What is the PIT declaration form - Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam?

- What is the PIT declaration form- Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam?

- What are the instructions for preparing a PIT declaration - Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam?

- What are the incomes from salaries and remunerations subject to PIT in Vietnam?

What is the PIT declaration form- Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam?

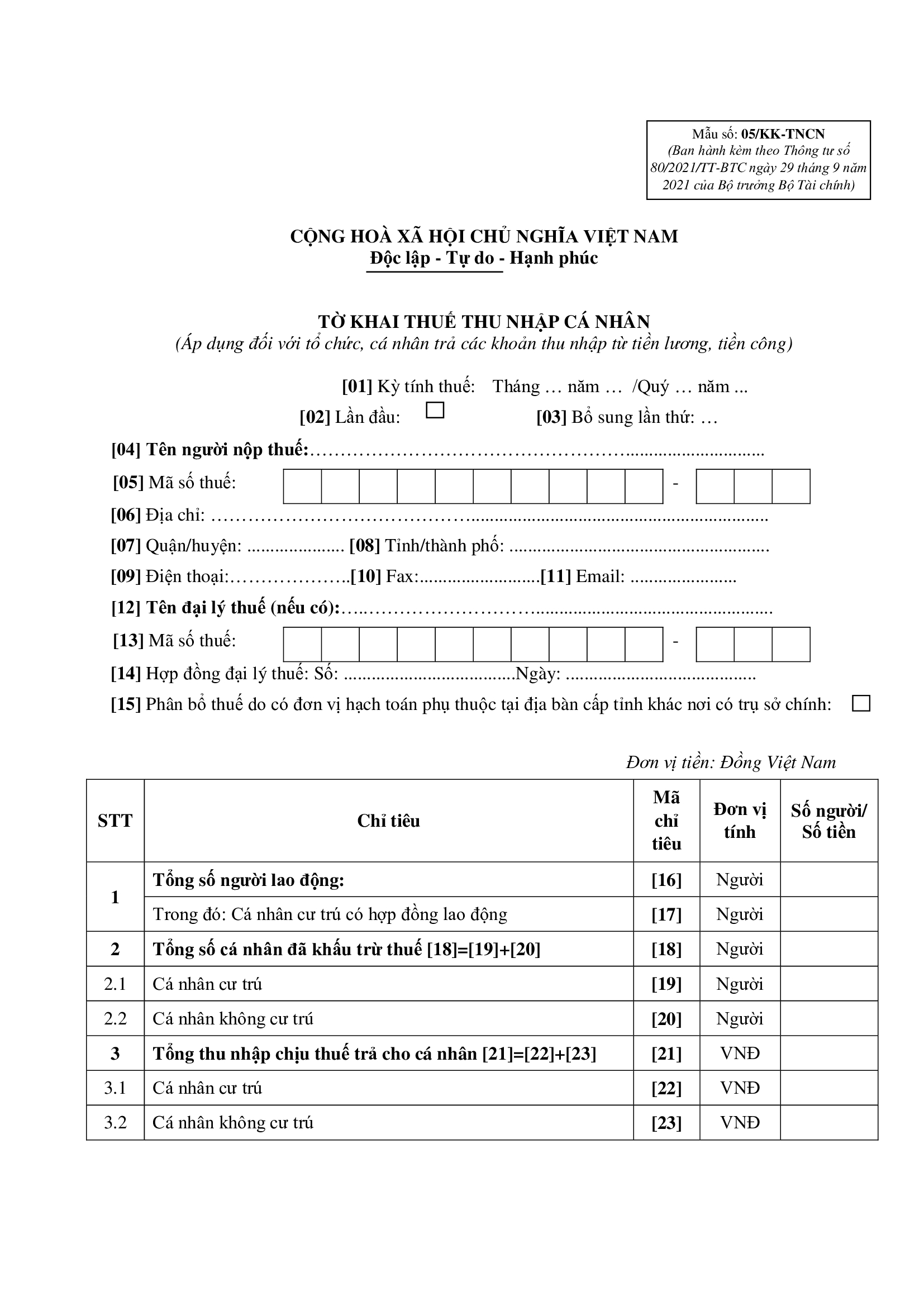

The PIT declaration form used by organizations and individuals paying incomes from salaries and remunerations in Vietnam is Form 05/KK-TNCN issued together with Circular 80/2021/TT-BTC as follows:

Download Form 05/KK-TNCN here

Note:

- This declaration only applies to organizations and individuals that incur to pay incomes from salaries and remunerations to individuals in the month/quarter, regardless of whether tax deductions arise or not.

- The monthly tax declaration period applies to income payers with total revenue from selling goods and providing services in the preceding year exceeding VND 50 billion or in case income-paying organizations or individuals choose to declare tax monthly.

- The quarterly tax declaration period applies to income payers with total revenue from selling goods and providing services in the preceding year of VND 50 billion or less, including income payers that do not generate revenue from selling goods and providing services.

What are the instructions for preparing a PIT declaration - Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam?

According to the instructions at the e-commerce portal, the General Department of Taxation in Vietnam provides the instructions for preparing a PIT declaration - Form 05/KK-PIT used by organizations and individuals paying incomes from salaries and remunerations in Vietnam as follows:

General information section:

[01] Tax period: Recorded by month, year or quarter or year of the tax declaration period. In case of monthly tax declaration, the income payer shall brick “quarter period” and and vice versa. (A tax period is a monthly or quarterly period; check for existence in the monthly/quarterly declaration).

