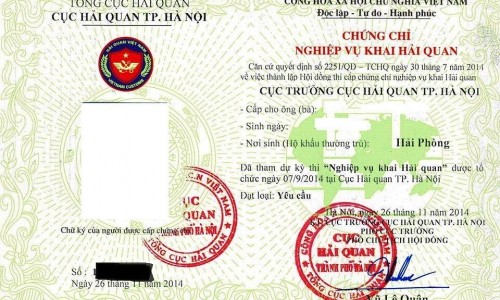

Cases of suspension of customs brokerage agents in Vietnam

This is a featured content specified in Circular No. 22/2019/TT-BTC of the Ministry of Finance of Vietnam on amendments to Circular No. 12/2015/TT-BTC on guidelines for procedures for issuance of certificate of training in customs declaration; issuance and revocation of customs broker number; procedures for recognition and operation of customs brokerage agents.

According to Circular No. 22/2019/TT-BTC of the Ministry of Finance of Vietnam, a customs brokerage agent is suspended from operation in any of the following cases:

- It fails to meet the conditions specified in clause 1 Article 20 of the Law on Customs or fails to operate with given name and at the location registered with the customs authority;

- It fails to comply with Clause 5 Article 13 of this Circular;

- It fails to follow reporting regulations or follow improper reporting regulations, or its report content is insufficient or its report is sent behind the schedule with the customs authority as prescribed in Article 13 of this Circular in 03 consecutive times;

- It submits an application for suspension of operation.

View relevant provisions at Circular No. 22/2019/TT-BTC of the Ministry of Finance of Vietnam, effective from July 01, 2019.

- Thanh Lam -

- Key word:

- Circular No. 22/2019/TT-BTC

- Number of deputy directors of departments in Vietnam in accordance with Decree 45/2025/ND-CP

- Cases ineligible for pardon in Vietnam in 2025

- Decree 50/2025 amending Decree 151/2017 on the management of public assets in Vietnam

- Circular 07/2025 amending Circular 02/2022 on the Law on Environmental Protection in Vietnam

- Adjustment to the organizational structure of the Ministry of Health of Vietnam: Certain agencies are no longer listed in the organizational structure

- Vietnam aims to welcome 22-23 million international tourists in Vietnam in 2025

-

- Amending regulations on shutdown of customs brokerage ...

- 14:50, 26/04/2019

-

- Vietnam: Cases of exemption from examination for ...

- 10:05, 26/04/2019

-

- Vietnam’s new regulations on examination application ...

- 16:30, 21/04/2019

-

- 07 cases of shutdown of operation of customs brokerage ...

- 15:22, 21/04/2019

-

- Vietnam: Cases of revocation of customs broker ...

- 11:30, 21/04/2019

-

- Notable new policies of Vietnam effective as of ...

- 16:26, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:21, 11/04/2025

-

.Medium.png)

- Notable documents of Vietnam in the previous week ...

- 16:11, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam to be effective ...

- 16:04, 02/04/2025

-

.Medium.png)

- Notable new policies of Vietnam effective from ...

- 14:51, 21/03/2025

Article table of contents

Article table of contents