Vietnam: What is the minimum coverage of compulsory fire and explosion insurance in Vietnam under Decree 67/2023/ND-CP?

- What is the minimum coverage of compulsory fire and explosion insurance in Vietnam under Decree 67/2023/ND-CP?

- What is the calculation of the minimum coverage of compulsory fire and explosion insurance in Vietnam in case the market price of property is unidentified?

- What are the compulsory fire and explosion insurance premiums and deductibles for facilities facing fire and explosion hazards in Vietnam?

What is the minimum coverage of compulsory fire and explosion insurance in Vietnam under Decree 67/2023/ND-CP?

Pursuant to the provisions of Article 24 of Decree 67/2023/ND-CP as follows:

Minimum coverage

1. Minimum coverage of compulsory fire and explosion insurance is a monetary value according to the market price of the property specified in Clause 1 Article 23 of this Decree at the time of entering into an insurance policy.

...

Thus, Minimum coverage of compulsory fire and explosion insurance is a monetary value according to the market price of the property being the insured at the time of entering into an insurance policy

Accordingly, the property include:

- Houses, construction works and property attached thereto; machinery and equipment.

- Goods and supplies (including raw materials, semifinished products and finished products).

.png)

What is the calculation of the minimum coverage of compulsory fire and explosion insurance in Vietnam in case the market price of property is unidentified?

In Clause 2, Article 24 of Decree 67/2023/ND-CP, there are the following provisions:

Minimum coverage

…

2. In case the market price of property is unidentified, the minimum coverage shall be agreed upon as follows:

a) As for the property prescribed in Point a Clause 1 Article 23 hereof: minimum coverage is a monetary value of the property according to the residual value or replacement value of the property at the time of entering into an insurance policy.

b) As for the property prescribed in Point b Clause 1 Article 23 hereof: minimum coverage is a monetary value of the property on the basis of valid invoices and receipts or relevant documents.

Thus, in case the market price of property is unidentified, the minimum coverage shall be agreed upon as follows:

- For houses, construction works and property attached thereto; machinery and equipment:

The minimum coverage is a monetary value of the property according to the residual value or replacement value of the property at the time of entering into an insurance policy

- For goods and supplies (including raw materials, semifinished products and finished products):

The minimum coverage is a monetary value of the property on the basis of valid invoices and receipts or relevant documents.

What are the compulsory fire and explosion insurance premiums and deductibles for facilities facing fire and explosion hazards in Vietnam?

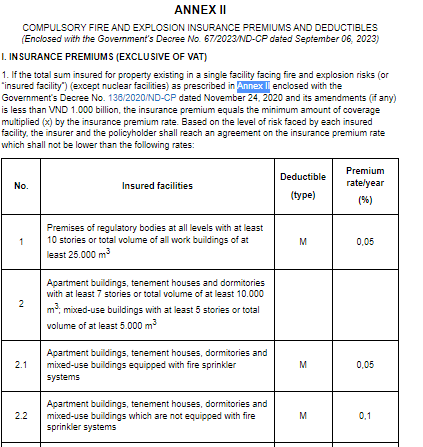

Pursuant to Article 26 of Decree 67/2023/ND-CP, the compulsory fire and explosion insurance premiums and deductibles for facilities facing fire and explosion hazards in Vietnam (excluding nuclear facilities) are determined as follows:

(1) If the total sum insured of property situated in a location of a single facility facing fire and explosion hazards (excluding nuclear facilities) is less than VND 1.000 billion:

- Premiums

Based on the level of risk faced by each insured facility, the insurer and the policyholder shall reach an agreement on the insurance premium rate which shall not be lower than rates specified in Clause 1 Section I of Appendix II promulgated together with Decree 67/2023/ND-CP.

> Download Schedule for insurance premium rates Here

- Deductibles

Compulsory fire and explosion insurance deductibles shall comply with Clause 1 Section II of Appendix II promulgated together with Decree 67/2023/ND-CP.

+ Minimum deductible

In any case, the deductible shall not be lower than the following values:

Sum insured | Deductible |

Not exceeding 2.000 Above 2.000 to 10.000 Above 10.000 to 50.000 Above 50.000 to 100.000 Above 100.000 to 200.000 Above 200.000 | 4 10 20 40 60 100 |

Unit: VND million

+ If the insured facility is facing type-M fire and explosion risk

the deductible shall not exceed 1% of the insurance premium but not be lower than the minimum deductible

+ If the insured facility is facing type-N fire and explosion risk

the deductible shall not exceed 10% of the insurance premium but not be lower than the minimum deductible

(2) In case the total sum insured for property existing in a single insured facility (except nuclear facilities) is VND 1.000 billion or higher:

Insurers and policyholders may negotiate insurance premiums and deductibles.

Where:

- Insurers and policyholders may negotiate insurance premiums and deductibles on the basis of evidence proving approval by the major foreign reinsurers.

- In any case, insurance premiums shall not be lower than the amounts equal VND 1.000 billion multiplied (x) by 75% of minimum insurance premiums for a location of a single facility facing fire and explosion hazards (excluding nuclear facilities) is less than VND 1.000 billion.

- Any major foreign reinsurer or foreign reinsurer that assumes from 10% of total insurance coverage of each reinsurance policy must be ranked at least “BBB” by Standard & Poor’s or “B++” by A.M.Best, or “Baal” by Moody’s or the equivalent ranks by other organizations that have competence and experience in rating in the financial year closest to the reinsurance assuming year.

LawNet