Is the total of sales subject to personal income tax in Vietnam?

Is the total of sales subject to personal income tax in Vietnam?

Pursuant to Clause 2, Article 10 of the Law on Personal Income Tax 2007, as amended by Clause 4, Article 2 of the Law Amending Tax Laws 2014, specific provisions regarding taxes for individuals doing business are as follows:

Tax on Individuals Doing Business

- Individuals doing business shall pay personal income tax based on the turnover rate for each field, industry of production, and business.

- Turnover comprises the total of sales, processing fees, commissions, and service provisions incurred during the tax calculation period from business activities, production of goods, and provision of services.

In the event that an individual doing business cannot determine their turnover, the tax authority with appropriate jurisdiction shall determine turnover as regulated by the law on tax administration.

- Tax rates:

a) Distribution, supply of goods: 0.5%;

b) Services, construction without including material costs: 2%.

Particularly for activities such as asset leasing, insurance agency, lottery agency, and multi-level sales agency: 5%;

c) Manufacturing, transportation, services associated with goods, construction that includes material costs: 1.5%;

d) Other business activities: 1%.

Thus, according to the above regulation, total of sales is subject to personal income tax.

What are regulations on personal income tax calculation period in Vietnam?

Based on Article 7 of the Law on Personal Income Tax 2007, as amended by Clause 3, Article 1 of the Amended Law on Personal Income Tax 2012, specific regulations on tax periods are as follows:

[1] The tax calculation period for resident individuals is regulated as follows:

- Annual tax calculation period applies to income from business activities; income from wages and salaries;

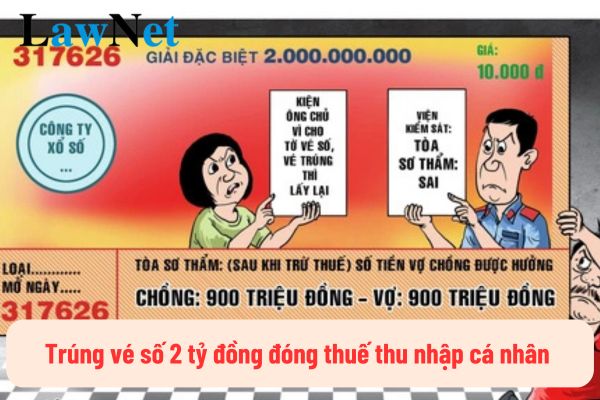

- Tax calculation period based on each time income arises applies to income from capital investment; income from capital transfers, except income from securities transfers; income from real estate transfers; income from winnings; income from copyright; income from franchising; income from inheritance; income from gifts;

- Tax calculation period based on each securities transfer or annually applies to income from securities transfers.

[2] The tax calculation period for non-resident individuals is calculated for each time income arises from all taxable income.

What Income is exempt from personal income tax in Vietnam?

According to Article 4 of the Law on Personal Income Tax 2007, supplemented by Clause 3, Article 2 of the Law Amending Tax Laws 2014 and amended by Clause 2, Article 1 of the Amended Law on Personal Income Tax 2012, the exempt income from personal income tax includes:

- Income from real estate transfers between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- Income from the transfer of residential housing, residential land use rights, and assets attached to residential land of individuals who possess only one house or residential land.

- Income from the value of land use rights allocated by the State.

- Income from inheritance, gifts that are real estate, between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- Income of households and individuals directly producing agriculture, forestry, salt making, aquaculture, and fisheries not yet processed into other products or only through preliminary processing.

- Income from the conversion of agricultural land by households and individuals granted by the State for production.

- Income from interest on deposits at credit institutions, interest from life insurance contracts.

- Income from remittances.

- Wages paid for night shifts, overtime, paid higher than day shifts, and work time as prescribed by law.

- Retirement pensions paid by the Social Insurance Fund; voluntary pension paid monthly.

- Income from scholarships, including:

+ Scholarships from the state budget;

+ Scholarships from domestic and foreign organizations under training support programs.

- Income from compensation from life and non-life insurance contracts, work accident compensation, state compensation, and other compensations as prescribed by law.

- Income received from charitable funds established or recognized by state agencies with authority, operating for charitable, humanitarian purposes, not for profit.

- Income received from foreign aid for charitable, humanitarian purposes in government and non-government forms approved by competent state agencies.

- Income from wages and salaries of Vietnamese crew members working for foreign ships or Vietnamese ships engaged in international transport.

- Income of individuals who are ship owners, individuals with ship use rights, and individuals working on ships from activities directly providing goods and services for offshore fishing, exploitation activities.

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?