How to fill out the registration fee declaration form for real estates in Vietnam?

What is the registration fee declaration form for real estates in Vietnam?

Currently, the registration fee declaration form for real estates being used is Form 01/LPTB - the registration fee declaration form issued together with Circular 80/2021/TT-BTC as follows:

How to fill out the latest registration fee declaration form for real estates in Vietnam?

How to fill out the registration fee declaration form for real estates in Vietnam?

Below is the guidance on how to fill out the registration fee declaration form applicable to real estates in Vietnam:

(1) - Tax period

- At section [01]: If it's for transfer, gift, inheritance, lease, sublease, capital contribution, etc., check the box.

- Section [2]: If it is for the first issuance of a certificate, check the box.

- Section [3]: For other cases, check the supplementation box.

(2) - Name of taxpayer

- Clearly write the full name of the person in whose name the land use right, house, and other assets attached to the land are registered when declaring the registration fee;

- In the case of a business entity, the name must be accurately written as in the taxpayer registration form, do not use abbreviations or trade names.

(3) - Taxpayer identification number

- [05] - Taxpayer identification number: Write the taxpayer number issued by the tax authority when registering to pay taxes (if any).

(4) - Address and other information

[06] – [11]: Correctly write down the taxpayer's address. Also, include the telephone number, fax number, and email address of the taxpayer so that the tax authority can contact them when necessary.

(5) - Tax agency (if any)

- In case the asset owner authorizes or signs a service contract with a tax agent, declare the name of the tax agency.

* Write the taxpayer identification number: The taxpayer number and address of the tax agency.

- Fields from [14] – [19] should be filled according to the address recorded in the business registration certificate, phone number, fax, and email of the tax agent.

- [20] Tax agency contract, number..... date…..: declare according to the contract identification number signed between the tax agency and the asset owner, date of signing.

*Guidelines for filling in “Characteristics of real estates”

- Land:

+ Parcel address: Clearly state the parcel address located in: village (urban area), commune (ward, commune-level town), district (urban district, district-level town, provincial city), province (centrally-run city).

+ Position: State if it's street-front, street, alleyway, or lane land.

+ Land use purpose: Agricultural or non-agricultural land as per the issued Land Use Right Certificate.

+ The land area subject to registration fee is the entire parcel area legally owned by the individual, organization being transferred....

+ The origin of the land: Clearly state whether the land is allocated, leased by the State, or received through transfer; inherited or gifted.

+ Actual land transfer value (if any): Record according to the value stated in the notarized transfer contract as agreed by the parties. Leave this section blank in cases of inheritance or gifting.

- House

+ House grade, type: Grade I; Grade II; Grade III; Grade IV, usually recorded according to the issued House Ownership Certificate.

+ The house area subject to registration fee is the total floor area (including auxiliary construction area) of an apartment or building legally owned by the individual, organization.

+ Origin of the house: Clearly indicate whether it's a self-built house (state the year of initiation or completion), or a purchased, inherited, donated house (state the time the sales contract (documents) was made).

+ The house value is the actual market purchase price at the time of the registration process, calculated in Vietnamese Dong. Typically, it is based on the sales contract between parties.

- Actual value of the house, land received through transfer, inheritance, gift (dong): Record according to the value on the transfer contract. Leave this section blank in cases of inheritance or gifting.

- Assets not subject to registration fees (reasons):

+ If the asset is not subject to registration fees, there must be documentation proving the asset or the asset owner is not required to pay or is exempted from registration fees.

- Related documents: List all related documents attached, such as:

+ real estate sales contract;

+ Documents pertaining to the house, land such as: Certificate (Red Book) if issued or any documents on land use rights (if Red Book not issued).

How to calculate the registration fees for real estates in Vietnam?

According to the provisions in Article 6 Decree 10/2022/ND-CP as follows:

Basis for calculating registration fees

The basis for calculating registration fees is the registration fee calculation price and the registration fee collection rate (%).

combined with the provisions of Article 8 Decree 10/2022/ND-CP, the formula for calculating registration fees for real estatess is as follows:

Registration fee for real estate = Registration fee calculation price x 0.5%.

Where:

The registration fee calculation price for land, houses stipulated in Clause 1, Article 7 Decree 10/2022/ND-CP is as follows:

- The registration fee calculation price for land is the land price in the Land Price Table issued by the People's Committee of provinces and centrally-run cities in accordance with the law on land at the time of registration fee declaration.

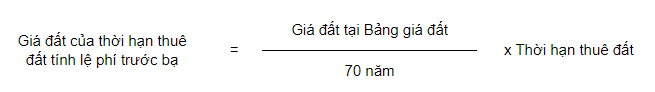

In the case of State land leasing under the one-time rent payment for the entire lease period, where the land lease term is shorter than the land type term stipulated in the Land Price Table by the People's Committee of provinces and centrally-run cities, the land price for the lease term subject to registration fee is determined as follows:

- The registration fee calculation price for houses is the price issued by the People's Committee of provinces and centrally-run cities in accordance with the construction law at the time of registration fee declaration.

The registration fee calculation price for land, houses in certain specific cases:

- The registration fee calculation price for houses owned by the state sold to current tenants under the laws on the sale of state-owned housing, including associated land, is the actual selling price as decided by the People's Committee of provinces and centrally-run cities.

- The registration fee calculation price for land, houses purchased through auction or tender under auction and tender laws is the actual winning auction or tender price stated on the invoice, documents in accordance with the law or the actual winning auction, tender price noted in the winning contract or in the approval document of auction or tender results (if any) by a competent state agency.

- The registration fee calculation price for multi-story and multi-apartment buildings includes the allocated land value. The allocated land value is calculated based on the land price in the Land Price Table issued by the People's Committee of provinces and centrally-run cities multiplied by the allocation coefficient. The allocation coefficient is determined according to Decree 53/2011/ND-CP and its replacing, amending, supplementing documents (if any).

Additionally, if the house or land price in the sales contract for the house or the land use rights transfer contract is higher than the price issued by the People's Committee of provinces and centrally-run cities, the registration fee calculation price for the house, land is the price in the land use rights transfer contract or house sales contract.

- Are hazardous allowances subject to personal income tax in Vietnam?

- Shall the TIN be deactivated due to bankrupcy in Vietnam?

- What are guideline for paying the registration fees through VCB bank app? When is the time of payment for registration fees in Vietnam?

- Vietnam: Is tax liability imposed when failing to present accounting books?

- What is the Notice form for e-tax transaction account in Vietnam (Form 03/TB-TDT)?

- Where to download the latest form 04/HGDL for delivery notes for goods sent to sales agents in Vietnam?

- What is the guidance on first-time taxpayer registration for foreign subcontractors who directly declare and pay contractor tax in Vietnam?

- What are cases where a 10% PIT is withheld in Vietnam?

- How to submit the dependant registration application for persons with income from wages and salaries in Vietnam?

- What are guidelines for first-time taxpayer registration for dependants declared directly at the tax authority in Vietnam?