What is the formula for calculation of the remaining land-related investment expense when the State expropriates land for national defense or security purposes in Vietnam?

- Which cases are compensated for remaining investment costs on land when the State expropriates land for national defense or security purposes in Vietnam?

- What are the regulations on the formula for calculation of the remaining land-related investment expense when the State expropriates land for national defense or security purposes in Vietnam?

- What are the bases for determination of the remaining land-related investment expense?

Which cases are compensated for remaining investment costs on land when the State expropriates land for national defense or security purposes in Vietnam?

In Article 76 of the 2013 Land Law of Vietnam stipulating the cases that are not eligible for compensation for land but are eligible for compensation for the remaining investment costs on land when the State recovers the land include:

- Land which is allocated by the State without land use levy, except the cases in which agricultural land is allocated to households and individuals as prescribed in Clause 1, Article 54 of this Law;

- Land which is allocated with land use levy by the State to organizations but those organizations are exempted from land use levy;

- Land which is leased by the State with annual rental payment or leased land with full one- off rental payment for the entire lease period but the land rental is exempted, for cases in which households and individuals use land under the policies for people with meritorious services to the revolution;

- Agricultural land belonging to the public land fund of the communes, wards or townships;

- Contracted land for agriculture, forestry, aquaculture or salt production.

What is the formula for calculation of the remaining land-related investment expense when the State expropriates land for national defense or security purposes in Vietnam? (Image from the Internet)

What are the regulations on the formula for calculation of the remaining land-related investment expense when the State expropriates land for national defense or security purposes in Vietnam?

In Clause 4, Article 3 of Decree No. 47/2014/ND-CP on compensation for the remaining land-related investment expense upon expropriation for national defense and security; socio-economic development for the benefits of the public and the country as follows:

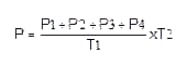

The remaining land-related investment expense should be in accordance with market price at the time of expropriation and determined according to the following formula:

Where:

P: The remaining land-related investment expense;

P1: Expenses for land grading;

P2: Expenses for enrichment of soil nutrients, soil desalination and de-acidification, corrosion and erosion control of the land used for agricultural production;

P3: Expenses for reinforcement load, vibration, and sinking bearing capacity of the land used as business premises;

P4: Other expenses in accordance with land use purpose.

T1: Land use term;

T2: Remaining land use term;

In case the time of investment in land takes places after the time of land allocation by the State, land use term (T1) shall be calculated from the time of investment in land.

What are the bases for determination of the remaining land-related investment expense?

In Article 3 of Circular No. 37/2014/TT-BTNMT on determination of the remaining land-related investment expense as follows:

Determination of the remaining land-related investment expense

The remaining land-related investment expense as defined in Article 3 of the Decree 47/2014/NĐ-CP dated May 15, 2014 of the Government regulating in detail compensation, support, and resettlement upon land expropriation (hereinafter referred to as the Decree No. 47/2014/NĐ-CP) shall be determined according to the following requirements:

1. Documentary evidences to show land users’ investment

2. Such documentary evidences shall include the followings:

a) Lease or lump-sum agreements, records on leveling and restoration of the land allocated or leased out by the State, land reclamation, inundation, erosion control, ground construction and reinforcement to create space for manufacturing and business premises;

b) Written contract discharge; invoices or payment vouchers for land-related investment expenses as defined in Point a of this Clause;

c) Other documents and contracts relating to funds invested in the land made at the date of investment.

3. Holders of the title to expropriated land plots do not have any of the papers as defined in Clause 2 of this Article, but have actually made investment in the land, the People’s Committees of central-affiliated cities and provinces (hereinafter referred to as the province-level People’s committee) shall determine the remaining land-related investment expense in reliance on specific circumstances of the locality under their management.

4. The remaining land-related investment expense as defined in Clause 4, Article 3 of the Decree 47/2014/NĐ-CP shall be calculated according to the following formula:

a) Determination of the remaining land-related investment expense should be based on unit prices, economic and technical norms stipulated by competent agencies;

b) In case investment in the land has been made a number of times or years, determination of the remaining land-related investment expense shall be done by accumulation of all the expenses paid in such periods or years.

Thus, the remaining land-related investment expense will also be determined based on documentary evidences to show land users’ investment.

LawNet