[02] First time: First-time tax declaration: In case of tax declaration for the first time, mark the "x" in the box.

[03] Supplementary declaration: For the next declaration (it is determined to be a supplementary declaration): write the number of supplementary declarations in the blank.

[04] Name of taxpayer: Clearly and fully state the name of the income payer according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate.

[05] TIN: Clearly and fully state the TIN of the income payer according to the Tax Registration Certificate or Tax ID Notice or TIN Card issued by the tax authority.

[06], [07], [08] Address: Clearly and fully state the head office address of the income payer according to the Business Registration Certificate, or the permanent address (for individuals) registered with the tax authority.

[09], [10], [11] Telephone, fax, email: Clearly and fully write the phone number, fax number, and email address of the income-paying organization or individual (if there is none, then leave it blank).

[12] Name of tax agent (if any): In case the income-paying organization or individual authorizes tax declaration to the tax agent, it must clearly and fully state the name of the tax agent according to the establishment decision or the business registration certificate of the tax agent.

[13] TIN: Clearly and fully state the TIN of the tax agent according to the Tax Registration Certificate or Tax ID Notice or TIN card issued by the tax authority.

[14] Tax agency contract: Clearly and fully state the number and date of the tax agency contract between the income payer and the tax agent (ongoing contract).

[15] Allocation of tax amount due to dependent accounting unit in another province where the head office is located: If so, mark "x" in the square.

The declaration of the criteria of the table:

[16] Total number of employees: The total number of individuals with incomes from salaries and remunerations that organizations or individuals pay income in the period.

[17] Resident individuals with labor contracts: The total number of resident individuals receiving incomes from salaries and remunerations under labor contracts for 03 months or more that organizations or individuals pay income in the period.

[18] Total number of individuals withheld tax: Entry [18] = [19] + [20].

[19] Resident individual: Number of resident individuals whose incomes from salaries and remunerations that income payers have withheld tax.

[20] Non-resident individuals: A number of non-resident individuals with incomes from salaries and remunerations that income payers have withheld tax.

[21] Gross taxable income (PIT) paid to individuals: Entry [21] = [22] + [23].

[22] Resident individuals: Taxable incomes from salaries and remunerations and other taxable incomes of the nature of salaries and remunerations that income payer paid to individuals residing in the period.

[23] Non-resident individuals: Taxable incomes from salaries and remunerations and other taxable incomes of the nature of salaries and remunerations that the income payer paid to non-resident individuals during the period.

[24] Total taxable income from premiums for life insurance and other optional insurance of insurance enterprises not established in Vietnam for employees: The amount of money that organizations or individuals pay income to buy life insurance or other optional insurance with accrual of premiums of insurance enterprises not established in Vietnam for workers.

[25] Total taxable income exempted under the provisions of the Petroleum Contract: Declare Total taxable income exempted under the provisions of the Petroleum Contract (if any).

[26] Total taxable income paid to individuals subject to tax withholding: Entry [26] = [27]+[28].

[27] Resident individuals: Taxable incomes from salaries and remunerations and other taxable incomes of the nature of salaries and remunerations that income payer paid to resident individuals subject to tax deductions according to the period.

[28] Non-resident individuals: Taxable incomes from salaries and remunerations and other taxable incomes of the nature of salaries and remunerations that income-paying organizations or individuals have paid to non-resident individuals subject to tax deduction during the period.

[29] Total personal income tax deducted: Entry [29] = [30] + [31].

[30] Resident individuals: The amount of personal income tax that organizations or individuals pay withheld income of individuals residing in the period.

[31] Non-resident individuals: The amount of personal income tax that organizations or individuals pay withheld income of non-resident individuals during the period.

[32] Total PIT deducted on life insurance premiums and other optional insurance of insurance enterprises not established in Vietnam for employees:

Is the total amount of personal income tax that income payers have deducted on the amount of life insurance premiums and other optional insurance accrued on premiums of insurance enterprises not established in Vietnam for employees. Entry [32] = [24] x 10%.

What are the incomes from salaries and remunerations subject to PIT in Vietnam?

Pursuant to Clause 2 Article 3 of the Law on Personal Income Tax 2007 (amended by Clause 1 Article 1 of the Law on amendments to Law on Personal Income Tax 2012), except for tax-exempt incomes, incomes from salaries and remunerations subject to PIT include:

(1) Salaries and remunerations and amounts of similar nature;

(2) Allowances, subsidies, except for amounts:

+ Those paid under legal provisions on preferential treatment of persons with meritorious services;

+ Defense or security allowances;

+ Hazard or danger allowances for persons working in branches, occupations, or jobs at places where exist hazardous or dangerous elements;

+ Allowances for the attraction of laborers to work in certain branches or in certain regions specified by law;

+ Allowances for sudden difficulties, allowances for laborers having labor accidents or suffering from occupational disease, lump-sum maternity or child adoption allowances;

+ Allowances for working capacity loss, lump-sum retirement allowances, monthly survivorship allowances, and other allowances as prescribed by law on social insurance;

+ Severance and job-loss allowances specified in the Labor Code;

+ Subsidies of social relief nature and other allowances, subsidies without the nature of salaries and remunerations as prescribed by the Government.

LawNet