What is the receipt note form of application for finalizing social insurance books (Form 620)?

What is the receipt note form of application for finalizing social insurance books in Vietnam (Form 620)?

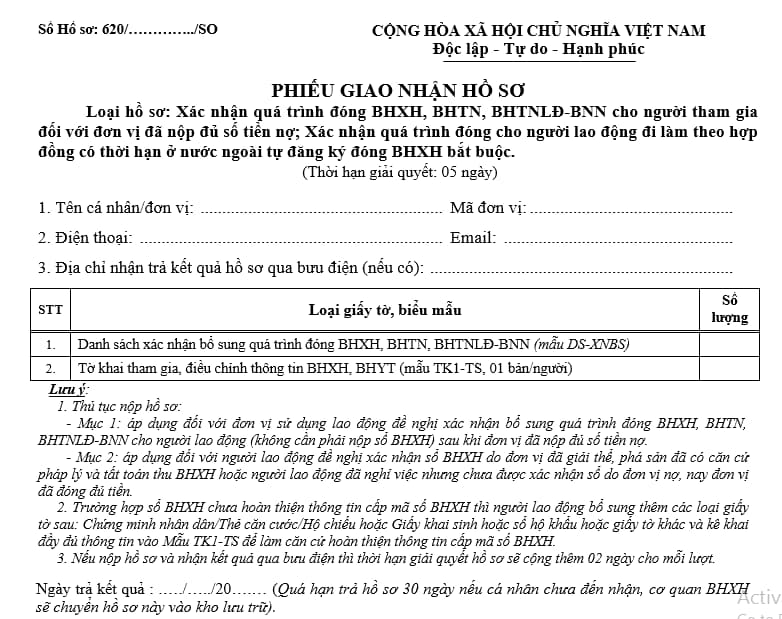

Based on the Appendix issued with Decision 595/QD-BHXH in 2017, and instructions at the Vietnam Social Insurance Information Portal, the receipt note form of application for finalizing social insurance books in Vietnam (Form 620) is specified as follows:

>> Download the receipt note form of application for finalizing social insurance books in Vietnam (Form 620): Here

01 application receipt note made in Form 620 and the accompanying documents and forms:

+ Social insurance book (old book template, 01 book/person) or Social insurance book cover sheet (new book template, 01 cover/person).

+ Leaflet of the social insurance book.

+ List of employees subject to additional confirmation of social insurance, unemployment insurance, and occupational accident and disease insurance premium payment period (Form DS-XNBS).

+ Statement on participation and modification of social insurance and health insurance (form TK1-TS, 01 declaration/person).

In 2024, what are the procedures for finalizing social insurance books in Vietnam?

Under the current provisions of Article 48 of the 2019 Labor Code and Article 21 of the Law on Social Insurance 2014, the employer is responsible for finalizing the social insurance book for the employee after terminating the employment contract.

The procedures for finalizing social insurance books in Vietnam consist of 02 steps: notification of reduction in the number of employees and finalization of social insurance book.

To be specific:

(1) Procedures for notification of reduction in the number of employees

Under Section 7 of the Official Dispatch 1952/BHXH-TST in 2023, there are instructions in the notification of reduction in the number of participants in social insurance, health insurance, unemployment insurance, and occupational accident insurance as follows:

The enterprise shall prepare the application for notification of reduction according to Electronic Application 600.

- In case the social insurance book has been reviewed and returned to the employee, the social insurance agency shall, based on the application for notification of reduction, confirm and print the leaflet of the social insurance book up to the time to which social insurance, unemployment insurance, and occupational accident and disease insurance premiums have been paid to the enterprise to return to the employee.

- In case the social insurance book has not been reviewed and returned by the social insurance agency, the social insurance agency does not confirm the process of social insurance and unemployment insurance according to the Electronic Application 600, enterprises are responsible for making the paper application according to the 626 application receipt note together with the social insurance book and submit it to the social insurance agency by post for review, updating of data, confirming and printing the leaflet of the social insurance book up to the time to which social insurance, unemployment insurance, and occupational accident and disease insurance premiums have been paid before transferring it to the enterprise for returning to the employee.

- In case the enterprise owes insurance premiums at the time of notification of reduction, after the social insurance agency confirms, prints the leaflet of the social insurance book up to the time to which social insurance, unemployment insurance, and occupational accident and disease insurance premiums have been paid, the enterprise is responsible for paying the full amount of debt and making a list of additional confirmation of social insurance, unemployment insurance, and occupational accident and disease insurance premium payment period for employees (no need to submit the social insurance book) sent under the application receipt slip 626 to the social insurance agency to print the leaflet of the social insurance book for additional confirmation.

For the application for modification of the social insurance and unemployment insurance premium period: the enterprise only submits Electronic Application 600 in cases where the employee has paid premiums at the enterprise; and the social insurance agency only modifies the data, does not print the leaflet of the social insurance book for confirming the modified period. In cases of resignation in which the employee’s social insurance book has been finalized and the leaflet of the social insurance book has been printed, Paper application 609 enclosed with the social insurance book must be submitted for printing the leaflet of the social insurance book for reconfirming the payment period per the modified period.

(2) Procedures for finalizing social insurance books

Enterprises prepare the application for finalizing social insurance books according to regulations and submit it to the social insurance agency for management.

Enterprises send directly to the social insurance agency or by post.

For e-applications, apply via https://dichvucong.baohiemxahoi.gov.vn or social insurance software.

Note: Enterprises can simultaneously carry out procedures for notification of reduction in the number of employees and finalization of the social insurance book.

Which entity is responsible for finalizing social insurance books in Vietnam?

Under the provisions of Clause 3, Article 48 of the 2019 Labor Code as follows:

Responsibilities of the parties upon termination of an employment contract

…

3. The employer has the responsibility to:

a) Complete the procedures for verification of period for participation in social insurance and unemployment insurance, return them and original copies of the employee’s other documents (if any);

b) Provide copies of the documents relevant to the employee’s work if requested by the employee. The employer shall pay the cost of copying and sending the documents.

…

At the same time, under Clause 5, Article 21 of the Law on Social Insurance 2014:

Responsibilities of employers

…

5. Coordinate with social insurance agencies in returning social insurance books to and certifying periods of social insurance premium payment for employees who terminate labor contracts or working contracts or cease working in accordance with law.

Thus, according to the above regulations, (except for the cases where since the enterprise is bankrupt and owes insurance premiums, it is impossible to finalize the social insurance books for employees), the finalization of the social insurance book is the responsibility of the enterprise..

LawNet