What is the form of sponsorship for healthcare confirmation of enterprises in Vietnam?

What is the form of sponsorship for healthcare confirmation of enterprises in Vietnam?

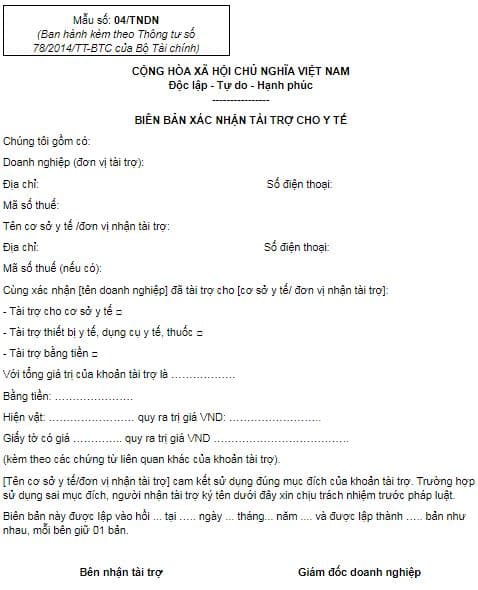

Currently, the form of sponsorship for healthcare confirmation of enterprises is made according to Form 04/TNDN issued together with Circular 78/2014/TT-BTC stipulating as follows:

Download the current form of sponsorship for healthcare confirmation of enterprises: Here.

What is the form of sponsorship for healthcare confirmation of enterprises in Vietnam?

Is the sponsorship for healthcare deductible when calculating taxable income of enterprises in Vietnam?

Pursuant to Clause 2, Article 6 of Circular 78/2014/TT-BTC as amended by Article 4 of Circular 96/2015/TT-BTC as follows:

Deductible and non-deductible expenses when calculating taxable income

...

2. The expenses below are not deductible when calculating taxable income:

...

2.1. Expenses that do not meet all of the conditions in Clause 1 of this Article.

If the enterprise incurs expenses related to damage caused by natural disasters, epidemics, blazes, and other force majeure events (hereinafter referred to as calamities) without compensation, such expenses will be deductible when calculating taxable income. In particular:

The enterprise must determine the value of damage caused by calamities in accordance with law.

The damage value equals (=) total damage value minus (-) the value of damage that must be compensated by insurers other entities as prescribed by law.

a) Documents about assets/goods damaged by calamities that are included in deductible expenses include:

- A statement of value of damaged assets/goods made by the enterprise.

A statement of value of damaged assets/goods must specify the value of damaged assets/goods, causes, responsibilities for such damage, categories, quantity, value of recoverable assets/goods (if any); statement of damaged goods certified by legal representative of the enterprise.

- A compensation claim upheld by the insurer (if any).

- Documents about responsibility for provision of compensation (if any).

b) Expired goods and goods damaged because of natural deterioration that are not compensated will be deductible expenses when calculating taxable income.

Documents about expired goods and goods damaged because of natural deterioration and that are included in deductible expenses include:

- Statement of damaged goods made by the enterprise

A statement of value of damaged goods must specify the value of damaged goods, causes; categories, quantity, and values of recoverable goods (if any) enclosed with a statement of inventory of damaged goods certified by the legal representative of the company.

- A compensation claim upheld by the insurer (if any).

- Documents about responsibility for provision of compensation (if any).

c) The aforementioned documents shall be retained at the enterprise and presented to the tax authority on request.

...

2.23. Provision of sponsorship for healthcare for illegitimate subjects according to Point (a) or without documentation mentioned in Point (b) below:

a) Sponsorship for healthcare include: Sponsorship for medical facilities established under regulations of law on healthcare, provided the sponsorship is not meant to contribute capital or buy shares of such medical facilities; Sponsorship for medical equipment, medicines; Sponsorships for regular operation of hospitals, medical centers; Monetary sponsorships for patients via an organization permitted to raise sponsorship as prescribed by law.

b) Documents about sponsorship for healthcare include: Certification of sponsorship bearing the signature of the representative of the sponsoring enterprise, representative of the unit that receives the sponsorship (or an organization permitted to raise sponsorship) (form 04/TNDN enclosed with Circular No. 78/2014/TT-BTC); invoices/receipts for purchase of goods (in case of in-kind sponsorship) or proof of payment (in case of monetary sponsorship).

According to the above regulations, the expenditures for health care but there is no record to determine the funding according to the above provisions will not be deducted when determining taxable income.

In addition, expenditures that do not fall into the following categories will not be deducted from corporate income tax:

- Sponsorship for medical facilities established under regulations of law on healthcare, provided the sponsorship is not meant to contribute capital or buy shares of such medical facilities;

- Sponsorship for medical equipment, medicines; Sponsorships for regular operation of hospitals, medical centers;

- Monetary sponsorships for patients via an organization permitted to raise sponsorship as prescribed by law.

What are the regulations on sponsorship for healthcare of enterprises in Vietnam?

Pursuant to Clause 2, Article 6 of Circular 78/2014/TT-BTC as amended by Article 4 of Circular 96/2015/TT-BTC as follows:

Deductible and non-deductible expenses when calculating taxable income

...

2. The expenses below are not deductible when calculating taxable income:

...

2.23. Provision of sponsorship for healthcare for illegitimate subjects according to Point (a) or without documentation mentioned in Point (b) below:

a) Sponsorship for healthcare include: Sponsorship for medical facilities established under regulations of law on healthcare, provided the sponsorship is not meant to contribute capital or buy shares of such medical facilities; Sponsorship for medical equipment, medicines; Sponsorships for regular operation of hospitals, medical centers; Monetary sponsorships for patients via an organization permitted to raise sponsorship as prescribed by law.

b) Documents about sponsorship for healthcare include: Certification of sponsorship bearing the signature of the representative of the sponsoring enterprise, representative of the unit that receives the sponsorship (or an organization permitted to raise sponsorship) (form 04/TNDN enclosed with Circular No. 78/2014/TT-BTC); invoices/receipts for purchase of goods (in case of in-kind sponsorship) or proof of payment (in case of monetary sponsorship).

Thus, the dossier for determining the health sponsorship will include a confirmation of sponsorship, proof of purchase of goods if sponsored in kind, voucher of payment if sponsored in cash.

LawNet