What are the guidelines for processing erroneous electronic invoices issued by tax authorities in Vietnam? Where to download Form 04/SS-HDDT?

Where to download Form 04/SS-HDDT specified in Decree 123/2020/ND-CP?

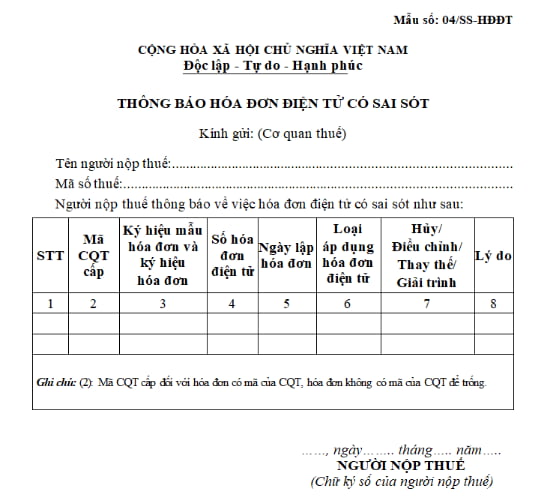

Form 04/SS-HDDT is a notification form for erroneous electronic invoices as prescribed in Appendix IA issued together with Decree 123/2020/ND-CP:

Download Form 04/SS-HDDT here.

What are the guidelines for processing erroneous electronic invoices issued by tax authorities in Vietnam? Where to download Form 04/SS-HDDT?

What are the guidelines for processing erroneous electronic invoices issued by tax authorities in Vietnam?

Under sub-item 3, Item B, Appendix 1 of Administrative Procedures issued together with Decision 1464/QD-BTC in 2022.

The General Department of Taxation in Vietnam provides specific guidance on each case as follows:

Case 1: For the case where the seller discovers that the issued authenticated e-invoice has errors and has not been sent to the buyer:

Step 1: The seller discovers that the issued authenticated e-invoice from the tax authority has errors and has not been sent to the buyer. The seller should notify the tax authority using Form 04/SS-HDDT, Appendix IA, issued together with Decree 123/2020/ND-CP to cancel the erroneous authenticated e-invoice.

Step 2: The seller creates a new electronic invoice, digitally signs it, and sends it to the tax authority to issue a new invoice code replacing the erroneous one to send to the buyer.

Step 3: The tax authority receives the notification file about the erroneous authenticated e-invoice via the General Department of Taxation's electronic portal or a service provider of electronic invoices, checks, and processes the file through the tax authority's electronic data processing system. The canceled electronic invoice is not valid for use but remains stored for referencing.

Step 4: The tax authority records the result of handling the canceled erroneous authenticated e-invoice on the tax authority's system.

Case 2: For the case where the seller discovers that the issued authenticated e-invoice or an electronic invoice without a code sent to the buyer has errors:

Step 1: The buyer or seller discovers errors in the authenticated e-invoice from the tax authority that has been sent to the buyer, handling as follows:

+ If there are errors in the name and address of the buyer but not in the tax code, and other contents are correct: The seller notifies the buyer about the erroneous invoice. The seller does not need to reissue the invoice. The seller informs the tax authority about the erroneous electronic invoice using Form 04/SS-HDDT, Appendix IA, issued together with Decree 123/2020/ND-CP, except in cases of non-coded erroneous electronic invoices that have not sent invoice data to the tax authority;

+ If there are errors in the tax code, amount of money on the invoice, tax rate, tax amount, or the goods recorded on the invoice do not conform to specifications or quality: Choose one of two ways to use electronic invoices as follows:

++ The seller issues an adjusted electronic invoice for the erroneous invoice. If the seller and buyer agree to create a clear agreement document before issuing the adjusted invoice, they will draft an agreement document stating the errors. The seller then issues an adjusted electronic invoice for the erroneous invoice.

The adjusted electronic invoice for the issued erroneous invoice must contain the line "Adjusted for invoice Form number... symbol... number... date... month... year".

++ The seller issues a new electronic invoice to replace the erroneous electronic invoice, except if the seller and buyer agree to create a clear agreement document before issuing the replacement invoice for the erroneous one. The seller and buyer draft an agreement document stating the errors. Then the seller issues a new electronic invoice to replace the erroneous one.

The new electronic invoice to replace the erroneous one must contain the line "Replaced for invoice Form number... symbol... number... date... month... year";

The seller digitally signs the new adjusted or replacement electronic invoice for the erroneous one. The seller then sends it to the buyer (for cases using unauthenticated e-invoices) or sends it to the tax authority for the tax authority to issue a new code to send to the buyer (for cases using coded electronic invoices).

Step 2: The tax authority receives the notification file about the erroneous electronic invoice via the General Department of Taxation's electronic portal or a service provider of electronic invoices, checks, and processes the file through the tax authority's electronic data processing system.

Step 3: The tax authority records the result of handling the erroneous authenticated e-invoice on the tax authority's system.

Case 3: For cases where the tax authority discovers that issued authenticated e-invoices or unauthenticated e-invoices have errors:

Step 1: The tax authority discovers that the issued authenticated e-invoice from the tax authority or unauthenticated e-invoices from the tax authority have errors. The tax authority notifies the seller using Form 01/TB-RSĐT, Appendix IB, issued together with Decree 123/2020/ND-CP on October 19, 2020, by the Government of Vietnam for the seller to check the errors.

Step 2: The seller notifies the tax authority using Form 04/SS-HDDT, Appendix IA, issued together with Decree 123/2020/ND-CP on October 19, 2020, by the Government of Vietnam about checking the erroneous electronic invoice.

Step 3: After the notice period stated on Form 01/TB-RSĐT, Appendix IB, issued together with Decree 123/2020/ND-CP, if the seller does not notify the tax authority, the tax authority will continue to notify for the second time using Form 01/TB-RSĐT, Appendix IB, issued together with Decree 123/2020/ND-CP on October 19, 2020, by the Government of Vietnam.

If after the second notice period stated on Form 01/TB-RSĐT, Appendix IB, issued together with Decree 123/2020/ND-CP, the seller still does not notify, the tax authority may consider transitioning to check the use of electronic invoices.

Step 4: The tax authority receives the file, processes it, and notifies about the reception and the processing results.

Note: Taxpayers can submit Form 04/SS-HDDT electronically via the General Department of Taxation's electronic portal or a service provider of electronic invoices.

What is the time limit for processing erroneous electronic invoices of tax authorities in Vietnam?

Under sub-item 3, Item B, Appendix 1 of Administrative Procedures issued together with Decision 1464/QD-BTC in 2022, the time limit for processing erroneous electronic invoices of tax authorities in Vietnam within one working day.

However, for cases where the tax authority discovers errors, the processing time limit is as stated on Form 01/TB-RSDT, Appendix IB, issued together with Decree 123/2020/ND-CP.

LawNet