What are the regulations on applying Vietnam's Special Preferential Import Tariff Schedule for the execution of the Vietnam – Chile Free Trade Agreement in the 2022 - 2027 period?

What is Vietnam's Special Preferential Import Tariff Schedule for the execution of the Vietnam – Chile Free Trade Agreement in the 2022 - 2027 period?

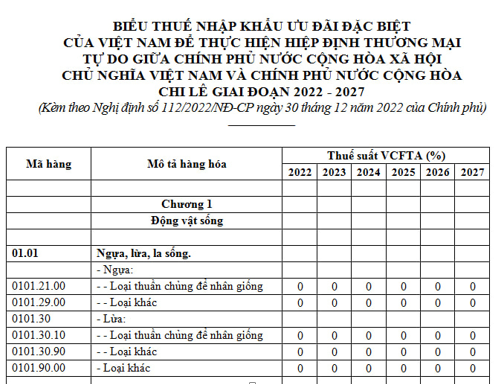

Recently, the Government has just issued Decree 112/2022/ND-CP on Vietnam's Special Preferential Import Tariff Schedule for the execution of the Vietnam – Chile Free Trade Agreement in the 2022 - 2027 period (hereinafter referred to as the Special Preferential Import Tariff Schedule).

Accordingly, Vietnam's Special Preferential Import Tariff Schedule for the execution of the Vietnam – Chile Free Trade Agreement in the 2022 - 2027 period issued together with Decree 112/2022/ND-CP is shown as follows:

See details of Vietnam's Special Preferential Import Tariff Schedule for the execution of the Vietnam – Chile Free Trade Agreement in the 2022 - 2027 period: here.

How to read Vietnam's Special Preferential Import Tariff Schedule?

Pursuant to Article 3 of Decree 112/2022/ND-CP stipulating as follows:

- Special Preferential Import Tariff Schedule includes codes, descriptions of goods, and special preferential import tax rates according to the stages imported into Vietnam from the Republic of Chile for each code.

- The column "Item code" and the column "Description of goods" in the Special Preferential Import Tariff issued together with this Decree are built based on the List of imported and exported goods of Vietnam and detailed according to the level of 8-digit or 10-digit codes.

In case the list of imported and exported goods of Vietnam is amended or supplemented, the customs declarant declares the description and code of goods according to the list of imported and exported goods amended and supplemented and applies the tax rate of the amended and supplemented goods code specified in the Special Preferential Import Tax Schedule promulgated together with this Decree.

- "VCFTA tax rate (%)" column in Special Preferential Import Tariff Schedule: Tax rates apply to different periods, including:

+ Column "2022": Tax rate applies from December 30, 2022, to December 31, 2022;

+ Column "2023": Tax rate applied from January 1, 2023, to December 31, 2023;

+ Column "2024": Tax rate applied from January 1, 2024, to December 31, 2024;

+ Column "2025": Tax rate applied from January 1, 2025, to December 31, 2025;

+ Column "2026": Tax rate applied from January 1, 2026, to December 31, 2026;

+ Column "2027": Tax rates apply from January 1, 2027, to December 31, 2027.

- Symbol "*": Imported goods are not entitled to special preferential import duties of the VCFTA Agreement.

- For imported goods subject to tariff quotas including some items in the categories of goods 04.07, 17.01, 24.01, 25.01, special preferential import tax in the quota is the tax rate specified in the Special Preferential Import Tariff promulgated together with this Decree;

- List and amount of annual import tariff quotas as prescribed by the Ministry of Industry and Trade and import tax rates in addition to applicable quotas as prescribed in export tariffs, preferential import tariffs, list of goods and absolute tariffs, mixed taxes, import duties in addition to the Government's tariff quota at the time of import.

Which goods are eligible for special preferential import duty in Vietnam?

According to the provisions of Article 4 of Decree 112/2022/ND-CP and Article 5 of Decree 112/2022/ND-CP on conditions for applying special preferential import duty in Vietnam as follows:

(1) For imported goods:

Pursuant to Article 4 of Decree 112/2022/ND-CP stipulating as follows:

Imported goods eligible for special preferential import duty rates under the VCFTA must fully satisfy the following conditions:

- Be in the Special Preferential Import Tariff Schedule promulgated together with this Decree.

- Be imported to Vietnam from the Republic of Chile.

- Meet the regulations on the origin of goods (including regulations on direct transportation) and have certificates of origin by the provisions of the VCFTA.

(2) For goods from Vietnam's free trade zones:

Pursuant to Article 5 of Decree 112/2022/ND-CP stipulating as follows:

Goods from Vietnam's free trade zones imported into the domestic market eligible for special preferential import duty rates under the VCFTA must meet the following conditions:

- Be in the Special Preferential Import Tariff Schedule issued together with Decree 112/2020/ND-CP.

- Meet the regulations on the origin of goods (including regulations on direct transportation) and have certificates of origin by the provisions of the VCFTA.

LawNet