Vietnam: What is the taxpayer registration declaration form - Form No. 01-DK-TCT under Circular 105 for organizations? What are the instructions on preparing a taxpayer registration declaration - Form No. 01-DK-TCT by organizations?

- What is the taxpayer registration declaration form - Form No. 01-DK-TCT under Circular 105 for organizations in Vietnam?

- What are the instructions on preparing a taxpayer registration declaration - Form No. 01-DK-TCT by organizations in Vietnam?

- What is the time limit for first-time taxpayer registration in Vietnam?

What is the taxpayer registration declaration form - Form No. 01-DK-TCT under Circular 105 for organizations in Vietnam?

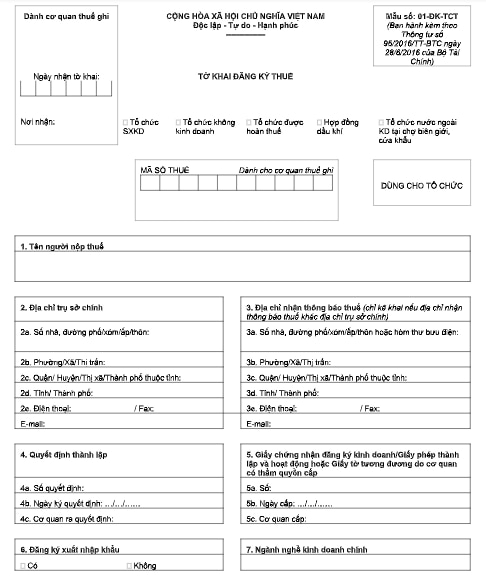

The taxpayer registration declaration form used by organizations follows Form No. 01-DK-TCT issued together with Circular 105/2020/TT-BTC as follows:

Download the taxpayer registration declaration form - Form No. 01-DK-TCT here

What are the instructions on preparing a taxpayer registration declaration - Form No. 01-DK-TCT by organizations in Vietnam?

The instructions on preparing a taxpayer registration declaration - Form No. 01-DK-TCT by organizations in Vietnam are specified as follows:

Taxpayers must check one of the appropriate boxes before declaring in the detailed information section, specifically as follows:

- "Business organization": tick in case taxpayers register for tax as prescribed in Clause 1 Article 7 of Circular 105/2020/TT-BTC,

- "Non-business organization": tick in case taxpayers register for tax as prescribed in Clause 6 Article 7 of Circular 105/2020/TT-BTC.

- "Organization entitled to tax refund": tick in case the taxpayer registers for tax as prescribed in Clause 6 Article 7 of Circular 105/2020/TT-BTC.

- "Petroleum contract": tick in case the taxpayer registers for tax as prescribed in Clause 2a Article 7 of Circular 105/2020/TT-BTC.

- "Foreign organizations doing business at border markets and border gates": tick in case taxpayers being organizations of countries sharing land borders with Vietnam carry out activities of buying, selling, and exchanging goods at border markets, border gate markets, and markets in Vietnam's border-gate economic zones to register for tax as prescribed in Clause 1 Article 7 of Circular 105/2020/TT-BTC.

Details include:

(1) Name of taxpayer: Clearly and fully state in capital letters the name of the organization according to the Establishment Decision or the Establishment and Operation License or equivalent documents issued by a competent authority (for Vietnamese organizations) or Business Registration Certificates (for organizations of countries sharing land borders with Vietnam carrying out operations buying, selling and exchanging goods at border markets, border gate markets, markets in Vietnam's border-gate economic zones).

(2) Head office address: Specify the number of houses, niches, alleys, alleys, streets/hamlets/villages, wards/communes/townships, districts/towns/cities of the province/city. If there is a phone number, fax number, specify the area code - phone number/fax number according to the following address information:

- Address of the organization's headquarters

- Business addresses in border markets, border gate markets, and border-gate economic zone markets, for organizations of countries sharing land borders with Vietnam.

- Address of the place where petroleum exploration activities take place, for Petroleum contracts.

(3) Address for receiving tax notices: If the organization has an address to receive tax notices different from the address of the head office, specify the address to receive tax notices for the tax authority to contact.

(4) Establishment decision:

- For organizations with establishment decisions: Specify the number of decisions, the date of issuance of the decision, and the agency issuing the decision.

- For Petroleum contracts: Specify the contract number, and contract signing date, and leave the decision-making agency section blank.

(5) Certificate of business registration/Establishment and operation license or equivalent document issued by a competent authority: Clearly state the number, date of issue and the agency issuing the Certificate of Business Registration of the country bordering Vietnam (for organizations of countries sharing land borders with Vietnam to carry out trade and purchase activities, exchange of goods at border markets, border gate markets, markets in Vietnam's border-gate economic zones), establishment and operation licenses or equivalent licenses issued by competent authorities (for Vietnamese organizations).

Particularly, the information of the "issuing agency" of the Certificate of Business Registration: write the name of the country sharing the land border with Vietnam that issued the Certificate of Business Registration (Laos, Cambodia, China).

(6) Import and export registration: If the organization has import and export activities, mark "Yes", and vice versa mark "No".

(7) Main business lines: Recorded by business lines on the establishment and operation license or equivalent license issued by a competent authority (for Vietnamese organizations) and the Business Registration Certificate (for organizations of countries sharing land borders with Vietnam conducting trade and purchase activities, exchange of goods at border markets, border gate markets, markets in the border gate economic zone of Vietnam). The taxpayer only lists 1 main business line that is actually in business.

