What are the real estate registration fees in 2024 that Vietnamese citizens should be aware of? What is the real estate registration fee rate in Vietnam?

What are the real estate registration fees in 2024 that Vietnamese citizens should be aware of?

Real estate registration tax (registration fee) currently does not have a specific definition in legal documents. However, it is possible to base on the concept of "charges" in Article 3 of the Law on Fees and Charges 2015 to explain "real estate registration tax" as follows:

Real estate registration tax (real estate registration fee) is a fixed amount of money that shall be paid by organizations or individuals for public services for state management provided by regulatory agencies.

Subjects to real estate registration fees

Pursuant to Clause 1, Article 2 of Circular 13/2022/TT-BTC, real estate is determined as follows:

- Buildings: residential houses, business establishments, constructions for other purposes.

- Land: agricultural and non-agricultural lands as defined in the Law on Land (regardless of the construction works on such lands).

Payment of real estate registration fees

Pursuant to Article 4 of Decree 10/2022/ND-CP, except for cases subject to exemption from registration fees, organizations or individuals in possession of a property subject to registrations fees shall pay such fees to competent state agencies upon:

- the registration of ownership

- the use of property.

Exemption from real estate registration fees

Follow the provisions of Article 10 of Decree 10/2022/ND-CP.

As follows:

Exemption from registration fees

...

1. Houses and land at which diplomatic missions, consular offices, representative agencies of United Nations’ international organizations, or residence of heads thereof is located.

...

3. Land allocated or leased out by the state with land rent paid in lump sum for the entire lease term is used for the following purposes:

a) Public purposes as prescribed by the law on land.

b) Mineral exploration and mining; or scientific research pursuant to a license or certificate granted by the competent agency;

c) Investment in construction of infrastructure (regardless of whether the land is within or outside an industrial zone or export processing zone), investment in construction of housing for transfer, including the case in which the transferee continues construction of the infrastructure or the housing for transfer. If in these cases the transferee registers ownership or right to use to lease out or itself uses the infrastructure or housing, registration fees must be paid.

4. Land allotted, leased or endorsed by the government for production activities in the fields of agriculture, forestry, aquaculture and salt making.

5. Agricultural land transferred between households or individuals in the same commune, ward or town for facilitating agricultural production in accordance with the Law on Land.

6. Undisputed agricultural land on which the right of use has been certified in writing by competent state agencies for households or individuals who have themselves reclaimed such land according to the land use plans approved by competent state agencies.

7. Land leased by the state on annual fee basis or rented from the holder of legitimate right to use the land.

8. Houses and land for public use by religious organizations accepted by the state or licensed for operation.

9. Cemetery land.

10. Houses and land inherited or gifted between spouses; parents and biological children; parents and adopted children; parents and daughters-in-law; parents and sons-in-laws; paternal or maternal grandparents and grandchildren; biological siblings, and certified by competent state agencies with regard to land use right and ownership of housing and property on land.

11. Residential housing that households or persons have acquired through individual housing development as prescribed in the Law on Housing.

12. Renters of financial property are exempted from registration fee upon the transfer of such property to such renters upon the expiration of the lease; financial lessors are exempted from registration fee when purchasing a property on which the proprietor has paid the registration fee then leasing it to such former proprietor.

13. Houses, land, peculiar property, or specialized property for national defense and security.

14. State-owned houses, land used as the office of government agencies, people's armed forces, public service providers, political organizations, socio-political organizations, social - vocational organizations.

15. Houses and land being compensation or serving relocation (including those purchased with compensation money or assistance) upon the expropriation by the State of houses or land in accordance with regulations of law.

The exemption from registration fees specified in this Clause is granted to the entities whose houses and land are expropriated.

16. Entities having acquired a certificate of ownership and right of use shall be exempted from re-registration fee in the following circumstances:

a) Property certified with a certificate of ownership and right of use issued by competent agencies of the Democratic Republic of Vietnam, the Provisional Revolutionary Government of the Republic of South Vietnam, the Government of the Socialist Republic of Vietnam, or competent agencies of previous regimes then re-certified with a new certificate without any change to proprietors.

b) Properties of state-owned enterprises, public service providers which are equitized to become a joint-stock company or otherwise restructured as per the laws.

c) Properties of a household or household members to which a certificate of ownership or right to use has been issued and which are then divided in accordance with law between the household members for re-registration; joint-owned properties of husband and wife after marriage; properties to be distributed to husband and wife upon divorce in accordance with a judgment or legal decision of a Court.

d) Properties of organizations or individuals to which a certificate of ownership or right to use has been re-issued due to the loss or deterioration of the former certificate. Such organizations or individuals are not required to apply for exemption from registration fees when the competent state agency re-issues their certificate of ownership or right to use.

dd) Registration fee is not chargeable on the increase in land area upon re-certification of land use right without any change to land boundary.

e) Entities allotted land by the state then having obtained a certificate a certificate of land use right, if later subjected to rent such land, shall pay at once the full rental for the entire duration of lease according to the Law on Land upon the effective date of this Decree.

g) Where the land use right is re-registered because the state allows land repurposing without change of the person who has the land use right and is not required to pay land levy upon land repurposing in accordance with regulations of law on collection of land levy.

