Perpetual Calendar 2025 - Lunar, Gregorian Calendar 2025? What are deadlines for the licensing fee payment and the licensing fee declaration in Vietnam in 2025?

Perpetual Calendar 2025 - Lunar Calendar 2025, Gregorian Calendar 2025

The year 2025 marks the return of the Snake in the 12 zodiac cycle, under the lunar calendar, this year is named At Ty.

Beginning on January 29, 2025 (the 1st day of the 1st lunar month of the year At Ty), the At Ty year extends until February 16, 2026 (the 29th day of the 12th lunar month of the year At Ty). In the lunar calendar, the year 2025 also includes a leap month, which falls in the sixth lunar month.

See the lunar calendar 2025 and Gregorian calendar 2025 month by month below:

Lunar and Gregorian Calendar January 2025

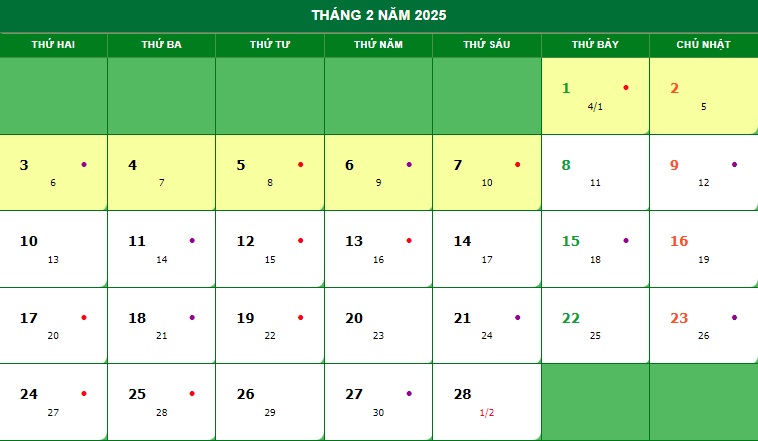

Lunar and Gregorian Calendar February 2025

Lunar and Gregorian Calendar March 2025

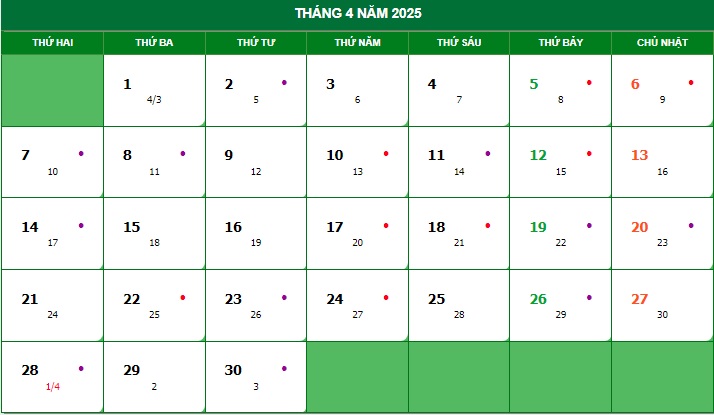

Lunar and Gregorian Calendar April 2025

Lunar and Gregorian Calendar May 2025

Lunar and Gregorian Calendar June 2025

Lunar and Gregorian Calendar July 2025

Lunar and Gregorian Calendar August 2025

Lunar and Gregorian Calendar September 2025

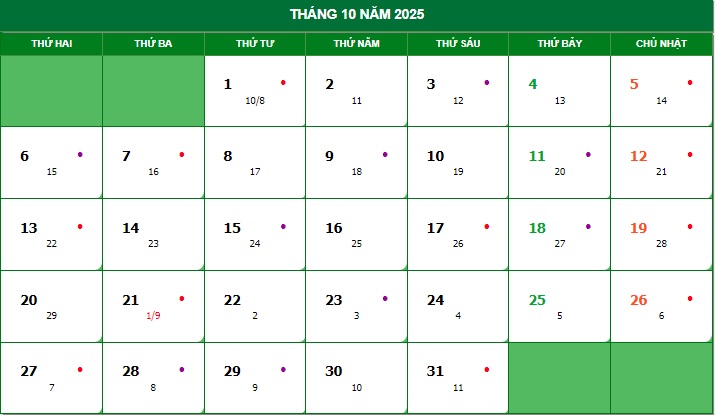

Lunar and Gregorian Calendar October 2025

Lunar and Gregorian Calendar November 2025

Lunar and Gregorian Calendar December 2025

Perpetual Calendar 2025 - Lunar, Gregorian Calendar 2025 (Image from the Internet)

What are deadlines for the licensing fee payment and the licensing fee declaration in Vietnam in 2025?

(1) Deadline for submitting the licensing fee declaration:

According to Clause 1 Article 10 Decree 126/2020/ND-CP, the deadline for submitting licensing fee declaration dossiers is regulated as follows:

Deadline for submitting tax declaration dossiers for land-related revenues, trade license fees, registration fees, licensing fees, and other revenues as per the law on public asset management and utilization

...

- Trade License Fee

a) Newly established trade license fee payers (excluding household businesses and individual businesses), including small and medium-sized enterprises switching from household businesses, or have established additional dependent units, business locations, or started production or business activities, must submit the licensing fee declaration dossier no later than January 30 of the following year of establishment or commencement of production or business activities.

