What is the order of the initial tax registration in Vietnam for an individual taxpayer who submits a tax registration dossier through an income-paying agency?

- What is the order of making the initial tax registration in Vietnam for individual taxpayers who submit tax registration documents through an income-paying agency?

- What is included in the initial tax registration dossier for an individual taxpayer who submits a tax registration dossier through an income-paying agency?

- What is the general tax registration form of an individual earning income from wages and salaries?

What is the order of making the initial tax registration in Vietnam for individual taxpayers who submit tax registration documents through an income-paying agency?

Pursuant to subsection 14, Section 2, Part 2, Administrative procedures promulgated together with Decision No. 2589/QD-BTC in 2021 as follows:

Step 1: The individual authorizing the income-paying agency to register for tax shall send a written authorization and one of his/her papers (a copy of the citizen identity card or or a copy of the valid ID card for individuals who are Vietnamese nationals; Copy of valid Passport for individuals who are foreign nationals or Vietnamese nationals living abroad) to the income-paying agency;

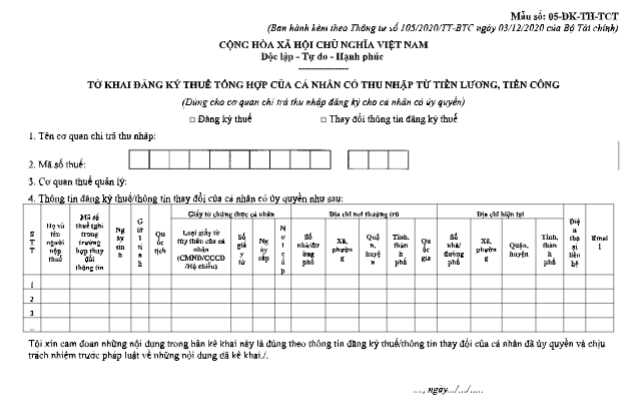

The income-paying agency summarizes and sends a tax registration declaration form No. 05-DK-TH-TCT issued together with Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance guiding on tax registration within 10 working days from the date of arising of tax obligations, in case the individual does not have a tax identification number, send it to the tax authority directly managing the income paying agency for tax registration on behalf of the authorized individual.

- For the case of electronic tax registration dossiers: Taxpayers access the portal chosen by the taxpayer the website of the General Department of Taxation/the website of the competent state agencies including the National Public Service Portal, the Ministry-level Public Service Portal, and the provincial-level Public Service Portal in accordance with regulations on implementation of the one-stop-shop mechanism in handling administrative procedures and and has been connected to the web portal of the General Department of Taxation/the portal of the T-VAN service provider) to declare declarations and attach required documents in electronic form (if any), electronically sign and send to tax authorities via the website that the taxpayer chooses;

Taxpayers submit dossiers (tax registration dossiers concurrently with business registration dossiers under the one-stop-shop mechanism) to competent state management agencies according to regulations. The competent state management agency shall send information about the taxpayer's received dossier to the tax authority via the web portal of the General Department of Taxation.

Step 2: The tax authority receives:

- For paper tax registration dossiers:

+ In case the dossier is submitted directly at the tax office: The tax official receives and affixes the receipt stamp on the tax registration dossier, clearly stating the date of receipt of the dossier, the number of documents according to the list of documents for the tax office for the case of tax registration dossiers submitted directly at the tax authorities. The tax officer writes an appointment slip for the date of return of the results and the time limit for processing the received documents;

+ In case the tax registration dossier is sent by post, the tax official shall stamp the receipt, write the date of receipt of the dossier in the dossier and write the letter number of the tax authority;

Tax officials check tax registration dossiers. In case the dossier is incomplete and needs to be explained and supplemented with information and documents, the tax authority shall notify the taxpayer using form No. 01/TB-BSTT-NNT in Appendix II issued together with Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government within 02 (two) working days from the date of receipt of the application.

- For the case of electronic tax registration dossiers:

Tax authorities shall receive dossiers through the portal of the General Department of Taxation, inspect and process dossiers through the tax authorities' electronic data processing system:

+ Receipt of dossiers: The website of the General Department of Taxation sends a notice of receipt of the taxpayer's submission of the dossier to the taxpayer via the portal that the taxpayer chooses to compile and send the dossier (website of the General Department of Taxation / Portal of a competent state agency or T-VAN service provider) within 15 minutes from the date of receipt of the electronic tax registration dossier of taxpayers;

+ Checking and processing dossiers: Tax authorities shall examine and process taxpayers' dossiers in accordance with the law on tax registration and return settlement results via the electronic portal that the taxpayers choose to make and send dossiers:

++ In case the dossier is complete and according to the prescribed procedures and the results must be returned: The tax authority shall send the result of the dossier settlement to the portal that the taxpayer chooses to prepare and send the dossier according to the deadline specified in Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance;

++ In case the dossier is incomplete or not according to the prescribed procedures, the tax authority shall send a notice of refusal to accept the dossier, send it to the portal that the taxpayer chooses to make and send the dossier within 02 (two) working days from the date written on the Notice of application receipt.

What is the order of the initial tax registration in Vietnam for an individual taxpayer who submits a tax registration dossier through an income-paying agency?

What is included in the initial tax registration dossier for an individual taxpayer who submits a tax registration dossier through an income-paying agency?

Pursuant to subsection 14, Section 2, Part 2, Administrative procedures promulgated together with Decision No. 2589/QD-BTC in 2021 stipulating the composition of the initial tax registration dossiers for individual taxpayers filing tax registration dossiers. Tax registration through the income-paying agency includes:

- An individual's tax registration dossier includes sending to the income paying agency:

Authorization letter and one of the personal papers:

++ Copy of National Identity Card

++ Or a copy of the valid ID card for individuals who have Vietnamese nationality;

++ A copy of the valid Passport for individuals who are foreign nationals or Vietnamese nationals living abroad;

+ The income paying agency is responsible for synthesizing the individual's tax registration information into the tax registration declaration form No. 05-DK-TH-TCT issued together with Circular No. 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance to the tax agency directly managing the income paying agency.

What is the general tax registration form of an individual earning income from wages and salaries?

Tax registration declaration form No. 05-DK-TH-TCT issued together with Circular No. 105/2020/TT-BTC dated December 3, 2020 of the Ministry of Finance.

Download the general tax registration form of individuals earning income from wages and salaries: Click here.

Download the general tax registration form of individuals earning income from wages and salaries: Click here.

LawNet