Vietnam: What is the social insurance premium payment rate by employers during 2024?

- What is the social insurance premium payment rate by employers in Vietnam during 2024?

- What are the cases in which employers in Vietnam are not required to pay social insurance premiums for their employees?

- What are the rights and responsibilities of employers in paying social insurance premiums to the occupational accident and disease benefit fund in Vietnam?

What is the social insurance premium payment rate by employers in Vietnam during 2024?

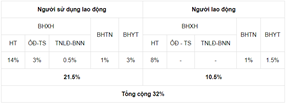

Under Articles 85 and 86 of the Law on Social Insurance 2014, Article 4 of Decree 58/2020/ND-CP, Article 5 of Decree 58/2020/ND-CP, and Decision 595/QD-BHXH in 2017, the social insurance premium payment rate by employers in Vietnam during 2024 is specified as follows:

Based on the employee's salary, the social insurance premium payment rate is 32%, of which the employee pays 10.5% of the monthly salary as the basis for payment of compulsory social insurance premiums, the employer pays 21.5% of the monthly salary fund for payment of compulsory social insurance premiums (except for part-time employees in communes, wards and townships), specifically:

Where: HT is a pension fund; OD-TS is a sickness and maternity fund; TNLD-BNN is an occupational accident and disease benefit fund; BHTN is unemployment insurance; BHYT is health insurance.

Thus, the social insurance premium payment rate by employers in Vietnam during 2024 is 21.5%. To be specific:

- The pension fund: 14%;

- The sickness and maternity fund: 3%;

- The occupational accident and disease benefit fund: 0.5%;

- The unemployment insurance: 1%;

- The health insurance: 3%.

Particularly for enterprises operating in industries with high risks of occupational accidents and diseases, if eligible, with a written request and approved by MOLISA, they may contribute to the occupational accident and disease benefit fund at a rate of 0.3%.

In addition, when there is a problem of labor, salary and arrears for employees, the enterprise is responsible for making a list of employees participating in social insurance, health insurance, unemployment insurance, occupational accident insurance and unemployment insurance (Form D02-TS) issued together with Decision 595/QD-BHXH in 2017.

> Download Form D02-TS Here.

Note: The above social insurance premium payment rate applies to Vietnamese citizens working in sole proprietorships.

.png)

What are the cases in which employers in Vietnam are not required to pay social insurance premiums for their employees?

According to the provisions of Article 86 of the Law on Social Insurance 2014 (with content expired by Clause 2, Article 92 of the Law on Occupational Safety and Health 2015) as follows:

Levels and methods of payment by employers

1. Employers shall make monthly payments calculated based on the salary funds on which social insurance premiums are based for employees defined at Points a, b, c, d, dd and h, Clause 1, Article 2 of this Law as follows:

a/ 3% to the sickness and maternity fund;

…

c/ 14% to the retirement and survivorship allowance fund.

2. Employers shall make monthly payments calculated based on the statutory pay rate for each employee defined at Point e, Clause 1, Article 2 of this Law as follows:

…

b/ 22% to the retirement and survivorship allowance fund.

3. Employers shall monthly pay an amount equal to 14% of the statutory pay rate to the retirement and survivorship allowance fund for employees defined at Point i, Clause 1, Article 2 of this Law.

4. Employers are not required to pay social insurance premiums for employees defined in Clause 3, Article 85 of this Law.

5. Employers being enterprises, cooperatives, household business households or cooperative groups engaged in agriculture, forestry, fishery or salt making that pay product-based or piecework-based salaries shall make monthly payments at the levels specified in Clause 1 of this Article; the payment may be made every month, every 3 months or every 6 months.

Accordingly, referring to the provisions in Clause 3, Article 85 of the Law on Social Insurance 2014, employers in Vietnam are not required to pay social insurance premiums for employees who neither work nor receive salary for 14 working days or more in a month.

What are the rights and responsibilities of employers in paying social insurance premiums to the occupational accident and disease benefit fund in Vietnam?

Under the provisions in Article 15 of Decree 58/2020/ND-CP as follows:

Employer’s rights and responsibilities

1. Reimburse the differential contribution amount and pay contributions at the rates specified in clause 3, clause 4 and point a of clause 5 of Article 30 herein.

2. Assign a coordinator and supervisor to ensure that the occupational safety and hygiene assessment body complies with law during the process of making assessment reports.

3. Provide documents or records related to occupational safety and hygiene activities during the process of carrying out assessments.

4. Store and keep custody of full documents used as a basis for request for application of the rate of contribution to the workplace accident and occupational disease benefit fund; provide any records request by competent state authorities.

5. Lodge claims or complaints about any acts of violation against laws arising from payment of contributions to the workplace accident and occupational disease benefit fund.

6. Pay assessment costs agreed upon with occupational safety and hygiene assessment bodies.

Thus, the rights and responsibilities of employers in paying social insurance premiums to the occupational accident and disease benefit fund in Vietnam are specified above.

LawNet