Vietnam: What is the newest licensing fee declaration form? What are the instructions for filling out the licensing fee declaration made in Form 01/LPMB?

What is the newest licensing fee declaration form in Vietnam?

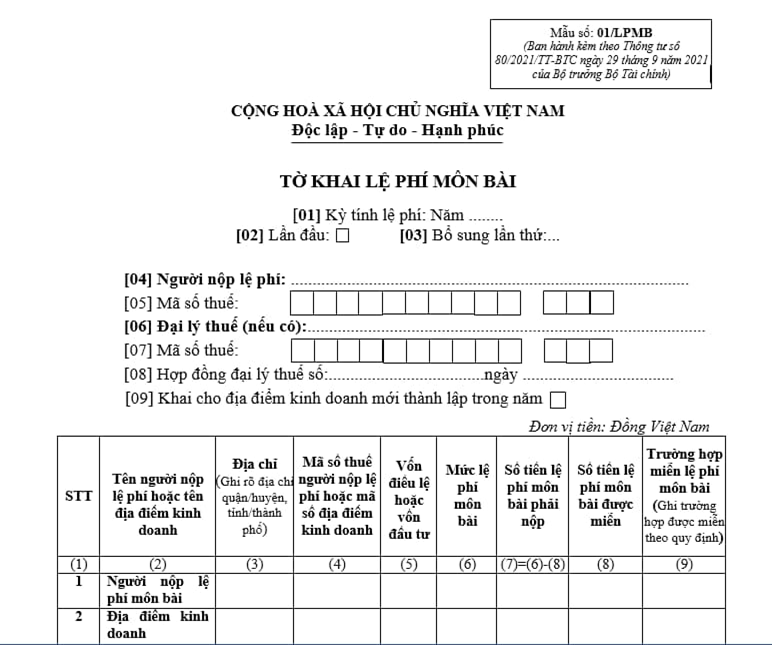

Based on Form 01/LPMB Appendix 2 issued together with Circular 80/2021/TT-BTC, the newest licensing fee declaration form in 2024 is specified as follows:

Download the latest licensing fee declaration form in 2024: here

What are the instructions for filling out the licensing fee declaration made in Form 01/LPMB?

- Entry [01]: Declare the year in which the license fee is calculated.

- Entry [02]: Only tick for the first time to declare.

- Entry [03]: Only check for cases where the fee payer (hereinafter collectively referred to as the taxpayer) has submitted a declaration but then detects a change in information about the declaration obligation and re-declares information in the declared fee period. Note, that the taxpayer only chooses one of two entries [02] and [03], not both simultaneously.

- Entry [04] to Entry [05]: Declare information according to the taxpayer's tax registration.

- Entry [06] to Entry [08]: Declare tax agent information (if any).

- Entry [09]: Only in case the taxpayer has declared, then establish a new business location.

In 2024, what is the deadline for submitting licensing fee declarations in Vietnam?

Under Clause 1, Article 10 of Decree 126/2020/ND-CP, the deadline for submitting licensing fee declarations in Vietnam is specified as follows:

- Deadlines for submission of declarations of land-related amounts, licensing fees, registration fees, fees for grant of rights and other amount payables prescribed by regulations of law on management and use of public property

- New businesses (except household and individual businesses), including medium and small enterprises converted from household businesses) and existing businesses that establish new dependent units or business locations shall submit the licensing fee declaration by January 30 of the year preceding the establishment or inauguration year.

In case capital is changed during the year, the licensing fee payer shall submit the declaration by January 30 of the year succeeding the year in which the change occurs.

- Household and individual businesses are not required to submit licensing fee declarations. Tax authorities shall determine the licensing fees payable according to their tax declaration dossiers and tax administration database and inform them by Article 13 of this Decree.

Accordingly, the deadline for submitting licensing fee declarations for enterprises and organizations in 2023 is January 30, 2024.

The deadline for submitting licensing fee declarations for enterprises and organizations is January 30, 2025.

Household businesses and individual businesses are not required to submit licensing fee declarations. Tax authorities shall determine the licensing fees payable according to their tax declaration dossiers and tax administration database.

What are the newest licensing fee rates in Vietnam?

Under Article 4 of Decree 139/2016/ND-CP (amended and supplemented by Clause 2 Article 1 of Decree 22/2020/ND-CP) the newest licensing fee rates in Vietnam are specified as follows:

For organizations engaging in business operations:

No. | Organizations | License fee rate |

1 | Organizations with charter capital and investment capital of greater than VND 10 billion | 03 million VND/year |

2 | Organizations with charter capital and investment capital of less than or equal to VND 10 billion | 02 million VND/year |

3 | Branches, representative offices, business premises, public service providers, other business entities | 01 million VND/year |

Notes:

- The licensing fee rates for the organizations specified in this Clause are based on the charter capital written in the certificate of business registration, the certificate of enterprise registration, or the charter of cooperatives.

In case of absence of charter capital, it is based on the investment capital written in the certification of investment registration or decision on investment policies.

- If the organizations change their charter capital or investment capital, the ground for determining the amount of licensing fees is their charter capital or investment capital of the year preceding the year of calculation of licensing fees.

Where the charter capital or investment capital written in the certificate of business registration or certificate of investment registration is in foreign currency, it shall be converted into Vietnamese dong as a basis for determining the amount of licensing fees by the buying rate of commercial banks or credit institutions where the licensing fee payers open their accounts at the time they make payment to the state budget.

For household and individual businesses engaging in business operations:

No. | Revenue | License fee rate |

1 | Over 500 million VND/year | 01 million VND/year |

2 | Over 300 to 500 million VND/year | 500,000 VND/year |

3 | Over 100 to 300 million VND/year | 300,000 VND/year |

Notes:

- Revenues used as the basis for determining the license fees payable by individuals, groups of individuals and household businesses shall be determined according to guidance given by the Ministry of Finance.

Upon the end of the period of exemption from the license fee (from the fourth year from the date of establishment), a SME transformed from a household business (including its branches, representative offices and/or business locations) shall pay the license fee for the whole year if its exemption period ends in the first 6 months of the year or pay 50% of the license fee payable for the whole year if its exemption period ends in the last 6 months of the year.

A household business, an individual or a group of individuals engaging in production/business that resumes its production/business after a suspension period shall pay the license fee for the whole year if it resumes its production/business in the first 6 months of the year or pay 50% of the license fee payable for the whole year if it resumes its production/business in the last 6 months of the year.

LawNet