Vietnam: What is the latest student loan confirmation letter form in 2023? Where to download the loan confirmation letter form?

What is the latest student loan confirmation letter form in Vietnam? Where to download the loan confirmation letter form?

The student loan confirmation letter form is a certificate form for students in need of loans who are in financial difficulties or members of poor or near-poor households,...

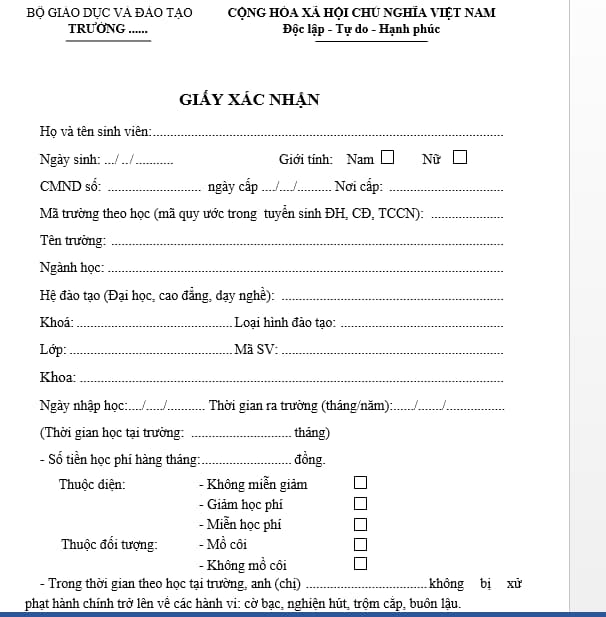

Parents and students can refer to the Student Loan Confirmation form below:

Download the loan confirmation letter application to students here.

Who is eligible for student loans in Vietnam?

Pursuant to the provisions of Article 2 of Decision 157/2007/QD-TTg amended by Clause 1 Article 1 of Decision 05/2022/QD-TTg as follows:

Borrowers

Disadvantaged pupils and students studying at universities (or university equivalents), colleges, professional secondary schools, and vocational education and training institutions established and operating in accordance with the provisions of Vietnamese law, including:

1. Pupils and students are orphaned by both parents or only orphaned by one parent but the other is incapable of working.

2. Pupils and students who are members of households belonging to one of the following subjects:

a/ Poor households according to standards prescribed by law.

b/ Near-poor households according to the standards prescribed by law.

c/ Households with average living standards according to the standards prescribed by law.

3. Pupils and students whose families face financial difficulties due to accidents, diseases, natural disasters, fires or epidemics during their study period certified by the People's Committees of communes, wards or townships where they reside.

Thus, based on the above regulations, the subjects eligible for student loans in Vietnam include:

Disadvantaged students studying at universities (or university equivalents), colleges, professional secondary schools, and vocational education and training institutions established and operating in accordance with the provisions of Vietnamese law, including:

- Students are orphaned by both parents or only orphaned by one parent but the other is incapable of working.

- Students who are members of households belonging to one of the following subjects:

+ Poor households according to standards prescribed by law.

+ Near-poor households according to the standards prescribed by law.

- Households with average living standards according to the standards prescribed by law.

- Students whose families face financial difficulties due to accidents, diseases, natural disasters, fires, or epidemics during their study period are certified by the People's Committees of communes, wards, or townships where they reside.

What is the maximum student loan amount in Vietnam?

Pursuant to the provisions of Article 5 of Decision 157/2007/QD-TTg amended by Clause 2 Article 1 of Decision 05/2022/QD-TTg as follows:

Loan amount:

1. The maximum loan amount is VND 4,000,000/month/student.

2. The Vietnam Bank for Social Policy shall prescribe specific loan amount for pupils and students based on tuition fees charged by each school and subsistence expenses by region, but not exceeding the loan level specified in Clause 1 of this Article.

3. When the State's tuition fee policy changes and the cost of living fluctuates, the Vietnam Bank for Social Policy shall agree with the Minister of Finance to submit it to the Prime Minister for consideration and decision on the adjustment of loan

According to the above regulations, the maximum student loan amount is 4,000,000 VND/month/student.

What is the student loan term in Vietnam?

Pursuant to Clause 3 Section I of Guideline 2162A/NHCS-TD of 2007, the student loan term in Vietnam includes the following:

- Loan term: The period calculated from the date the borrower receives the first loan until the date of paying off the principal and interest agreed upon in the Debt Acceptance Contract.

Loan term includes loan issuance term and repayment term.

+ Loan granting term: It is the period from the date the borrower receives the first loan until the date the student ends the course, including the time when the student is allowed to leave school for a period of time and is entitled to reserve learning results (if any).

During the loan granting term, the borrower has not yet had to pay the principal and interest on the loan; Loan interest is calculated from the date the borrower receives the first loan to the date of repayment of the principal.

+ Loan repayment term: It is a period calculated from the date the borrower pays the first debt to the date of paying off the principal and interest. The borrower and the bank shall agree on a specific repayment term not exceeding the maximum repayment term specified as follows:

++ For training programs with a training period of up to one year, the maximum repayment period is equal to 2 times the loan issuance term.

++ For training programs of more than one year, the maximum repayment period is equal to the loan issuance term.

- In case a household borrows loans for many students at the same time, but the graduation term of each student is different, the loan term shall be determined according to the student with the longest time to study at the school.

LawNet