What are the tax periods for personal income tax and corporate income tax in Vietnam?

What are the tax periods for personal income tax and corporate income tax in Vietnam?

First of all, in Clause 6, Article 3 of the Law on Tax Administration 2019, the definition of a tax period is recorded as follows:

Definitions

...

6. “tax period” means a period of time used to determine tax liabilities that must be paid towards the state budget in accordance with provisions on taxation.

Accordingly, a tax period is a period of time to determine the amount of tax payable to the state budget.

- Personal income tax period:

According to the provisions of Article 7 of the Law on Personal Income Tax 2007 (amended by Clause 3, Article 1 of the Law on amending and supplementing a number of articles of the Law on personal income tax 2012) on the personal income tax period:

- For residents, tax period is specified as follows:

+ Annual tax period, which is applicable to incomes from business, salaries and wages.

+ Tax period upon each time of income generation, which is applicable to incomes from capital investment; incomes from capital transfer, except for incomes from securities transfer; incomes from real estate transfer; incomes from prizes; incomes from copyright; incomes from commercial franchising; incomes from inheritances; and gifts.

+ Tax period upon each transfer or annual tax period, which is applicable to Incomes from transfer of securities.

- For non-residents, the tax period counted upon each time of income generation is applicable to all their taxable incomes.

- CIT period:

Pursuant to Article 5 of the Law on Corporate Income Tax 2008 on the CIT period as follows:

- An enterprise income tax period is the calendar year or fiscal year, except the cases defined in Clause 2 of this Article.

- The enterprise income tax period upon each time of income generation applies to foreign enterprises:

+ Organizations established under the Law on Cooperatives;

+ Non-business units established under Vietnamese law;

What are the tax periods for personal income tax and corporate income tax in Vietnam?

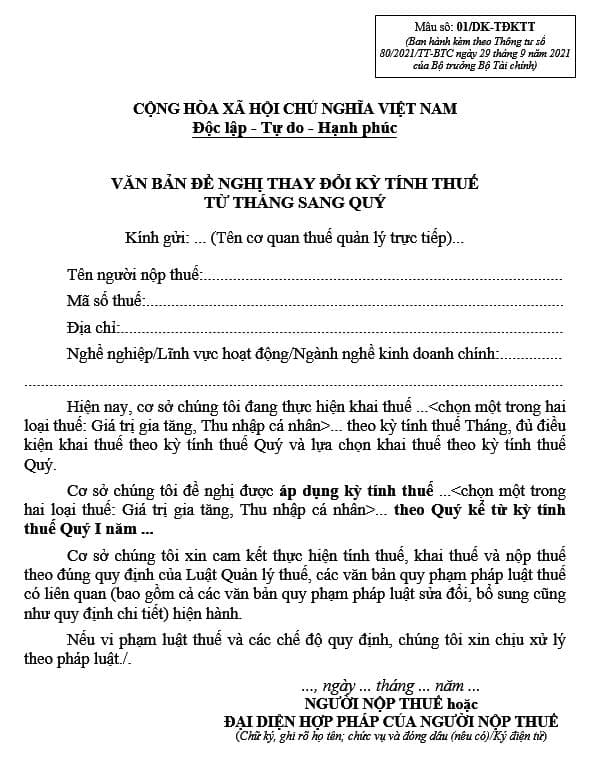

What is the application for conversion from monthly declaration to quarterly declaration of taxes in Vietnam in 2023?

The form of application for conversion from monthly declaration to quarterly declaration of taxes is form 01/DK-TDKTT Appendix II issued together with Circular 80/2021/TT-BTC. As follows:

Download a form of application for conversion from monthly declaration to quarterly declaration of taxes in 2023 here.

What is the notification of changes to taxpayer registration information in Vietnam?

According to the provisions of Article 36 of the Law on Tax Administration 2019, this content is as follows:

- Upon any change to taxpayer registration information, taxpayers who combine taxpayer registration with business registration shall notify the changes to taxpayer registration information together with changes to business registration information as prescribed by law.

In case taxpayers' change of address leads to change of supervisory tax authorities, taxpayers must complete tax procedures with supervisory tax authorities as prescribed in this Law before registering with business registration authorities for change of information.

- When there is any change to taxpayer registration information, taxpayers directly registered with tax authorities must notify their supervisory tax authorities within 10 working days starting from the date of changes to information.

- In case individuals authorizing their income payers to register changes to taxpayer registration information for themselves and their dependants, they must notify the income payers in no later than 10 working days starting from the date of changes to information; the income payers shall be responsible for notifying tax authorities of the changes in no later than 10 working days starting from the date of authorization from taxpayers.

LawNet