What are the instructions for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad according to form 04/NNG-TNCN?

- What is the form for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad?

- What are the instructions for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad according to form 04/NNG-TNCN?

- How to convert taxable income to Vietnam Dong?

What is the form for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad?

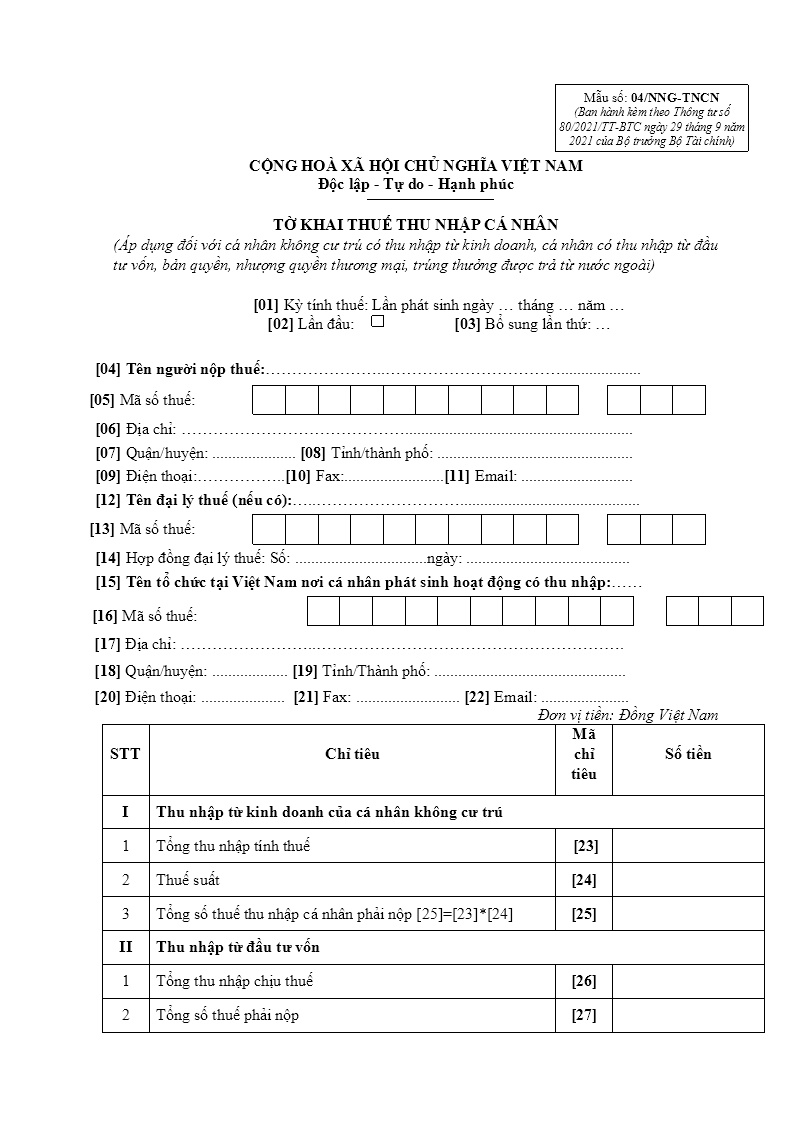

The form of PIT declaration form applicable to non-resident individuals with income from business, individuals with income from capital investment, copyright, franchise, winning prizes paid from abroad is form No. 04/NNG-TNCN.

Form No. 04/NNG-TNCN in Section VII, Appendix II issued together with Circular 80/2021/TT-BTC is as follows:

Download Form No. 04/NNG-TNCN here: download

What are the instructions for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad according to form 04/NNG-TNCN?

What are the instructions for declaring PIT declaration in Vietnam for income from capital investment, winning prizes paid from abroad according to form 04/NNG-TNCN?

The information portal of General Department of Taxation of Vietnam guides the declaration form No. 04/NNG-TNCN for non-resident individuals earning income from business, individuals earning income from capital investment, copyright, franchise, winning. Bonuses paid from abroad are as follows:

General information section:

[01] Tax period: Specify the date, month and year of making the tax declaration.

[02] First time: If you are filing for the first time, put an “x” in the box.

[03] The second addition: If the declaration is made after the first time, it will be determined as an additional declaration and fill in the blank number of additional declarations. The number of additional declarations is recorded by digits in the sequence of natural numbers (1, 2, 3….).

[04] Taxpayer's name: Clearly and fully write the name according to the tax registration or identity card/CCCD/Passport of the individual.

[05] Tax identification number: Clearly and fully write the individual's tax identification number according to the individual tax registration certificate or the personal tax identification number notice or the tax identification number card issued by the tax authority.

[06] Address: Clearly and fully write the address of the house, commune, ward where the individual resides.

[07] District: Enter the district or district in the province/city where the individual resides.

[08] Province/City: Enter the province/city where the individual resides.

[09] Phone: Write clearly and fully the individual's phone.

[10] Fax: Write clearly and fully the individual's fax number.

[11] Email: Write clearly and fully the individual's email address.

[12] Name of tax agent (if any): In case an individual authorizes a tax agent to declare tax, it must clearly and fully write the name of the tax agent according to the establishment decision or the business registration certificate. of the Tax Agent.

[13] Tax identification number: Clearly and fully write the tax agent's tax identification number according to the tax registration certificate issued by the tax authority.

[14] Tax agency contract: Specify clearly, in full, the number and date of the tax agency contract between the taxpayer and the tax agent (the contract is in progress).

