What is the declaration form for changes in tax registration information in Vietnam? When should the notification of changes in tax registration information be performed?

What is the declaration form for changes in tax registration information in Vietnam?

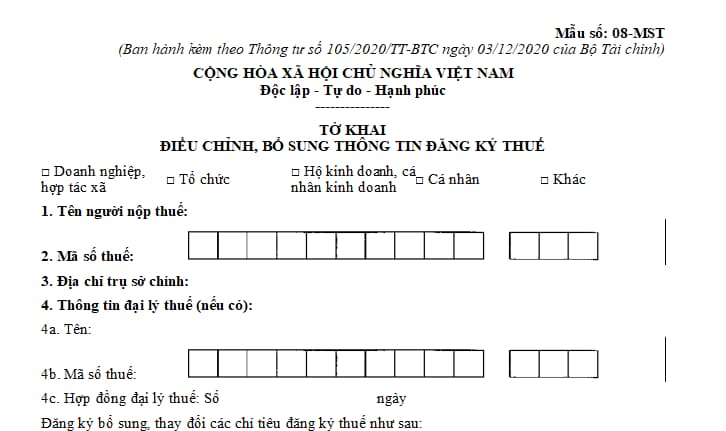

Currently, the form of declaration of adjustment and supplementation of tax registration information is specified in form No. 08-MST, Appendix II issued together with Circular 105/2020/TT-BTC as follows:

Download the declaration form of changes in tax registration information here

- Guideline for writing a declaration form of changes in tax registration information:

+ Column (1): Enter the names of the changed items on the tax registration declaration or the lists attached to the tax registration dossier.

+ Column (2): Record the content of tax registration information declared in the most recent tax registration.

+ Column (3): Enter the exact content of newly changed or added tax registration information.

What is the declaration form for changes in tax registration information in Vietnam? When should the notification of changes in tax registration information be performed? (Image from the Internet)

Vietnam: When should the notification of changes in tax registration information be performed?

Pursuant to Article 36 of the Law on Tax Administration 2019, the notification of changes in the tax registration information is made at the following time:

Notification of changes to taxpayer registration information

1. Upon any change to taxpayer registration information, taxpayers who combine taxpayer registration with business registration shall notify the changes to taxpayer registration information together with changes to business registration information as prescribed by law.

In case taxpayers' change of address leads to change of supervisory tax authorities, taxpayers must complete tax procedures with supervisory tax authorities as prescribed in this Law before registering with business registration authorities for change of information.

2. When there is any change to taxpayer registration information, taxpayers directly registered with tax authorities must notify their supervisory tax authorities within 10 working days starting from the date of changes to information.

3. In case individuals authorizing their income payers to register changes to taxpayer registration information for themselves and their dependants, they must notify the income payers in no later than 10 working days starting from the date of changes to information; the income payers shall be responsible for notifying tax authorities of the changes in no later than 10 working days starting from the date of authorization from taxpayers.

What is the penalty for late notification of changes in tax registration information in Vietnam?

Pursuant to Article 11 of Decree 125/2020/ND-CP has the following provisions:

Penalties for violations against regulations on time limits for notification of changes in tax registration information

1. Cautions shall be given as a form of penalty imposed for the following violations:

a) Notifying changes in tax registration information from 01 to 30 days after expiration of the prescribed time limits without entailing any change in tax registration certificates or tax identification number notifications under mitigating circumstances;

b) Notifying changes in tax registration information from 01 to 10 days after expiration of the prescribed time limits if such changes entail any change in tax registration certificates or tax identification number notifications under mitigating circumstances.

2. Fines ranging from VND 500,000 to VND 1,000,000 shall be imposed for the act of notifying changes in tax registration information from 01 to 30 days after expiration of the prescribed time limits without entailing any change in tax registration certificates or tax identification number notifications, except the cases specified in point a of clause 1 of this Article.

3. Fines ranging from VND 1,000,000 to VND 3,000,000 shall be imposed for one of the following violations:

a) Notifying changes in tax registration information from 31 to 90 days after expiration of the prescribed time limits without entailing any change in tax registration certificates or tax identification number notifications;

b) Notifying changes in tax registration information from 01 to 30 days after expiration of the prescribed time limits if such changes entail any change in tax registration certificates or tax identification number notifications, except as specified in point b of clause 1 of this Article.

4. Fines ranging from VND 3,000,000 to VND 5,000,000 shall be imposed for one of the following violations:

a) Notifying changes in tax registration information at least 91 days after expiration of the prescribed time limits without entailing any change in tax registration certificates or tax identification number notifications;

b) Notifying changes in tax registration information from 31 to 90 days after expiration of the prescribed time limits if these changes entail any change in tax registration certificates or tax identification number notifications.

5. Fines ranging from VND 5,000,000 to VND 7,000,000 shall be imposed for one of the following violations:

a) Notifying changes in tax registration information at least 91 days after expiration of the prescribed time limits if these changes entail any change in tax registration certificates or tax identification number notifications;

b) Failing to notify changes of information contained in tax registration applications.

6. Regulations laid down in this Article shall be applied to the following cases:

a) Non-business persons who have been granted personal income tax identification codes delay in registering changes in their ID information after receipt of 12-digit ID cards;

b) Income payers delay in registering changes from ID cards to 12-digit ID cards of PIT payers that are persons granting authorization to complete PIT finalization procedures;

c) Notifying changes in information about taxpayer’s address contained in tax registration applications after expiration of the prescribed time limits due to any change in administrative jurisdictions under the Resolutions of the National Assembly’s Standing Committee or National Assembly.

7. Remedies: Compelling the submission of application for changes in tax registration information in case of committing the act specified in point b of clause 5 of this Article.

Accordingly, late notification of changes in information in tax registration can be administratively sanctioned according to the above provisions with the lowest penalty being a warning to a maximum fine of 7 million VND.

Note that this fine level is applied to organizations, the fine level for individuals is 1/2 of the above penalty.

LawNet