Vietnam: What is the latest tax registration declaration form - Form No. 03-DK-TCT for individual and household businesses according to Circular 105?

- What is the latest tax registration declaration form - Form No. 03-DK-TCT for individual and household businesses in Vietnam according to Circular 105?

- What are the instructions on preparing tax registration declaration - Form No. 03-DK-TCT for individual and household businesses in Vietnam?

- What does the tax registration application of a household business or an individual business in Vietnam include?

What is the latest tax registration declaration form - Form No. 03-DK-TCT for individual and household businesses in Vietnam according to Circular 105?

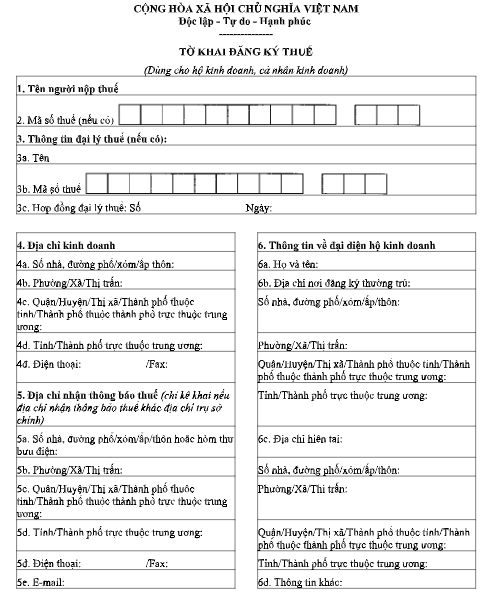

Under Circular 105/2020/TT-BTC, the tax registration declaration form for individual and household businesses in Vietnam is Form No. 03-DK-TCT issued under Circular 105/2020/TT-BTC.

Download Form No. 03-DK-TCT: here

What are the instructions on preparing tax registration declaration - Form No. 03-DK-TCT for individual and household businesses in Vietnam?

In Form 03-DK-TCT issued together with Circular 105/2020/TT-BTC, the instructions on preparing tax registration declaration - Form No. 03-DK-TCT for individual and household businesses in Vietnam are specified á follows:

(1) Name of taxpayer: Clearly and fully state in capital letters the name of the individual business or household business. In case there is a Certificate of Household Business Registration, it must be correctly stated according to the name of the household business on the Certificate of Household Business Registration.

(2) TIN: Write the 10-digit TIN of the representative of the household business or individual in case of tax registration for the newly established business location, or the issued TIN of the business location in case of re-operation of the terminated business location.

(3) Tax agent information: Record all information of the tax agent in case the tax agent signs a contract with the taxpayer to carry out tax registration procedures on behalf of the taxpayer by the Law on Tax Administration.

(4) Business address:

(4.1) For individual and household businesses with regular business activities and fixed business locations; Individuals leasing assets shall specify the business address of the household business, individual business, or the address where the individual leases the property, including: house number, street/neighborhood/hamlet/village, ward/commune/town, district/town/city of the province/province/city. If there is a phone number or fax number, specify the area code – phone number/fax number. In case there is a Certificate of Household Business Registration, it must be correctly stated according to the business address on the Certificate of Household Business Registration.

(4.2) For individual or household businesses with regular business activities and no fixed business location, clearly state the address of the permanent residence of the representative of the household business or the current address if the representative of the household business does not live at the address of the permanent residence.

(5) Address for receiving tax notices: If individual or household businesses have an address to receive notices of tax authorities different from the address of the head office, clearly state the address to receive tax notices for tax authorities to contact.

(6) Information about the representative of the household business: Write down all information about the representative of the individual business or household business (Full name, permanent address, current address). If there is a phone number or fax number, specify the area code - phone number/fax number.

(7) Certificate of Household Business Registration/Certificate of Business Registration:

- For individual and household businesses doing business in Vietnam and individual businesses of countries sharing land borders with Vietnam carrying out activities of buying, selling, and exchanging goods at border markets, border gate markets, and markets in border-gate economic zones: Specify the number, date of issuance and issuing agency of the Certificate of Household Business Registration (if any).

- For household businesses of countries sharing land borders with Vietnam carrying out activities of buying, selling, and exchanging goods at border markets, border gate markets, and markets in border-gate economic zones: Specify the number and date of issuance of the Certificate of Business Registration. Particularly, the information of the "issuing agency" of the Certificate of Business Registration: write the name of the country sharing the land border with Vietnam that issued the Certificate of Business Registration (Laos, Cambodia, China).

(8) Information on documents of the representative of the household business: Specify the number, date of issue, Issuing agency 1 in the documents of the representative of the household business: identity card; citizenship identification; passport; other attestation documents issued by competent authorities. Particularly, the information "place of issue" only states the province or city of issue.

(9) Business capital: Write according to the information "business capital" on the Certificate of Household Business Registration or Business Registration Certificate. In case there is no Certificate of Household Business Registration or Business Registration Certificate or no information about business capital on the Business Registration Certificate, the actual capital in business shall be recorded.

(10) Main business line: Recorded by business line on the Certificate of Household Business Registration or Certificate of Business Registration. The taxpayer only lists 1 main business line that is actually in business.

(11) Date of commencement of operation: Specify the date on which households, groups of individuals, and individual businesses commence production and business activities.

(12) Tax registration status:

If individual or household businesses register for tax for business activities for the first time or newly established business locations to issue TINs with tax authorities, mark X in the box "New issuance".

If a household business or individual after a period of inactivity has changed the TIN of the representative of the household business into the TIN of the individual or resumed business activities, mark X in the box "Re-operation of business business" and write the TIN issued by the tax authority in the box "TIN" of the declaration.

(13) Information about related units: In case individual or household businesses have additional dependent shops, shops, and warehouses, mark X in the box "There are dependent shops and shops" and declare in the List of dependent shops, shops, and warehouses" form No. 03-DK-TCT-BK01.

(14) The part where the representative of the individual business or household business signs and clearly states the full name: The representative of the individual business or household business must sign and clearly write their full name in this section.

(15) Tax agent: In case a tax agent declares on behalf of a taxpayer, he shall declare in this information

What does the tax registration application of a household business or an individual business in Vietnam include?

Under Clause 8, Article 7 of Circular 105/2020/TT-BTC, the taxpayers being household/individual businesses shall file an application for tax registration with the Department of Taxation or regional Department of Taxation where they are headquartered.

The required documents in an application for tax registration of household business or individual business include:

- Application form for tax registration No. 03-DK-TCT hereto appended or tax return of household/individual business as per the law on tax administration;

- Schedule of affiliated stores and shops No. 03-DK-TCT-BK01 hereto appended (if any);

- Copy of certificate of household business registration (if any);

- Copy of unexpired citizen identification card or ID card, for a Vietnamese nationality individual; copy of unexpired passport, for a foreign national or overseas Vietnamese.

Besides, required documents in an application for tax registration of household/individual businesses of neighbor countries on land with Vietnam engaging in sale and barter at border marketplace, checkpoint marketplaces, and marketplaces in checkpoint economic zones include:

- Application form for tax registration No. 03-DK-TCT hereto appended;

- Schedule of affiliated stores and shops No. 03-DK-TCT-BK01 hereto appended (if any);

- Copies of the documents mentioned in clause 1 Article 2 of Circular No. 218/2015/TT-BTC dated December 31, 2015 of the Ministry of Finance on guidelines for taxation policies and administration for traders engaging in sale and barter at border marketplace, checkpoint marketplaces, marketplaces in checkpoint economic zones as prescribed in Decision No. 52/2015/QD-TTg dated October 20, 2015 of the Prime Minister.

LawNet