[15] Name of organization in Vietnam where the individual generates income: Clearly and fully write the name of the organization in Vietnam according to the Establishment Decision or Business Registration Certificate or Certificate Tax registration. The organization in Vietnam in this case is the place where the individual generates taxable income but that income is paid from abroad (if any).

[16] Tax code: Clearly and fully write the tax identification number of the organization in Vietnam where the individual generates taxable income (if any information is declared in the target [15]).

[17] Address: Clearly and fully write the address of the organization in Vietnam where the individual generates taxable income (if any information is declared at target [15])

[18] District: Enter the district in the province/city of the organization in Vietnam where the individual generates taxable income (if any information is declared in the target [15]).

[19] Province/city: Enter the province/city where the organization's head office is located in Vietnam where the individual generates taxable income (if any information is declared in the item [15]).

[20] Phone: Clearly and fully write the phone number of the organization in Vietnam where the individual generates taxable income (if any information is declared in the target [15]).

[21] Fax: Clearly and fully write the fax number of the organization in Vietnam where the individual generates taxable income (if any information is declared in the target [15]).

[22] Email: Clearly and fully write the email address of the organization in Vietnam where the individual generates taxable income (if any information is declared in the target [15]).

The declaration of the table's criteria:

IV. TAX CALCULATION DETAILS

(I) Business income of non-resident individuals

[23] Total taxable income: is the total proceeds from the sale of goods, processing fees, commissions, and money for the supply of goods and services arising in a tax period, including price subsidies, surcharges and allowances. benefits to which a non-resident individual is entitled, regardless of whether or not the money has been collected.

[24] Tax rate: prescribed for each field, production line and business according to Clause 3, Article 25 of the Law on Personal Income Tax No. 04/2007/QH12 as follows:

- 1% for goods trading activities.

- 5% for service business activities.

- 2% for manufacturing, construction, transportation and other business activities.

In case a non-resident individual has turnover from many different production and business fields and lines but cannot separate the revenue from each field or line, the personal income tax rate shall be applied according to the provisions of the law. the highest tax rate for the field or business line actually operating on the entire revenue.

[25] Total personal income tax payable: [25]=[23]x[24].

(II) Income from capital investment:

[26] Total taxable income: is the total income from capital investment that an individual receives from abroad.

[27] Tax payable: target [27] = [26] x 5%.

[28] Total tax paid abroad: determined according to tax payment documents abroad. In case the foreign tax authority does not issue a certificate confirming the paid tax amount, the tax paid abroad shall be determined based on a photocopy of the tax withholding certificate (specifying which tax declaration has been paid). issued by the income paying agency or a copy of the bank statement for the tax amount paid abroad, certified by the taxpayer.

[29] Tax payable: target [29]=[27]-[28]. The tax payable abroad to be deducted does not exceed the payable tax amount calculated according to Vietnam's tax schedule

(III) Income from copyright, franchise:

[30] Total taxable income: is the total income from copyright, franchise that an individual receives from abroad.

[31] Tax payable: target [31] = ([30] - 10,000,000 VND) x 5%.

[32] Total tax paid abroad: determined according to tax payment documents abroad. In case the foreign tax authority does not issue a certificate confirming the paid tax amount, the tax paid abroad shall be determined based on a photocopy of the tax withholding certificate (specifying which tax declaration has been paid). issued by the income paying agency or a copy of the bank statement for the tax amount paid abroad, certified by the taxpayer.

[33] Tax payable: target [33]=[31]-[32]. The amount of tax already paid abroad to be deducted does not exceed the payable tax amount calculated according to Vietnam's tax schedule.

(IV) Income from winning:

[34] Total taxable income: is the total income from winning prizes that an individual receives from abroad.

[35] Tax payable: target [35] = ([34]-10,000,000 VND) x 10%.

[36] Total tax paid abroad: determined according to tax payment documents abroad. In case the foreign tax authority does not issue a certificate confirming the paid tax amount, the tax paid abroad shall be determined based on a photocopy of the tax withholding certificate (specifying which tax declaration has been paid). issued by the income paying agency or a copy of the bank statement for the tax amount paid abroad, certified by the taxpayer.

[37] Tax payable: target [37]=[35]-[36]. The amount of tax already paid abroad to be deducted does not exceed the payable tax amount calculated according to Vietnam's tax schedule.

How to convert taxable income to Vietnam Dong?

Pursuant to Article 5 of Circular 111/2013/TT-BTC (amended and supplemented by Article 13 of Circular 92/2015/TT-BTC) as follows:

Converting taxable income into VND

1. Revenues and incomes subject to PIT are expressed as VND.

Revenues and taxable incomes received in foreign currencies must be converted into VND at the buying rate of the bank where the person opens the transaction account at the time incomes are earned.

In case a taxpayer does not have a transact account in Vietnam, foreign currencies shall be converted into VND at the buying rate of Vietcombank at the time incomes are earned.

The foreign currencies without rates of exchange into VND shall be converted into a foreign currency that has a rate of exchange into VND.

2. Non-cash taxable incomes must be converted into VND at the market prices of such products/services or the similar products/services when the incomes are earned.

Accordingly, the revenues and taxable incomes received in foreign currencies must be converted into VND at the buying rate of the bank where the person opens the transaction account at the time incomes are earned.

In case a taxpayer does not have a transact account in Vietnam, foreign currencies shall be converted into VND at the buying rate of Vietcombank at the time incomes are earned.

The foreign currencies without rates of exchange into VND shall be converted into a foreign currency that has a rate of exchange into VND.

Non-cash taxable incomes must be converted into VND at the market prices of such products/services or the similar products/services when the incomes are earned.

However, the above regulation has been annulled by point n, clause 4, Article 87 of Circular 80/2021/TT-BTC.

LawNet