Vietnam: What is the PIT declaration form applicable to organizations and individuals paying tax-deductible income for income from copyrights and franchises?

- What is the PIT declaration form applicable to organizations and individuals paying tax-deductible income for income from copyrights and franchises in Vietnam?

- What does the PIT declaration dossier for income from copyrights and franchises of organizations and individuals paying tax-deductible income in Vietnam include?

- Shall PIT on income from copyrights and franchises in Vietnam be declared separately?

What is the PIT declaration form applicable to organizations and individuals paying tax-deductible income for income from copyrights and franchises in Vietnam?

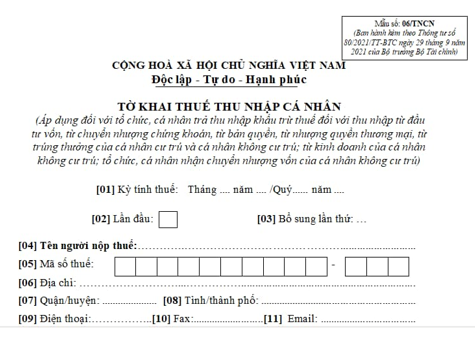

The PIT declaration form applicable to organizations and individuals paying tax-deductible income for income from copyrights and franchises in Vietnam is Form No. 06/PIT issued together with Circular 80/2021/TT-BTC as follows:

Download the PIT declaration form applicable to organizations and individuals paying tax-deductible income for income from copyrights and franchises in Vietnam: Here.

What does the PIT declaration dossier for income from copyrights and franchises of organizations and individuals paying tax-deductible income in Vietnam include?

Pursuant to Section 9.10 Appendix I List of tax returns issued together with Decree 126/2020/ND-CP, the PIT declaration dossier for income from copyrights and franchises of organizations and individuals paying tax-deductible income in Vietnam includes:

- PIT declaration form (applicable to organizations and individuals paying tax-deductible income for income from capital investment, securities transfer, copyrights, franchises, and wining prizes of resident and non-resident individuals; income from business of non-resident individuals; organizations and individuals receiving capital transfers of non-resident individuals) according to Form No. 06/PIT (issued together with Appendix II of Circular 80/2021/TT-BTC).

- Appendix to the detailed list on individuals having income in the tax year (declared in the tax return of the last month/quarter in the tax year) according to Form No. 06-1/BK-PIT (issued together with Appendix II of Circular 80/2021/TT-BTC).

Shall PIT on income from copyrights and franchises in Vietnam be declared separately?

Pursuant to Point g, Clause 4, Article 8 of Decree 126/2020/ND-CP as follows:

Article 8. Taxes declared monthly, quarterly, annually, separately; tax finalization

...

4. The following taxes and other amounts shall be declared separately:

a) VAT payable by taxpayers specified in Clause 3 Article 7 of this Decree or taxpayers that declare VAT directly on added value as prescribed by VAT laws and also incur VAT on real estate transfer.

b) Excise tax incurred by exporters on goods that are sold domestically instead of being exported if excise tax is not paid during manufacture of such goods. Excise tax incurred by business establishments buying domestically manufactured motor vehicles, airplanes, yachts that were originally not subject to excise tax but then repurposed and become subject to excise tax.

c) Tax on exports and imports, including: export duty, import duty, safeguard duty, anti-dumping tax, countervailing duty, excise tax, environment protection tax, VAT. The Ministry of Finance shall specify the cases in which separate declaration of tax on exports and imports is not required.

d) Resource royalty payable by the organization assigned to sell confiscated resources; resource royalty on irregular resource extraction licensed by competent authorities or exempt from licensing as prescribed by law.

dd) Irregular VAT and corporate income tax incurred by payable by taxpayers paying tax directly on value-added and revenue as prescribed by VAT and corporate income tax laws. In case these taxes are incurred multiple times within a month, they may be declared monthly.

e) Corporate income tax on real estate transfer incurred by taxpayers paying tax directly on revenue under corporate income tax laws.

g) Personal income tax directly declared by the income earners or declared and paid by the income payers on behalf of the income earners on income from real estate transfer, capital transfer, capital investment, copyright, franchising, wining overseas prizes; inheritance, gifts.

...

Thus, according to the above provisions, PIT on income from copyrights and franchises in Vietnam shall be declared separately.

LawNet