaction declaration in Vietnam according to Circular 132

On March 4, 2025, the General Department of Taxation of Vietnam announced the upgrade of the Tax Declaration Support application (HTKK) version 5.3.0 to meet Circular 41/2024/TT-BTC and upgrade the declaration 02/TNDN-DK to meet Decree 132/2020/ND-CP while updating some arising contents during the deployment of HTKK 5.2.9.

>>> The latest HTKK 5.3.0 software upgrading the related-party transaction declaration...Download

Below is the latest upgrade notice for HTKK 5.3.0:

(1) Upgrade application to meet Circular 41/2024/TT-BTC

- Upgrade the function of searching local tax resource pricing tables: Allow taxpayers to search the resource pricing table prescribed by the Provincial People's Committee.

- Upgrade constraints on declarations 01/TAIN (TT80/2021), 02/TAIN (TT80/2021), 01/CNKD (TT40/2021) as follows:

+ Resource list: Allows choosing from the resource list according to the price framework of the Ministry of Finance and the province's own resources that are newly added.

+ "Tax calculation price for resource unit": The declared tax unit price must be >= the price prescribed by the Provincial People's Committee. Declaration of resources not yet priced by the Provincial People's Committee is not allowed.

(2) Upgrade declaration 02/TNDN-DK (TT80/2021) to meet Decree 132/2020/ND-CP

- Upgrade the declaration to attach 4 appendices for related-party transaction meeting Decree No. 132/2020/ND-CP: Appendices GDLK_ND132_01, GDLK_ND132_02, GDLK_ND132_03, GDLK_ND132_04

(3) Upgrade to update some arising contents

* Update the administrative area of Ba Ria - Vung Tau province to meet Resolution No. 1365/NQ-UBTVQH15

- Change the name "Phu My Town" (code 71709) to "Phu My City" and change the names of administrative areas under "Phu My City" as follows:

+ Change "Tan Hoa Commune" (code 7170907) to "Tan Hoa Ward"

+ Change "Tan Hai Commune" (code 7170905) to "Tan Hai Ward"

* Update the declaration of detailed list of PIT tax payments made on behalf of each individual

- Update the constraint "Document ID (ID)" at indicator [05] on the declaration must be 16 characters long

* Update the comprehensive tax registration declaration for dependents of individuals with income from salaries, wages (20-DK-TH-TCT)

- Update to allow XML declaration export when the declaration table has many data lines

Starting from March 4, 2025, when compiling tax declarations related to the above upgrade content, organizations and individuals paying taxes will use the declaration functions in the HTKK 5.3.0 application instead of previous versions.

HTKK 5.3.0 software update: Related-party transaction declaration in Vietnam according to Circular 132 (Image from the Internet)

What are guidelines on line breaks and handling error notifications in HTKK software in Vietnam?

HTKK software is a utility to support online tax declarations for taxpayers, specifically the name of tax declaration support software.

However, while using it, there will still be certain difficulties. Below is how to insert line breaks and handle error notifications in HTKK software:

(1) Line Breaks

To add a line for entering information, press F5 (or press Fn+F5), to delete a line press F6 (or press Fn+F6).

(2) Handling Error Notifications

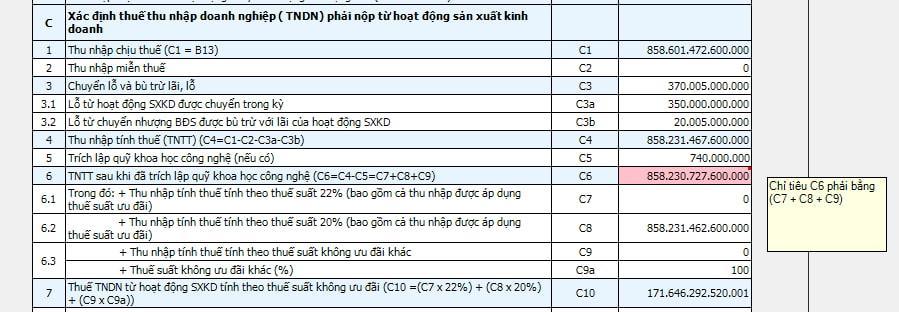

According to the guidelines of the General Department of Taxation of Vietnam when using HTKK, if there is a declaration error, the system will notify of declaration errors, all erroneous declaration boxes will display with a pink background and have a red mark in the upper right corner. When moving the mouse over this red mark, the system will automatically display the error content and guide for correction.

The system automatically jumps to the first error box. Below is an example of an error notification.

Taxpayers perform the following steps to correct errors:

Step 1: Move the mouse to the red mark for the system to display error content and correction guidance.

Step 2: Proceed to correct the error, press F1 for detailed guidance on this declaration item.

Step 3: Press "Save" or "Print" or "Export" for the system to recheck data after correction.

Step 4: Repeat steps 1 to 3 until the system does not show error notifications.

What are principles for taxpayers when applying related-party transaction in Vietnam?

Based on Article 3 Decree 132/2020/ND-CP there are regulations on the principles when applying related-party transaction as follows:

- Taxpayers having related-party transaction must eliminate factors causing tax obligation reduction due to controlled associated relationships to declare and determine tax obligations for related-party transaction equivalent to independent transactions under the same conditions.

- The tax authority manages, inspects, and audits the pricing of related-party transaction of taxpayers according to independent transaction principles, where the nature of activities and transactions determines the tax obligations corresponding to the value created from the inherent nature of the transaction, business activities of taxpayers, not recognizing related-party transaction not following independent transaction principles that reduce the tax obligations of enterprises to the state budget and implement price adjustments of those related-party transaction to correctly determine tax obligations as prescribed in Decree 132/2020/ND-CP.