What are the procedures for applying for an e-tax transaction account through the General Department of Taxation’s web portal in Vietnam?

- Can entities apply for an e-tax transaction account with a tax authority through the General Department of Taxation’s web portal in Vietnam?

- What are the procedures for applying for an e-tax transaction account through the General Department of Taxation’s web portal in Vietnam?

- What are the regulations on email addresses when applying for an e-tax transaction account through the General Department of Taxation’s web portal in Vietnam?

Can entities apply for an e-tax transaction account with a tax authority through the General Department of Taxation’s web portal in Vietnam?

Pursuant to Point a, Clause 1, Article 10 of Circular 19/2021/TT-BTC as follows:

Article 10. Registration of e-tax transactions

1. Apply for an e-tax transaction account with a tax authority through the GDT’s web portal

a) The taxpayer that is an authority, organization or individual that has been issued with a digital certificate or an individual that has not had a digital certificate but has had a TIN is entitled to apply for an e-tax transaction account with a tax authority.

The authority or organization specified in Clause 1 Article 13 of this Circular shall follow procedures for applying for the e-tax transaction account with the tax authority through the GDT’s web portal as prescribed in this Clause after being issued with a TIN.

Thus, the taxpayer that is an authority, organization or individual that has been issued with a digital certificate or an individual that has not had a digital certificate but has had a TIN is entitled to apply for an e-tax transaction account with a tax authority..

The authority or organization applying for first tax registration shall follow procedures for applying for the e-tax transaction account with the tax authority through the GDT’s web portal as prescribed in this Clause after being issued with a TIN.

What are the procedures for applying for an e-tax transaction account through the General Department of Taxation’s web portal in Vietnam?

Pursuant to Point b, Clause 1, Article 10 of Circular 19/2021/TT-BTC on procedures for applying for an e-tax transaction account through the GDT’s web portal as follows:

- For taxpayer that is an authority, organization or individual that has been issued with a digital certificate or an individual that has had a TIN but has not been issued with a digital certificate but uses the biometric authentication, the registration of e-transactions with the tax authority shall be carried out as follows:

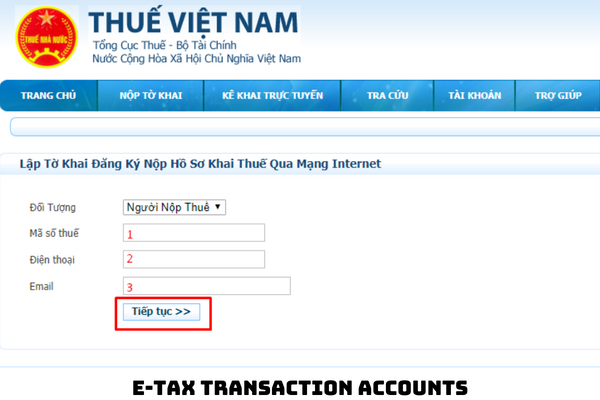

- The taxpayer shall access the GDT’s web portal to register transactions with the tax authority by electronic means (Form No. 01/ĐK-TĐT enclosed herewith), e-sign and send the application form to the GDT’s web portal.

- The GDT’s web portal shall send a notification (Form No. 03/TB-TĐT enclosed herewith) to the email address or phone number registered by the taxpayer within 15 minutes after the application form is received:

+ In the case of acceptance, the GDT’s web portal sends information about the e-tax transaction account (Form No. 03/TB-TĐT enclosed herewith) to the taxpayer.

+ In the case of non-acceptance, the taxpayer shall rely on the reason for non-acceptance provided by the tax authority in the notification (Form No. 03/TB-TĐT enclosed herewith) to complete the registered information, e-sign and send it to the GDT’s web portal or contact the supervisory tax authority for instructions and assistance.

- After being issued with the e-tax transaction account (main account), the taxpayer is entitled to conduct e-transactions with the tax authority as prescribed.

- If the taxpayer is entitled to use the main account issued by the tax authority to conduct all e-transactions with the tax authority as prescribed in Clause 1 Article 1 of this Circular, except for the regulations in Clause 5 of this Article; and from that main account, the taxpayer may generate and grant privileges to one or more (no more than 10 (ten)) sub-accounts via the GDT’s web portal to conduct each e-tax transaction with the tax authority.

- If an individual taxpayer has had a TIN but has not been issued with a digital certificate and uses the e-transaction verification code, he/she after performing the tasks mentioned in Point b.1 above shall go to any tax authority and present his/her ID card; or passport or Citizen ID card to receive and activate the e-tax transaction account.

What are the regulations on email addresses when applying for an e-tax transaction account through the General Department of Taxation’s web portal in Vietnam?

Pursuant to Point c, Clause 1, Article 10 of Circular 19/2021/TT-BTC stipulating email addresses when applying for and issuing an e-tax transaction account through the GDT’s web portal as follows:

- The taxpayer reserves the right to register one official email address to receive all notifications in the process of conducting e-transactions with the tax authority.

- In addition, the taxpayer also reserves the right to register an additional email address for each tax administrative procedure to receive all notifications related to such tax administrative procedure.

LawNet