Which entities are subject to road tolls in Vietnam according to Decree 90/2023/ND-CP? What are the latest road toll rates in Vietnam?

Which entities are subject to road tolls in Vietnam according to Decree 90/2023/ND-CP?

According to the provisions of Article 2 Decree 90/2023/ND-CP, entities subject to road tolls are registered and inspected road motor vehicles, including:

- Automobiles;

- Trucks;

- Similar types of vehicles.

The following cases are exempt from tolls:

- Destroyed due to accidents or natural disasters.

- Confiscated or revoked vehicle registration certificate and license plates.

- Damaged beyond repair, rendering the vehicle inoperable for 30 days or more.

- Vehicles used for public transportation belonging to enterprises, cooperatives, or transportation business cooperatives that are continuously out of operation for 30 days or more.

- Vehicles of enterprises not participating in traffic, not using roads within the road traffic system (only awarded inspection certificates without inspection stamps as per technical safety and environmental protection inspection regulations of the Ministry of Transport) or vehicles participating in traffic, using roads within the road traffic system (awarded inspection certificates and inspection stamps as per technical safety and environmental protection inspection regulations of the Ministry of Transport) which later shift to not participating in traffic, not using roads within the road traffic system, and only used within:

+ Driving test centers;

+ Stations;

+ Ports;

+ Mineral extraction areas; agricultural, forestry, aquaculture, and processing areas;

+ Construction sites (transportation, irrigation, energy).

- Vehicles registered and inspected in Vietnam but operating abroad for 30 days or more.

- Vehicles stolen for 30 days or more.

Note:

Road tolls are not yet collected for automobiles with foreign license plates (including vehicles issued temporary registration certificates and temporary license plates) permitted by the competent authorities for temporary import and re-export within a defined period as per the law.

Vehicles under the exempt category must have adequate documentation compliant with Article 8 of Decree 90/2023/ND-CP. If a vehicle has already paid road tolls, the owner will get a refund for the paid amount or a reduction in the subsequent toll equivalent to the non-usage period.

Which entities are subject to road tolls in Vietnam according to Decree 90/2023/ND-CP? What are the latest road toll rates in Vietnam?

What are the road toll rates in Vietnam according to Decree 90/2023/ND-CP?

According to Decree 90/2023/ND-CP, the collection rates, policies for exemption, management, and usage of road tolls are prescribed.

