What is the form of Notes to financial statement for small and medium enterprises in Vietnam?

- What is the form of Notes to financial statement for small and medium enterprises in Vietnam?

- On what rules do small and medium enterprises prepare and present the Notes to financial statements in Vietnam?

- What is the time limit for submitting annual financial statements of small and medium enterprises in Vietnam?

What is the form of Notes to financial statement for small and medium enterprises in Vietnam?

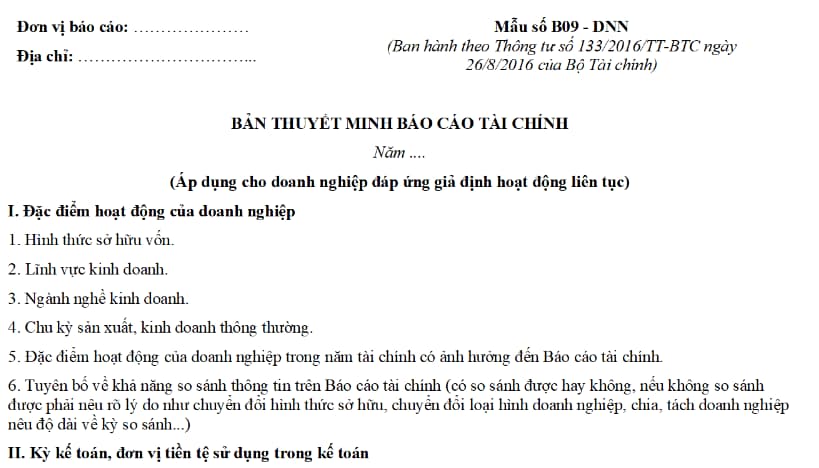

The form of Notes to financial statement in the annual financial statement records for small and medium enterprises is specified in Form B09 - DNN issued together with Circular No. 133/2016/TT-BTC, specifically as follows:

Download the form of Notes to financial statement for small and medium enterprises in Vietnam: Click here.

What is the form of Notes to financial statement for small and medium enterprises in Vietnam?

On what rules do small and medium enterprises prepare and present the Notes to financial statements in Vietnam?

Pursuant to Paragraph 2.5.2 point 2.5 Clause 2 Article 81 of Circular No. 133/2016/TT-BTC small and medium enterprises prepare and present the notes to financial statements in Vietnam according to the following rules:

- When preparing the financial statement, the enterprise shall prepare the notes to the financial statement according to instructions herein.

- The notes to the financial statement must contain the following information:

+ The basis of the financial statement, accounting policies applied to important transactions and events;

+ Additional information that is not presented in other financial statements but necessary for truthful and rational presentation of the enterprise’s finance and performance.

- The notes to the financial statement must be systematically presented. The enterprise may arrange the order of the notes to the financial statement as long as each entry of the financial position statement, income statement, and cash flow statement is linked to relevant information in the notes to the financial statement.

What is the time limit for submitting annual financial statements of small and medium enterprises in Vietnam?

Pursuant to Article 80 of Circular No. 133/2016/TT-BTC stipulating as follows:

Responsibility and time limit for preparing and submitting financial statement

1. Responsibility and time limit for preparing and submitting a financial statement:

a) Every small and medium enterprise shall prepare and send its financial statement within 90 days from the end of the fiscal years to relevant authorities.

b) Apart from the annual financial statement, an enterprise may prepare monthly or quarterly financial statements if necessary.

2. Recipients of annual financial statements:

Annual financial statements shall be submitted to tax authorities, business registration authorities and statistics authorities.

In addition to the aforementioned authorities, enterprises (both Vietnamese enterprises and foreign-invested enterprises) in export-processing zones, industrial parks, hi-tech zones shall submit their financial statements to the management boards thereof.

Thus, small and medium enterprises must prepare and submit annual financial statements within 90 days from the end of the fiscal year.

Recipients of annual financial statements:

- Annual financial statements shall be submitted to tax authorities, business registration authorities and statistics authorities.

- In addition to the aforementioned authorities, enterprises (both Vietnamese enterprises and foreign-invested enterprises) in export-processing zones, industrial parks, hi-tech zones shall submit their financial statements to the management boards thereof.

LawNet