Vietnam: What is the latest PIT finalization declaration- Form 05/QTT-PIT? What are the appendices on the detailed lists attached with Form 05/QTT-TNCN?

What is the latest PIT finalization declaration in Vietnam- Form 05/QTT-PIT?

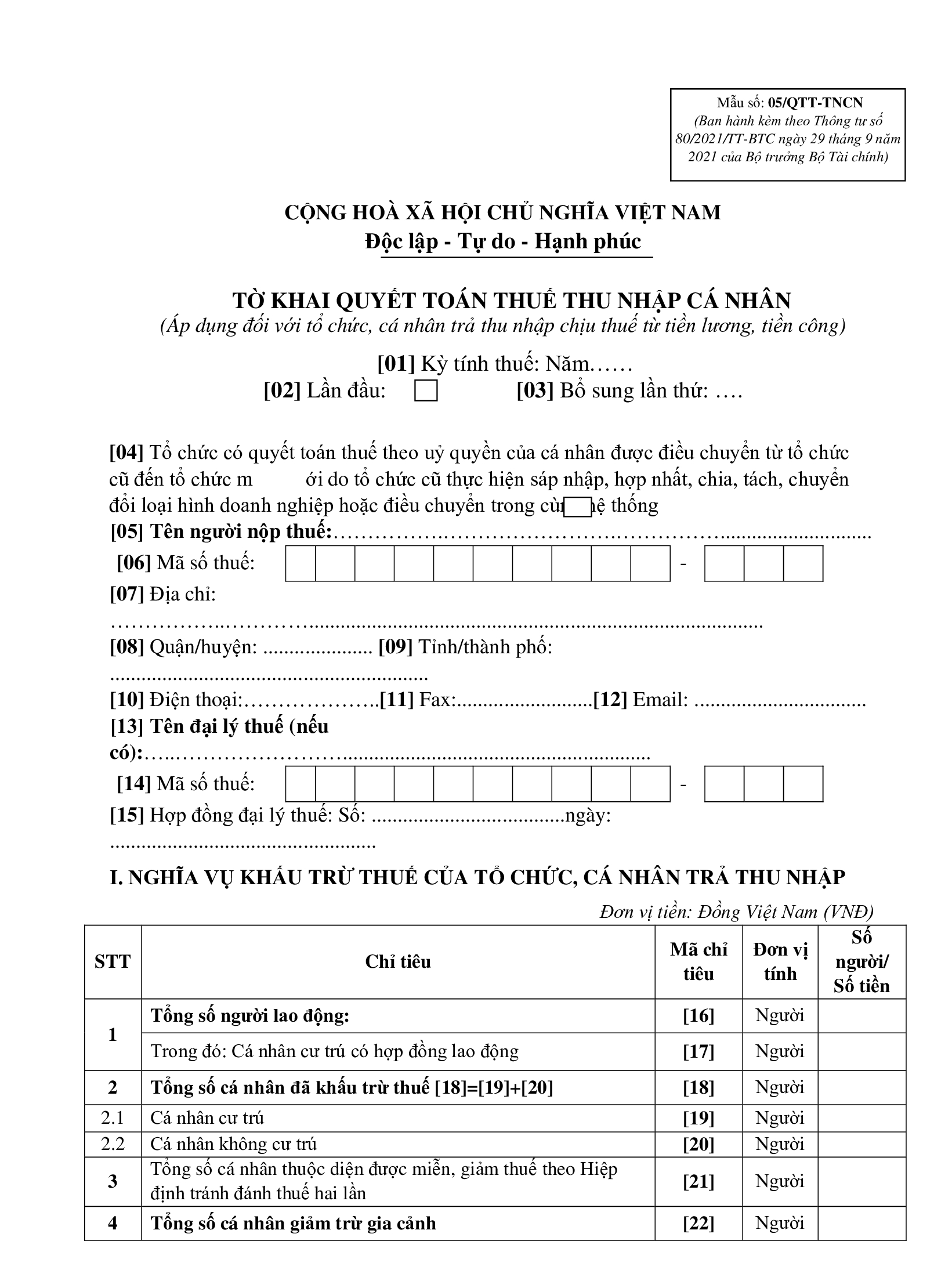

The latest PIT finalization declaration in Vietnam applicable to organizations and individuals paying taxable income from salaries and remunerations is specified in Form 05/QTT-PIT issued together with Circular 80/2021/TT-BTC as follows:

Download the latest PIT finalization declaration in Vietnam- Form 05/QTT-PIT here

What are the appendices on the detailed lists attached with Form 05/QTT-TNCN?