17. In the following event, registration fee is not chargeable on a property on which its proprietor has paid registration fee (except circumstances in which registration fee is exempted) before being transferred to and registered under another entity:

a) An organization, individual or member of a cooperative business invests their property into an enterprise, credit institution, or cooperative business; or an enterprise, credit institution or cooperative business dissolves, undergoes a division or withdraws the capital constituents that its shareholding entities have contributed.

b) An enterprise circulates its property internally; or state-funded organizations circulate their property internally at the discretion of competent agencies.

18. Entities receive portions of a divided property or contribute their property as a result of the division, consolidation, merger or renaming of an organization according to competent agencies' decisions provided that prior registration fee has been paid on such property.

19. Entities relocate their property on which registration fee has been paid to the place of use without alteration of the proprietor.

20. Donatories apply for registration of ownership of houses of gratitude, philanthropic housing, or humane subsidized houses and of land use right thereof.

...

28. Houses, land contributed by private investors in education - vocational training; health care; cultural activities; sports and gymnastics; environment who have their land use right or house ownership registered for the same purposes as per the laws.

29. Houses, land registered under non-state entities for education - training; health care; cultural activities; sports and gymnastics; science and technology; environment; society; population, family, child care and protection as per the laws, except those defined in Clause 28 of this Article.

30. Houses, land registered under scientific and technological enterprises as per the laws.

Deferment of real estate registration fees

Pursuant to the provisions in Clause 1, Article 9 of Decree 10/2022/ND-CP as follows:

Deferment of registration fees

1. The fee for registration of houses and land of households and individuals eligible for deferment of land use fee shall be deferred according to regulations of the land law on the collection of land use fee. Households and individuals shall pay the registration fee in arrears according to the houses and land price prescribed by People’s Committees of provinces or centrally affiliated cities upon the declaration of such fee.

Compare the provisions in Clause 1, Article 16 of Decree 45/2014/ND-CP amended by Article 1 of Decree 79/2019/ND-CP.

Households and individuals may be granted permission for deferred repayment of land use fees if they are allocated resettlement land after the State’s land expropriation in accordance with law on land in the following cases:

- persons rendering meritorious revolutionary services;

- poor households;

- ethnic minority households and individuals;

- households and individuals obtaining registration for their permanent residence at communes that are recognized as difficult or extremely difficult socio-economic areas)

Persons rendering meritorious revolutionary services shall be identified under law on persons rendering meritorious services.

What are the real estate registration fees in 2024 that Vietnamese citizens should be aware of? What is the real estate registration fee rate in Vietnam? (Image from the Internet)

What is the current real estate registration fee rate in Vietnam?

The real estate registration fee rate is determined according to the provisions of Article 8 of Decree 10/2022/ND-CP as follows:

Registration fee rates (%)

1. Houses, land: 0,5%.

...

Thus, according to the above regulations, the registration fee rate for real estate is 0.5%.

How to calculate the real estate registration fees in Vietnam?

Pursuant to the provisions of Article 6 of Decree 10/2022/ND-CP, Factors for determining a registration fee include the base price and the registration fee rates (%).

Specifically, the calculation formula is as follows:

Real estate registration fee = Base price x registration fee rate (%)

In particular, the base price and the registration fee rates (%) are determined as follows:

(1) Base price for real estate

Follow Clause 1, Article 7 of Decree 10/2022/ND-CP. Specifically:

The base price for land is the price on the Land Price List promulgated by the People's Committee of the province or centrally affiliated city in accordance with regulations of the law on land in effect upon the declaration of registration fees.

If the price of a house or land in the contract for transfer of the land use right or for purchase and sale of the house is higher than the price imposed by the People's Committee of the province or centrally affiliated city, the base price is the price specified in such contract.

Some special cases:

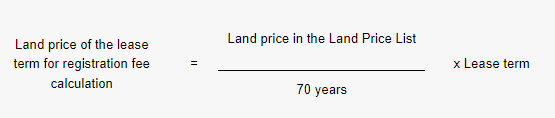

- If land is leased out by the state and a lump sum land rent is payable for the entire lease term but the lease term is shorter than the term of the type of land prescribed in the Land Price List promulgated by the People's Committee of the province or centrally affiliated city, the land price of the lease term for registration fee calculation is determined as follows:

- The base price for a state-owned house sold to its current lessee:

The base price is the actual selling price pursuant to a decision of the People's Committee of the province or centrally affiliated city.

- The base price for a house or land purchased at an auction or bidding:

The base price is the actual hammer price or winning bid specified in the sales invoice or receipt in accordance with the law or the hammer price or winning bid according to the auction or bidding winning document, or the document approving the result of the auction, bidding (if any) of competent state agencies.

- The base price for a tenement or an apartment building:

The base price includes its allocated land value. The allocated land value is determined by the land price in the Land Price List issued by the People’s Committee of the province or centrally affiliated city multiplied by the allocation coefficient.

The allocation coefficient is determined in accordance with regulations of Decree No. 53/2011/ND-CP and amendment or replacement documents (if any).

(2) Registration fee rates (%)

Pursuant to the provisions of Article 8 of Decree 10/2022/ND-CP, the real estate registration fee is 0.5%.

LawNet