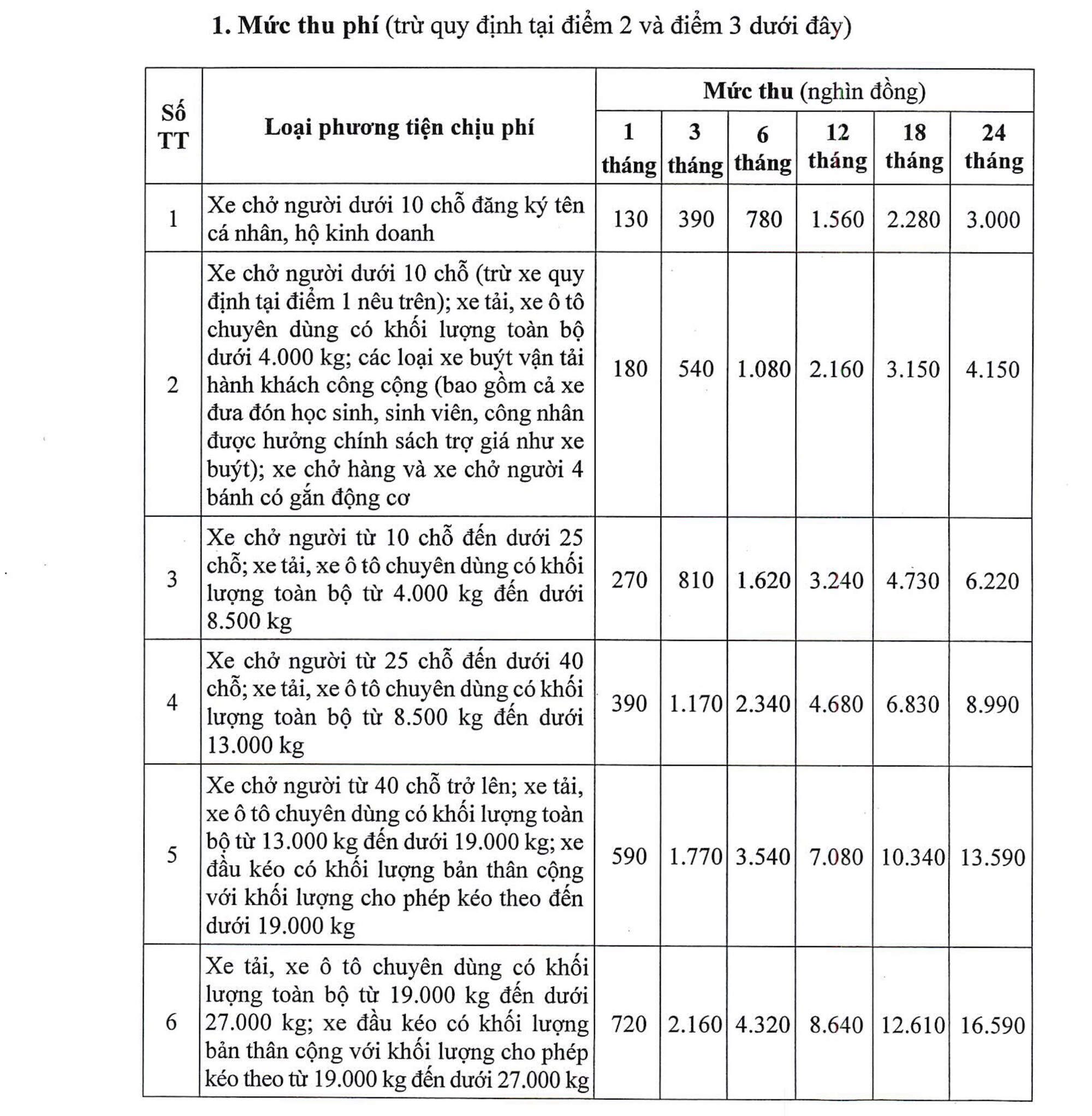

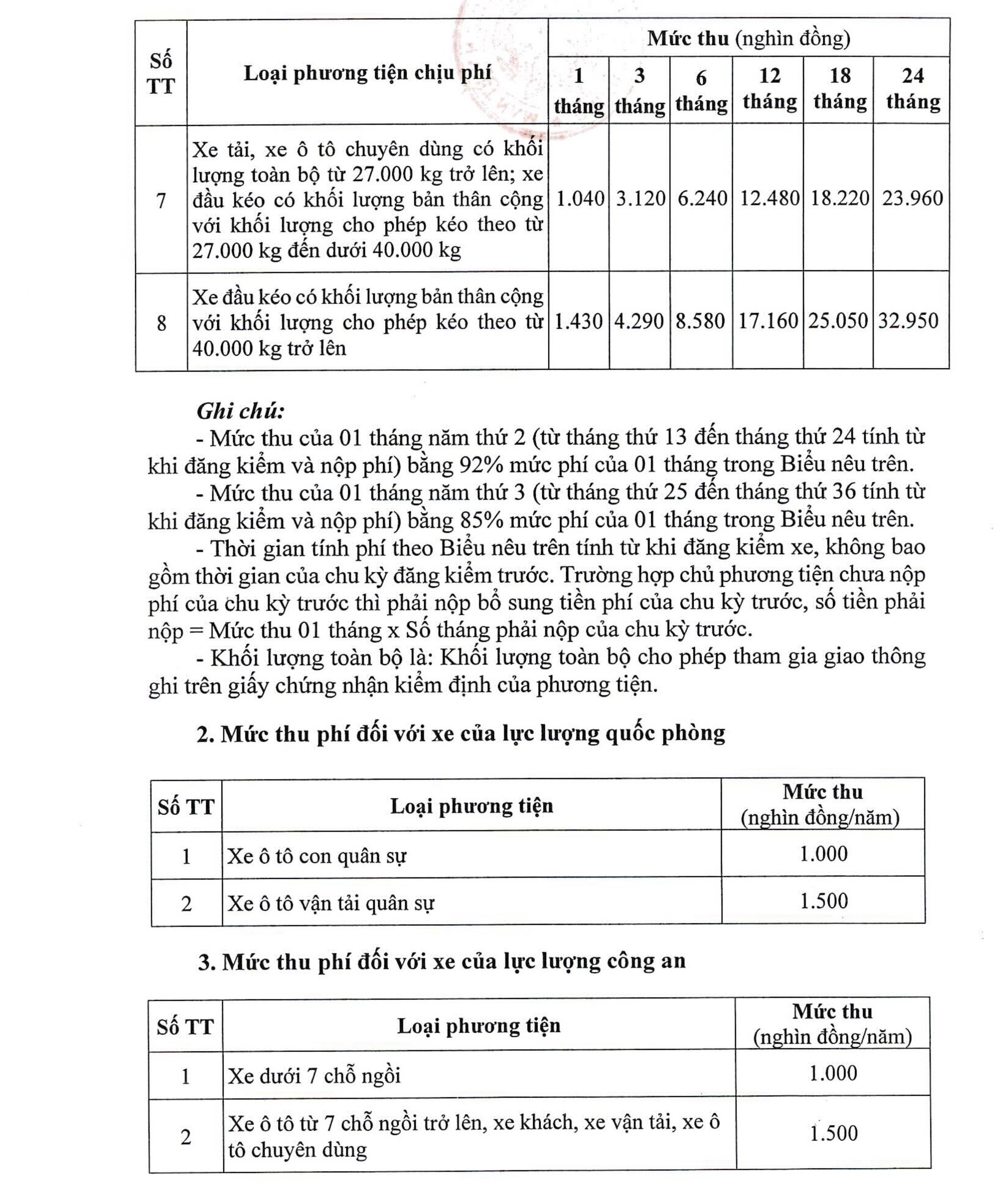

The road toll rates are specified in Article 5 of Decree 90/2023/ND-CP and Appendix I issued together with Decree 90/2023/ND-CP.

To be specific:

Note: In cases where the toll amount is fractional, the collecting organization rounds the amount based on the principle that fractions below 500 VND are rounded down, and fractions from 500 VND to below 1,000 VND are rounded up to 1,000 VND.

When does Decree 90/2023/ND-CP in Vietnam come into effect?

Based on the provisions of Article 10 Decree 90/2023/ND-CP regarding its effective date:

Effective Date

1. This Decree shall be effective from February 1, 2024.

2. Repeal:

a) Clause 1, Article 2 of Decree No. 09/2020/ND-CP dated January 13, 2020 of the Government of Vietnam repealing several legal documents regarding the Road Maintenance Fund.

b) Circular No. 70/2021/TT-BTC dated August 12, 2021 of the Minister of Finance prescribing collection rates, exemption policies, management, and usage of road tolls.

3. Other contents related to the collection, remission, management, and usage of tolls, accounting documents, and toll collection notices not stipulated in this Decree shall comply with the provisions of the Law on tolls and Charges, the Law on Tax Administration, Decree No. 120/2016/ND-CP, Decree No. 82/2023/ND-CP, Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam detailing several articles of the Law on Tax Administration, Decree No. 91/2022/ND-CP dated October 30, 2022 of the Government of Vietnam amending and supplementing some articles of Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam detailing several articles of the Law on Tax Administration; Decree No. 123/2020/ND-CP dated October 19, 2020 of the Government of Vietnam on invoices and documents.

4. In the course of implementation, where the legal documents referred to in this Decree are amended, supplemented, or replaced, the implementation shall follow the newly amended, supplemented, or replaced documents.

5. Ministers, Heads of ministerial-level agencies, Heads of agencies under the Government of Vietnam, Chairpersons of People’s Committees of provinces and centrally affiliated cities shall be responsible for the implementation of this Decree.

Decree 90/2023/ND-CP shall come into effect from February 1, 2024.

LawNet