(8) Charter capital:

- For limited companies, joint stock companies, and partnerships: Write according to the charter capital of the establishment and operation license or equivalent license granted by a competent authority or the capital source on the establishment decision (specify the currency, classify capital sources by owner, the proportion of each type of capital source in the total capital).

- For sole proprietorships: Write according to the investment capital on the establishment and operation license or equivalent license issued by the competent authority (specify the currency).

- For organizations of countries sharing land borders with Vietnam and other organizations: If on the establishment decision, the Certificate of Business Registration,... If there is no capital, leave this information blank.

(9) Operation commencement date: The date of commencement of operation of the organization.

(10) Economic type: The organization itself marks X in one of the corresponding boxes.

(11) Form of accounting for business results: Only mark X in one of the two boxes of this indicator.

(12) Fiscal year: Specify from the first day and month of the accounting year to the last day and month of the accounting year according to the calendar year or fiscal year.

(13) Information about the management authority or supervisory authority: Specify the name, TIN, and address of the supervisory authority of the organization.

(14) Information of the legal representative/SOE owner: declare the details of the legal representative of the organization (for economic organizations and other organizations except sole proprietorships) or information of the owner of the sole proprietorship.

(15) Taxes payable: Mark X in the boxes corresponding to the taxes payable by the organization.

(16) VAT calculation method: Mark X in one of the boxes of this indicator.

(17) Information about relevant entities:

- If there is an independent unit, mark X in the box "There are independent units", then it must be declared in the section "List of independent units" form No. 01-DK-TCT-BK01.

- If there are subordinate units, mark X in the box "There are subordinate units", then it must be declared in the "List of subordinate units subject to the issuance of 13-digit TINs" form No. 01-DK-TCT-BK02 (for cases where TINs must be issued to subordinate units) or "List of subordinate units, business locations not subject to TIN issuance" form No. 01-DK-TCT-BK03 (for subordinate units not subject to TIN issuance).

- If there is a business location or subordinate warehouse without business function, mark X in the box "Having a business location, affiliated warehouse", then must declare in the section "List of subordinate units and business locations not subject to TIN issuance" form No. 01-DK-TCT-BK03.

- If there are foreign contractors or subcontractors, mark X in the box "There are foreign contractors and subcontractors", then declare in the section "List of foreign contractors and subcontractors" form No. 01-DK-TCT-BK04.

- If there are Petroleum contractors or investors, mark X in the box "There are petroleum contractors and investors", then it must be declared in the section "List of petroleum contractors and investors" form No. 01-DK-TCT-BK05 (for Petroleum contracts).

(18) Other information: Specify the full name, and contact telephone number of the General Director or Director and Chief Accountant.

(19) Bank account: If there is an account opened at a bank or treasury, mark X in the box "Have a bank account", then declare in the "Statement of bank accounts" form No. 01-DK-TCT-BK06.

(20) Status before the reorganization of the economic organization (if any): If the economic organization registers for tax due to the reorganization of the previous economic organization, it shall mark one of the following cases: merger, consolidation, division, separation and must clearly state TIN previously issued by the merged economic organization, consolidated, divided, separated.

(21) The part where the taxpayer or the taxpayer's legal representative signs and states full name: The taxpayer or the taxpayer's legal representative must sign and include his or her full name in this section.

(22) Stamp of the taxpayer: Where the taxpayer has a seal at the time of taxpayer registration, the stamp must be affixed to this section. In case the taxpayer does not have a seal at the time of taxpayer registration, it is not required to stamp it on the tax declaration. When the taxpayer comes to receive the result, it must supplement the stamp to the tax authority.

What is the time limit for first-time taxpayer registration in Vietnam?

Under the provisions of Article 33 of the Law on Tax Administration 2019 as follows:

Time limit for first-time taxpayer registration

1. For taxpayers who combine taxpayer registration with business registration, the time limit for taxpayer registration is the time limit for business registration as prescribed by law.

2. For taxpayers directly registered with tax authorities, the time limit for taxpayer registration is 10 working days starting from the day on which:

a) the certificate of household business registration, establishment and operation license, investment registration certificate or establishment decision is granted;

b) the taxpayer inaugurates business operation for organizations that are not required to apply for business registration and household businesses and individual businesses that are required to apply for business registration but yet to be granted the business registration certificate;

c) the responsibility to deduct and pay tax on behalf of individuals arises; organizations paying tax on behalf of individuals according to business cooperation contracts and/or agreements;

d) the contract with the foreign contractor and/or subcontractors who directly declare and pay tax to tax authorities; the petroleum contract or agreement is concluded;

dd) personal income tax is incurred;

e) tax refund in claimed;

g) other amounts payable to the state budget are incurred.

3. In case an individual does not have a TIN, his/her income payer shall apply for taxpayer registration on his/her behalf in no later than 10 working days starting from the date tax liabilities are incurred; in case a dependant of a taxpayer does not have a TIN, the income payer shall apply for taxpayer registration for the dependant in no later than 10 working days starting from the date the taxpayer applies for dependant exemption as prescribed by law.

Thus, the time limit for first-time taxpayer registration in Vietnam is specified above.

In case an individual does not have a TIN, his/her income payer shall apply for taxpayer registration on his/her behalf in no later than 10 working days starting from the date tax liabilities are incurred; in case a dependant of a taxpayer does not have a TIN, the income payer shall apply for taxpayer registration for the dependant in no later than 10 working days starting from the date the taxpayer applies for dependant exemption as prescribed by law.

LawNet