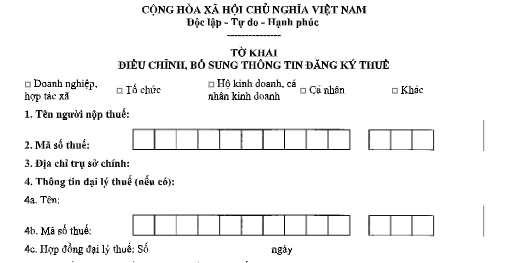

Form No. 08-MST for amendments to tax registration in Vietnam

Form No. 08-MST for amendments to tax registration in Vietnam

The latest Form No. 08-MST is stipulated in Circular 105/2020/TT-BTC, used in cases of amendments to tax registration. To be specific:

Download Form No. 08-MST: Here

Form No. 08-MST amendments to tax registration in Vietnam (Image from the Internet)

Guidelines for filling out Form No. 08-MST for amendments to tax registration in Vietnam

In Form No. 08-MST - Declaration for amendments to tax registration, certain notes should be taken into account when filling out Form No. 08-MST as follows:

- The taxpayer fills in personal information such as: Name of the taxpayer, tax code, information of the tax agent (if any).

- When registering to change taxpayer registration information, note the following:

+ Column (1): State the criteria changed on the taxpayer registration form or the attached taxpayer registration document.

+ Column (2): Record the previously declared taxpayer registration information from the most recent taxpayer registration.

+ Column (3): Accurately state the new or supplemented taxpayer registration information.

Vietnam: What does an application for amendments to tax registration include?

According to Clause 3 of Article 10 in Circular 105/2020/TT-BTC, it is stipulated as follows:

Place of submission and application for amendments to tax registration

The place of submission and application for amendments to tax registration are to be carried out according to Article 36 of the Law on Tax Administrationand the following regulations:

...

3. Taxpayers who are individuals as specified in Points k, l, n of Clause 2, Article 4 of this Circular, and particularly in cases of amendments to tax registration of themselves and their dependants (including cases of changing the direct tax management authority), are required to submit the application to the income-paying body or the Tax Department, Regional Tax Department where the individuals have registered for permanent or temporary residence (in the case where the individual does not work at the income-paying body) as follows:

a) The application for amendments to tax registration when submitted through the income-paying body includes: Authorization document (for cases where there was no previous authorization document for the income-paying body) and copies of documents indicating the changes in the taxpayer registration information of the individual or dependent.

The income-paying body is responsible for compiling the changed information of the individual or dependent into the taxpayer registration declaration Form No. 05-DK-TH-TCT or Form No. 20-DK-TH-TCT issued with this Circular and submitting it to the tax management authority directly managing the income-paying body.

b) The application for amendments to tax registration when submitted directly at the tax authority includes:

- The declaration of adjustment and supplement of taxpayer registration information using Form No. 08-MST issued with this Circular;

- A copy of the effective Citizen ID card or ID card for dependants with Vietnamese nationality; an effective copy of the Passport for dependants with foreign nationality or Vietnamese nationals living abroad if the taxpayer registration information on these documents changes.

Thus, the application for amendments to tax registration when submitted directly at the tax authority includes:

- The declaration of adjustment and supplement of taxpayer registration information using Form No. 08-MST.

- A copy of the effective Citizen ID card or ID card for dependants with Vietnamese nationality.

How to notify amendments to tax registration in Vietnam?

According to Article 36 of the Law on Tax Administration 2019, the regulations on notifying amendments to tax registration are as follows:

- Taxpayers registered together with business registration, cooperative registration, or business registration. When amendments to tax registration, they must notify the change in taxpayer registration information along with the changes in business registration, cooperative registration, or business registration as per legal provisions.

In cases where taxpayers change their head office address, leading to a change in the tax management authority, they must complete tax procedures with the direct tax management authority according to Law on Tax Administration 2019 before registering the changes with the business registration authority, cooperative registration, or business registration authority.

- Taxpayers directly registered with the tax authority must notify the direct tax management authority within 10 working days from the date of the information change.

- In cases where individuals authorize organizations or individuals to pay income to register amendments to tax registration for the individual and dependants, they must notify the income-paying organization or individual within 10 working days from the date of the information change; the income-paying organization or individual must inform the tax management authority within 10 working days from the date of receiving the authorization from the individual.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?