What should be kept in mind when making a declaration of assets and income in Vietnam? What are the regulations on the asset and income declaration form according to Plan 4779/KH-SGDDT in 2022?

What is the asset and income declaration form according to Plan 4779/KH-SGDDT in 2022?

Pursuant to subsection 2, Section II of Plan 4779/KH-SGDDT of Vietnam in 2022, specifying the asset and income declaration form for the subjects that must declare in the Department of Education and Training and public service providers under the Department of Education and Training of Ho Chi Minh City as follows:

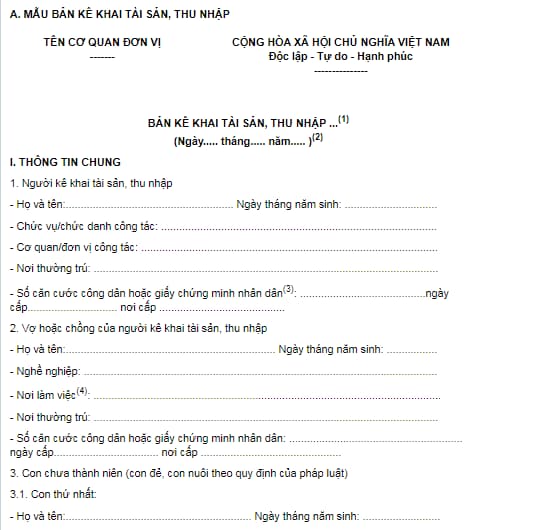

- Form of declaration of assets, initial and annual income:

Pursuant to Appendix I enclosed with Decree 130/2020/ND-CP of Vietnam stipulating the form of declaration of assets, initial and annual income as follows:

See detail of the form of declaration of assets, initial and annual income: Here.

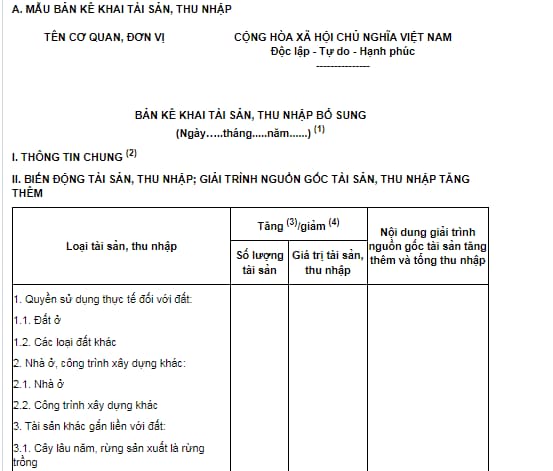

- Form of declaration of additional assets and income:

Pursuant to Appendix II enclosed with Decree 130/2020/ND-CP of Vietnam stipulating the form of declaration of additional assets and income as follows:

See detail of the form of declaration of additional assets and income: Here.

What should be kept in mind when making a declaration of assets and income in Vietnam?

Pursuant to Plan 4779/KH-SGDDT of Vietnam in 2022, some contents need to be kept in mind when making a declaration of assets and income in Vietnam as follows:

- The declarant must sign each page at the bottom right corner of the page, without initials or initials, but with the same signature as the last page.

- The declaration must be typed, not handwritten, printed on one side with the quantity of 02 originals, no photocopies will be accepted.

- Do not sign the section “Recipient of declaration” (this is the part signed by the Leader of the Personnel Department).

- Title: DECLARATION OF ASSETS, ANNUAL INCOME IN 2022 (for persons who are obliged to declare assets, annual income) or DECLARATION OF ADDITIONAL ASSETS AND INCOME IN 2022 (for persons who are obliged to declare assets), additional income) or DECLARATION OF ASSETS, INITIAL INCOME (for the person who is obliged to declare assets and income for the first time).

- Keep the contents of the Declaration form intact, do not delete lines, if there is no content, write "No" at the beginning of each item, if there is content, fill in all information as required in Decree 130/2020/ND-CP.

- Land declaration:

+ Address: write fully and specifically the house number (if any), alley, alley, neighborhood, hamlet, hamlet, hamlet; communes, wards and townships; districts, towns, provincial cities; provinces / cities under central.

+ Value: is the original value in Vietnamese currency; if the value cannot be determined, write "Unidentified value" and clearly state the reason why it cannot be determined.

+ Certificate of full 04 contents: number, date of issue, issuing agency, name of recipient.

+ Other information: write specifically according to the instructions on the actual status of management and use of the house, such as being used to live in or lease, lend or vacant.

+ For types of land including residential land, it must be declared in the Residential land section, clearly stating the land area and opening brackets, in which the residential land area is above the total land area.

- Declare the house

+ Type of house: Single house or apartment (only these two types of houses, in addition, declare in the section Other construction works such as: Factory, factory,...), specify the floor area of construction build, value; If the value cannot be determined, the reason must be stated.

+ Other information: write specifically according to the instructions on the actual status of management and use of the house, such as being used to live in or lease, lend or vacant.

+ For separate houses, the residential land attached to the house must be declared in the Residential land section, clearly stating the land area; Other information clearly states "what plot is the house attached to the land in the order of declaration in the section Residential land".

- Other construction works are non-residential construction works.

- Assets attached to land:

+ Perennial plants: trees in production forests are not included in this entry.

+ Other architectural objects attached to the land: Nam Bo island, stone statues, sculpture works and the like, etc.

- Section 4 on gold, diamond, platinum, etc. when declaring, must include the estimated value converted into Vietnam dong, (for comparison, it is over 50 million dong).

- In Section 6.3 on contributed capital: specify the form of capital contribution: to the Company (specify the name of the Company); business capital contribution (specify business form), etc. record both direct and indirect.

- For assets declared in Sections 3, 6 and 7: write all information to be declared on the name, quantity and value (if the value cannot be determined, write "The value cannot be determined" and specify the reason).

- Money item: Specify the currency, if it is a bank deposit, write the name of the sending bank.

What should be kept in mind when making a declaration of assets and income in Vietnam? What are the regulations on the asset and income declaration form according to Plan 4779/KH-SGDDT in 2022? (Image from the Internet)

What is the purpose of the declaration and disclosure of assets and income in Vietnam?

Pursuant to subsection 1, Section I, Plan 4779/KH-SGDDT of Vietnam in 2022 stipulating the purpose of declaration and disclosure of assets and income in Vietnam as follows:

- To declare and publicize assets and income so that competent agencies, organizations and units know the assets and incomes of the persons obliged to declare in order to be transparent about the assets and incomes of civil servants, public employees and employees.

- Promote self-discipline, honesty and sense of responsibility of persons obliged to declare in the implementation of regulations on transparency of assets and income; serving the management of civil servants and public employees, contributing to the prevention and prevention of corrupt acts.

LawNet