According to the instructions of the General Department of Taxation in Vietnam, when making Form 05/QTT-TNCN issued together with Circular 80/2021/TT-BTC, the appendices on the detailed lists attached with Form 05/QTT-TNCN includes:

- Appendix to the list of personal details subject to taxation according to the partially progressive tariff

- Appendix to the list of personal details subject to tax calculation at the full tax rate

- Appendix to the detailed list of dependents for personal deductions;

In 2024, what is the deadline for PIT finalization in Vietnam?

The deadline for submitting annual tax declaration dossiers is specified in Points a and b, Clause 2, Article 44 of the Law on Tax Administration 2019 as follows:

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual personal income tax statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

c) For presumptive tax declarations prepared by household businesses and individual businesses: the 15th of December of the preceding year. For new household businesses and individual businesses: within 10 days from the date of commencement of the business.

Thus, in 2024, the deadline for PIT finalization in Vietnam is specified as follows:

- For income payers: no later than March 31, 2024

- For individuals directly finalizing PIT: April 30, 2024.

Note: In case the last day of the deadline for PIT finalization dossiers coincides with a prescribed holiday, the last day of the deadline is calculated as the working day immediately following that holiday.

In 2024, what are the 10 latest incomes subject to PIT in Vietnam?

Under Article 3 of the Personal Income Tax Law 2007 (amended by Clauses 1 and 2, Article 2 of the 2014 Law on Amendments to Tax Laws and Clause 1, Article 1 of the 2012 Law on Amendments to Personal Income Tax Law), incomes subject to PIT in Vietnam include:

(1) Incomes from manufacturing, trading of goods, services as prescribed by law. This regulation only applies to incomes from agriculture, forestry, salt production, fisheries if the conditions for tax exemption stipulated in Clause 5, Article 4 of Decree 65/2013/ND-CP are not satisfied

Incomes from independent practice of individuals having licenses or practising certificates as prescribed by law.

Incomes from business mentioned in this Clause do not include incomes of individual entrepreneurs whose revenues are VND 100 million or less.

(2) Incomes from salaries and wages, including:

- Salaries, wages and amounts of similar nature;

- Allowances, subsidies, except for amounts: Those paid under legal provisions on preferential treatment of persons with meritorious services; defense or security allowances; a hazard or danger allowances for persons working in branches, occupations or jobs at places where exist hazardous elements; allowances for attraction of laborers to work in certain branches or in certain regions specified by law; allowances for sudden difficulties, allowances for laborers having labor accident or suffering from an occupational disease, lump-sum maternity or child adoption allowances; allowances for working capacity loss, lump-sum retirement allowances, monthly survivorship allowances and other allowances as prescribed by law on social insurance; , severance and job-loss allowances specified in the Labor Code; subsidies of social relief nature and other allowances, subsidies without nature of salaries, wages as prescribed by the Government.

(3) Incomes from capital investment, including:

- Interests;

- Dividends;

- Incomes from capital investment in other forms, except for government bond interests.

(4) Incomes from capital transfer, including:

- Incomes from transfer of capital holdings in economic organizations;

- Incomes from transfer of securities;

- Incomes from transfer of capital in other forms.

(5) Incomes from transfer of real estate, including:

- Incomes from transfer of rights to use land and assets attached to land;

- Incomes from transfer of right to own or use residential houses;

- Incomes from transfer of right to lease land or water surface;

- Other incomes earned from the transfer of real estate under any form.

(6) Incomes from won prizes, including:

- Lottery winnings;

- Sales promotion winnings;

- Prizes won from betting;;

- Winnings in prized games and contests and other forms of winning.

(7) Incomes from copyright, including:

- Incomes from assignment or licensing of intellectual property objects;

- Incomes from technology transfer.

(8) Incomes from commercial franchising.

(9) Incomes from inheritances that are securities, capital holdings in economic organizations or business establishments, real estate and other assets subject to ownership or use registration.

(10) Incomes from gifts that are securities, capital holdings in economic organizations or business establishments, real estate and other assets subject to ownership or use registration.

LawNet