What important notes about tax obligations should be known to avoid being suspended from exit from Vietnam? What form is the exit suspension cancellation notice form?

- What important notes about tax obligations should be known to avoid being suspended from exit from Vietnam?

- If a suspended person has fulfilled his/her tax obligations in Vietnam, when will the exit suspension be cancelled?

- What form is the exit suspension cancellation notice form after fulfilling tax obligations in Vietnam?

What important notes about tax obligations should be known to avoid being suspended from exit from Vietnam?

Pursuant to Clause 1 and Clause 2, Article 21 of Decree 126/2020/ND-CP on fulfillment of tax obligations upon exit from Vietnam:

Exit from Vietnam will be suspended in the following cases:

(1) The individual, the individual that is the legal representative of an enterprise has not fulfilled tax obligations under a tax enforcement decision.

(2) A Vietnamese national has not fulfilled his/her tax obligations before emigration.

(3) A Vietnamese national residing overseas has not fulfilled his/her tax obligations before exit.

(4) A foreigner has not fulfilled his/her tax obligations before exit.

Therefore, cases regulated from (1) to (4) shall be suspended from exit from Vietnam if failing to fulfill tax obligations.

In addition, authority to impose, extend and cancel suspension from exit

(1) The head of the supervisory tax authority of the taxpayer has the authority to suspend the taxpayer from exit in the cases specified in Clause 1 of this Article.

(2) The person that imposes the exit suspension also has the authority to extend and cancel the suspension.

(3) The person that imposes the exit suspension shall cancel the suspension within 24 hours after the taxpayer fulfills his/her tax obligations.

What important notes about tax obligations should be known to avoid being suspended from exit from Vietnam? What form is the exit suspension cancellation notice form?

If a suspended person has fulfilled his/her tax obligations in Vietnam, when will the exit suspension be cancelled?

Pursuant to Clause 3, Article 21 of Decree 126/2020/ND-CP on fulfillment of tax obligations upon exit from Vietnam:

Fulfillment of tax obligations upon exit from Vietnam

.....

Procedures for imposing, extending and cancelling exit suspension

a) After a taxpayers’ tax obligations are determined, the tax authority shall compile a list of individuals suspended from exit and send a suspension notice (Form No. 01/XC in Appendix III hereof) to the immigration authority and the taxpayers.

b) Within the day on which the suspension notice is received, the immigration authority shall suspend these persons from exit and post the suspension notice on its website.

c) If a suspended person has fulfilled his/her tax obligations within 24 working hours, the tax authority shall issue a suspension cancellation notice (Form No. 02/XC in Appendix III) and send it to the immigration authority.

For suspended persons who have not fulfilled their tax obligations in 30 days before expiration of the suspension period, the tax authority shall send a notice of extended suspension (Form No. 02/XC) to the immigration authority and these persons.

d) The suspension notice, extended suspension notice and suspension cancellation notice shall be sent by post or electronically if possible and posted on the website of the tax authority. It will be considered that a notice has been sent if it has been posted on the tax authority’s website even if it is returned after sent by post.

If a suspended person has fulfilled his/her tax obligations within 24 working hours, the tax authority shall issue a suspension cancellation notice (Form No. 02/XC in Appendix III) and send it to the immigration authority.

The suspension cancellation notice shall be sent by post or electronically if possible and posted on the website of the tax authority

It will be considered that a notice has been sent if it has been posted on the tax authority’s website even if it is returned after sent by post.

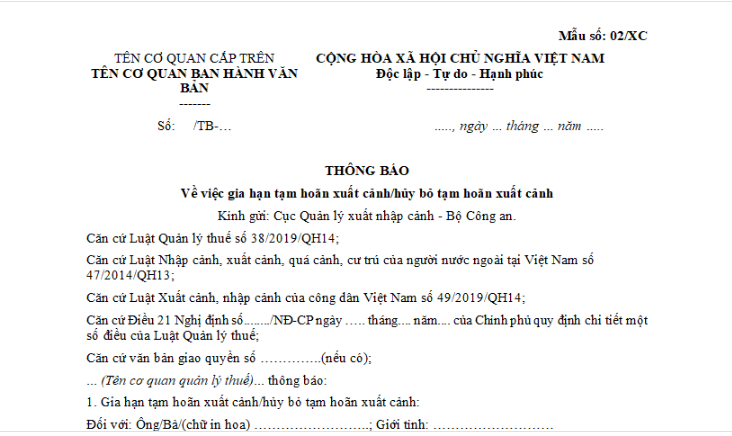

What form is the exit suspension cancellation notice form after fulfilling tax obligations in Vietnam?

Pursuant to Form No. 02/XC in Appendix III issued with Decree 126/2020/ND-CP on the exit suspension cancellation notice form after fulfilling tax obligations as follows:

>>> Exit suspension cancellation notice form after fulfilling tax obligations >>> Here.

LawNet