Vietnam: What is the VAT declaration form applicable to entities engaged in construction activities or real estate transfers and paying VAT calculated by the credit-invoice method?

- What is the VAT declaration form applicable to entities engaged in construction activities or real estate transfers and paying VAT calculated by the credit-invoice method in Vietnam?

- What are the regulations on the declaration and payment of VAT on real estate transfers in Vietnam?

- What are the regulations on the declaration and payment of VAT on construction activities in Vietnam?

- Where will taxpayers in Vietnam pay VAT?

What is the VAT declaration form applicable to entities engaged in construction activities or real estate transfers and paying VAT calculated by the credit-invoice method in Vietnam?

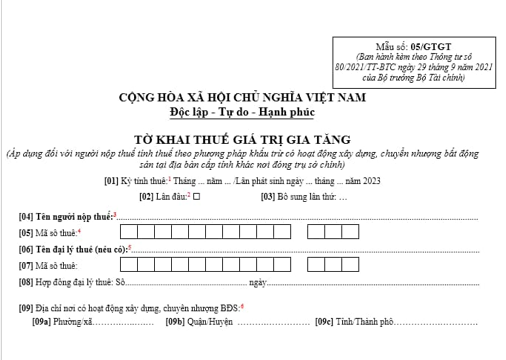

The VAT declaration form applicable to entities engaged in construction activities or real estate transfers and paying VAT calculated by the credit-invoice method in Vietnam is Form No. 05/VAT specified in Appendix II issued together with Circular 80/2021/TT-BTC as follows:

Download the VAT declaration form applicable to entities engaged in construction activities or real estate transfers and paying VAT calculated by the credit-invoice method in Vietnam: Here.

What are the regulations on the declaration and payment of VAT on real estate transfers in Vietnam?

Pursuant to Point b, Clause 3, Article 13 of Circular 80/2021/TT-BTC on the declaration and payment of VAT on real estate transfers in Vietnam as follows:

- The taxpayer shall declare VAT and submit the VAT declaration dossier according to Form No. 05/GTGT in Appendix II issued with Circular 80/2021/TT-BTC; pay the declared tax in the province where the transferred real estate is located.

- The taxpayer shall include the VAT-exclusive revenue from real estate transfer in the tax declaration dossier prepared at the headquarters in order to determine the VAT payable on the entire business operation at the headquarters. The VAT paid in the province where the transferred real estate is located shall be offset against the VAT payable in the headquarters' province.

What are the regulations on the declaration and payment of VAT on construction activities in Vietnam?

Pursuant to Point c, Clause 3, Article 13 of Circular 80/2021/TT-BTC on the declaration and payment of VAT on construction activities in Vietnam as follows:

- In case the taxpayer is a construction contractor that directly signs the contract with the investor for the construction of the work in a province other than the province in which the taxpayer is headquartered, including construction works and items that are relevant to multiple provinces, the taxpayer shall declare VAT on these construction works and items at the tax authority of the area where the construction work is located according to Form No. 05/GTGT in Appendix II issued with Circular 80/2021/TT-BTC; submit the declared tax in the province where the construction work is located.

- In case the State Treasury has carried out deduction as prescribed in Clause 5 of Article 13 of Circular 80/2021/TT-BTC, the taxpayer is not required to pay the amount deducted by State Treasury to the state budget.

- The taxpayer shall include the VAT-exclusive revenue from construction activities in the tax declaration dossier prepared at the headquarters in order to determine the VAT payable on the entire business operation at the headquarters. The VAT paid in the province where construction work is located shall be offset against the VAT payable in the headquarters' province.

Where will taxpayers in Vietnam pay VAT?

Pursuant to Article 20 of Circular 219/2013/TT-BTC, places to pay VAT in Vietnam are as follows:

- Taxpayer shall declare and pay VAT in the locality where the business is situated.

- If the taxpayer that pays VAT using the credit-invoice method has a financially dependent manufacturing facility in a province other than the province where the headquarter is situated, VAT shall be paid in both provinces.

- If a company or cooperative that uses the direct method has a manufacturing facility in a province other than that where the headquarter is situated or engages in the extraprovincial sale, the company or cooperative shall pay direct VAT on the revenue earned from extraprovincial sale in the province where the sale is made.

The company or cooperative is not required to pay direct VAT on such revenue, which has been declared and paid at the headquarter.

- When a provider of telecommunications services provides postpaid telecommunications services in a province other than the province where their headquarter is situated and establishes a financially dependent branch that pays VAT using the credit-invoice method and also provides postpaid telecommunications services in that same province, the provider of telecommunications services shall declare and pay VAT on postpaid telecommunications services as follows:

+ VAT on the total revenue from the provision of postpaid telecommunications services of the provision shall be declared at the supervisory tax authority of the headquarter.

+ VAT shall be paid in the provinces where the headquarter and the branch are situated.

Direct VAT shall be paid at 2% of the revenue from telecommunications services provided in the province where the branch is situated (postpaid telecommunications services are subject to 10% tax).

LawNet