What is the PIT declaration form for income from capital transfer and securities transfer in Vietnam?

Personal Income Tax Declaration Form for Income from Capital Transfer, Securities Transfer?

According to Appendix II issued together with Circular 80/2021/TT-BTC regulating the personal income tax declaration form (Form No. 04/CNV-TNCN) as follows:

Download the form: Here.

What is the PIT declaration form for income from capital transfer and securities transfer in Vietnam?(Image from the internet)

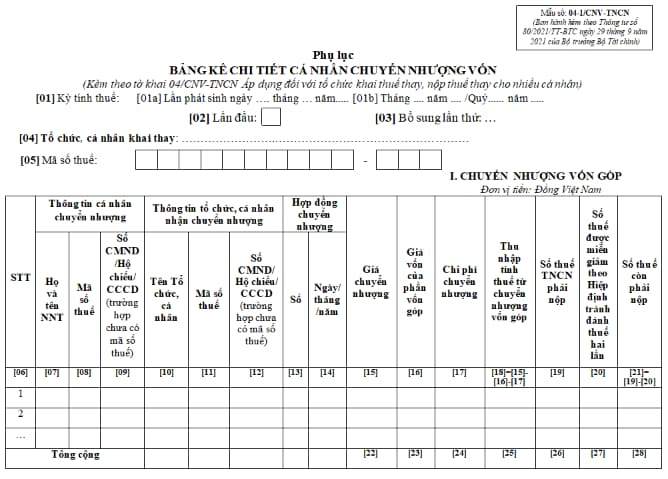

Vietnam: Appendix of detailed personal capital transfer list for organizations declaring taxes and paying taxes on behalf of multiple individuals

According to Appendix II issued together with Circular 80/2021/TT-BTC regulating the appendix of the detailed list (Form No. 04-1/CNV-TNCN) as follows:

Download the form: Here.

What is the PIT declaration form for income from capital transfer and securities transfer in Vietnam?

According to Clause 4, Article 16 of Circular 156/2013/TT-BTC, it is regulated as follows:

"Article 16. Personal Income Tax Declaration and Payment

...

4. Tax declaration for income from capital transfer activities (excluding securities transfer).

a) Tax declaration principles

a.1) Resident individuals transferring contributed capital must declare taxes each time a transfer occurs, regardless of whether income arises.

a.2) Non-resident individuals with income from capital transfer in Vietnam are not required to directly declare taxes with the tax authority. Instead, the organization or individual receiving the transfer shall withhold and declare taxes according to Clause 1 of this Article. If the transferee is an individual, the tax must be declared per occurrence without an annual finalization obligation for the withholding obligation.

a.3) Enterprises changing the list of contributing members in case of capital transfer without proof of tax completion by the transferring individuals must declare and pay taxes on behalf of the individuals. The enterprises must fill out the tax declaration forms on behalf of the individuals. The enterprise must record the term “On behalf” before the phrase "Taxpayer or Legal Representative of the Taxpayer" and have the declarant sign, clearly state their full name, and seal of the enterprise. On tax calculation forms and tax payment receipts, the taxpayer must still be the individual transferring contributed capital (if resident) or the individual receiving the transferred capital (if non-resident)

b) Tax declaration documents

Resident individuals with income from capital transfer declare taxes using the following forms:

- Personal income tax declaration form for individuals with income from capital transfer (Form No. 12/KK-TNCN issued together with this Circular).

- Photocopy of the Capital Transfer Agreement.

- Documents identifying the value of contributed capital according to accounting records, agreements to buy back contributed capital in case of transferred capital.

- Photocopies of documents proving related costs in determining income from capital transfer activities with the individual's signed commitment on the photocopy.

The tax authority issues a Tax Payment Notification (Form No. 12-1/TB-TNCN issued together with this Circular) to the individuals (even if no tax liability arises).

c) Place to submit tax declaration documents

Individuals or enterprises declaring taxes on behalf of individuals shall submit the tax declaration documents at the tax authority directly managing the enterprise with transferred contributed capital.

d) Deadline for submitting tax declaration documents

Individuals declaring taxes on income from capital transfer must submit personal income tax declarations by the 10th day from the date the Capital Transfer Agreement takes effect.

If enterprises declare and pay taxes on behalf of the individuals, the tax declaration documents must be submitted before the procedure to change the list of contributing members as per the law.

dd) Tax payment deadline

The tax payment deadline is the deadline indicated on the tax authority’s Tax Payment Notification."

Above is the newest personal income tax declaration form applicable to income from capital transfer and securities transfer.

LawNet