In case of changes in capital during the year, licensing fee payers must submit the licensing fee declaration dossier no later than January 30 of the year following the year in which the change occurred.

b) Household businesses or individual businesses are not required to submit licensing fee declaration dossiers. The tax authority, based on tax declaration dossiers and tax management databases, will determine the revenue as the basis for calculating the payable trade license fee and notify the trade license fee payer to comply according to regulations at Article 13 of this Decree.

...

Thus, the deadline for submitting the licensing fee declaration for the year 2024 is January 30, 2025.

(2) Deadline for paying the licensing fee

Based on Clause 9 Article 18 Decree 126/2020/ND-CP, the deadline for paying the licensing fee is specified as follows:

Deadlines for payment of taxes on budgetary receipts from land, fees for the right to exploit water, mineral resources, fees for the use of maritime space, registration fees, and trade license fees

...

- Trade License Fee:

a) The deadline for paying the trade license fee is no later than January 30 annually.

b) For small and medium-sized enterprises transitioning from household businesses (including dependent units, business locations of enterprises) when the period of trade license fee exemption ends (the fourth year from the year of establishment), the deadline for paying the trade license fee is as follows:

b.1) If the exemption period ends within the first 6 months of the year, the deadline is no later than July 30 of the year the exemption period ends.

b.2) If the exemption period ends within the last 6 months of the year, the deadline is no later than January 30 of the year following the year the exemption period ends.

c) Household businesses and individual businesses that ceased production or business activities and then resumed operations must adhere to the following deadlines for trade license fee payment:

c.1) If operations resume within the first 6 months of the year: No later than July 30 of the year resuming operations.

c.2) If operations resume in the last 6 months of the year: No later than January 30 of the year following the year resuming operations.

Thus, the deadline for paying the licensing fee for the year 2024 is no later than January 30, 2025.

Taxpayers need to determine which category they fall into to comply with the corresponding tax payment deadline as per the above regulations.

For small and medium-sized enterprises transitioning from household businesses, the deadline for paying the trade license fee is as follows:

- If the exemption period ends within the first 6 months of the year, the deadline is no later than July 30 of the year the exemption ends.

- If the exemption period ends within the last 6 months of the year, the deadline is no later than January 30 of the year following the end of the exemption.

- Household businesses and individual businesses that have ceased and then resumed operations must adhere to the following deadlines for trade license fee payment:

+ If operations resume within the first 6 months of the year: No later than July 30 of the year resuming operations.

+ If operations resume within the last 6 months of the year: No later than January 30 of the year following the year of resuming operations.

Which taxes are filed quarterly in Vietnam in 2025?

According to Clause 2 Article 8 Decree 126/2020/ND-CP, the types of taxes declared quarterly in 2025 are regulated as follows:

(1) Corporate income tax for foreign airlines, foreign reinsurance.

(2) Value-added tax, corporate income tax, and personal income tax for credit institutions or third parties authorized by credit institutions to exploit secured assets while waiting for handling, filing on behalf of taxpayers with secured assets.

(3) Personal income tax for organizations and individuals paying income subject to withholding tax under the law on personal income tax, where the income payer is subject to value-added tax declaration on a quarterly basis and chooses to declare personal income tax quarterly; individuals with income from wages and salaries directly filing with the tax authority and choosing to declare personal income tax quarterly.

(4) Other taxes and fees belonging to the state budget declared by organizations or individuals paying taxes on behalf of individuals where such organizations or individuals are subject to value-added tax declaration on a quarterly basis and choose to declare on behalf of individuals on a quarterly basis, except cases specified at point g Clause 4 Article 8 Decree 126/2020/ND-CP.

(5) Surcharge when crude oil prices fluctuate upwards (excluding oil and gas activities of the Vietsovpetro joint venture in Block 09.1).

- What are 02 methods for writing a self-assessment for members of Communist Party of Vietnam who hold leading positions in 2024? How much is the membership fee for CPV members in political-social organizations?

- Is there an official adjustment to increase pension in Vietnam from July 1, 2025? Does increasing the pension affect the personal income tax in Vietnam?

- What are 02 methods for writing Form 02B on limitations, shortcomings, and causes in the self-assessment for members of Communist Party of Vietnam for the end of 2024? How much is the membership fee for CPV members in armed forces?

- What are 02 ways to write limitations, shortcomings, and causes in the Form 02A on year-end self-assessment for members of Communist Party of Vietnam 2024? Which incomes are bases for determining membership fees?

- How to determine the effective tax rate and top-up tax percentage in Vietnam?

- Will there be penalties imposed for supplementing a tax return before a tax audit in Vietnam?

- When shall a fine which is 2 times as much as the amount of evaded tax be imposed for the act of tax evasion in Vietnam?

- What are cases of distribution of corporate income tax in Vietnam?

- Is a person who assists in tax evasion subject to publishing of information about taxpayers in Vietnam?

- What are conditions for not imposing anti-dumping duties on products whose dumping margin are not more than 2 % of export price in Vietnam?