Who pays the non-agricultural land use tax in Vietnam? Declaration form of non-agricultural land use tax for households and individuals in the case of transfer or donation of land use rights in Vietnam?

Who pays the non-agricultural land use tax in Vietnam?

Pursuant to Article 4 of the 2010 Law on Non-agricultural Land Use Tax in Vietnam as follows:

Taxpayers

1. Taxpayers are organizations, households and individuals that have the right to use tax-liable land specified in Article 2 of this Law.

2. When organizations, households or individuals have not yet been granted land use right certificates or house and land-attached asset ownership certificates (below collectively referred to as certificates), current land users will be taxpayers.

3. Taxpayers in some cases are specified as follows:

a/ When land is leased by the State for the implementation of investment projects, lessees will be taxpayers;

b/ When persons having land use rights lease land under contracts, taxpayers shall be identified as agreed upon in these contracts. When no agreement on taxpayers is made in contracts, persons having land use rights will be taxpayers;

c/ When land has been granted a certificate but is currently under dispute, pending the dispute settlement, current land users will be taxpayers. Tax payment does not serve as a ground for the settlement of disputes over land use rights;

d/ When many persons have the right to co-use a land plot, the lawful representative of these co-users will be the taxpayer;

e/ When a person having land use rights contributes his/her land use rights as business capital, thereby forming a new legal entity that has the right to use tax-liable land specified in Article 2 of this Law, the new legal entity will be the taxpayer.

Thus, taxpayers are subject to the above regulations.

Who pays the non-agricultural land use tax in Vietnam? Declaration form of non-agricultural land use tax for households and individuals in the case of transfer or donation of land use rights in Vietnam?

How much are the current non-agricultural land use tax rates?

According to the provisions of Article 7 of the 2010 Law on Non-agricultural Land Use Tax in Vietnam, the tax rates for non-agricultural land are as follows:

(1) Tax rates for residential land, including land used for commercial purposes, to be applied according to the Partially Progressive Tariff are specified as follows:

Tax grade | Taxable land area (m2) | Tax rate (%) |

1 | Area within the set quota | 0.03 |

2 | Area in excess of up to 3 times the set quota | 0.07 |

3 | Area in excess of over 3 times the set quota | 0.15 |

The residential land quota used as a basis for tax calculation is the new quota of residential land allocation set by provincial-level People’s Committees from the effective date of this Law.

When residential land quotas have been set before the effective date of this Law, the following provisions shall be applied:

- When the residential land quota set before the effective date of this Law is lower than the new quota of residential land allocation, the new quota will be used as a basis for tax calculation;

- When the residential land quota set before the effective date of this Law is higher than the new quota of residential land allocation, the old quota will be used as a basis for tax calculation.

(2) Residential land of multi-story buildings with many households, condominiums or underground construction works is subject to the tax rate of 0.03%.

(3) Non-agricultural production and business land is subject to the tax rate of 0.03%.

(4) Non-agricultural land specified in Article 3 of this Law which is used for commercial purposes is subject to the tax rate of 0.03%.

(5) Land used for improper purposes or land not yet used under regulations is subject to the tax rate of 0.15%.

Land of a phased investment project as registered by the investor and approved by a competent state agency will not be regarded as unused land and is subject to the tax rate of 0.03%.

(6) Encroached or appropriated land is subject to the tax rate of 0.2% and has no applicable quota. Tax payment does not serve as a basis for recognizing taxpayers’ lawful land use rights for the encroached or appropriated land area.

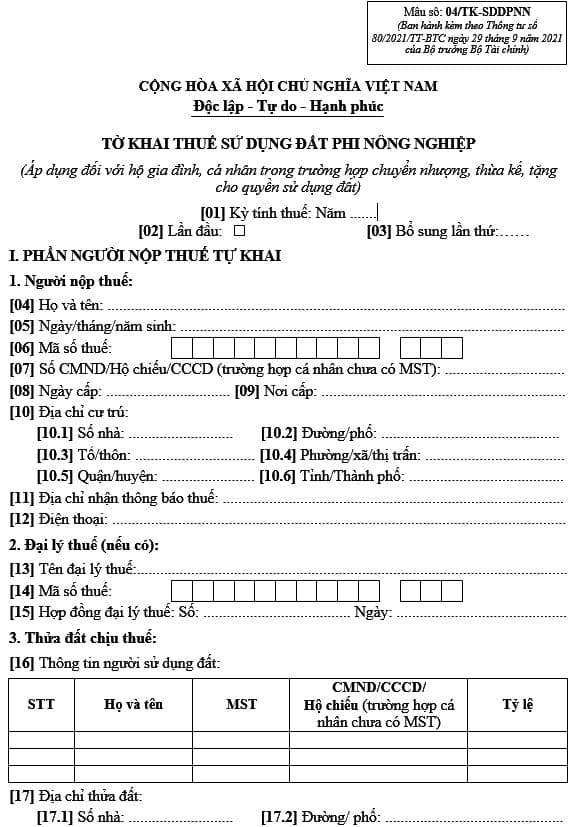

The most standard declaration form of non-agricultural land use tax for households and individuals in the case of transfer or donation of land use rights in Vietnam?

The declaration form of non-agricultural land use tax for households and individuals in case of transfer or donation of land use rights in Vietnam are specified in Form No. 04/TK-SDDPNN attached to Circular 80/2021/TT BTC as follows:

Download the declaration form of non-agricultural land use tax for households and individuals in case of transfer or donation of land use rights in Vietnam: here

LawNet