Vietnam: What is the latest Excel file used for calculating PIT on incomes from salaries and remunerations of employees in 2023?

What is the latest Excel file used for calculating PIT on incomes from salaries and remunerations of employees in 2023?

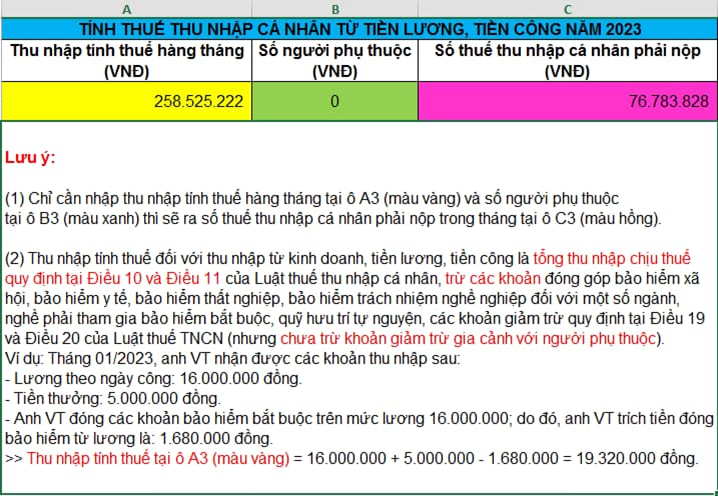

Employees can refer to the latest Excel file used for calculating PIT on incomes from salaries and remunerations of employees below:

>> Download the latest Excel file used for calculating PIT on incomes from salaries and remunerations of employees: here.

To calculate PIT on incomes from salaries and remunerations under the above File Excel, employees shall :

Step 1: Enter the total income

Total income includes monthly salary, bonuses, and allowances (minus mandatory insurance premiums).

Step 2: Enter the number of dependents (if any)

Step 3: Get results.

.png)

Who are PIT payers in Vietnam?

Pursuant to the provisions of Article 2 of the Personal Income Tax Law 2007 as follows:

Taxpayers

1. Personal income taxpayers include residents who earn taxable incomes specified in Article 3 of this Law inside and outside the Vietnamese territory and non-residents who earn taxable incomes specified in Article 3 of this Law inside the Vietnamese territory.

2. Resident means a person who satisfies one of the following conditions:

a/ Being present in Vietnam for 183 days or more in a calendar year or 12 consecutive months counting from the first date of their presence in Vietnam;

b/ Having a place of habitual residence in Vietnam, which is a registered place of permanent residence or a rented house for dwelling in Vietnam under a term rent contract.

3. Non-resident means a person who does not satisfy any of the conditions specified in Clause 2 of this Article.

Thus, PIT payers in Vietnam include:

- Personal income taxpayers include residents who earn taxable incomes specified in Article 3 of Personal Income Tax Law 2007 inside and outside the Vietnamese territory and non-residents who earn taxable incomes specified in Article 3 of Personal Income Tax Law 2007 inside the Vietnamese territory.

- Resident means a person who satisfies one of the following conditions:

+ Being present in Vietnam for 183 days or more in a calendar year or 12 consecutive months counting from the first date of their presence in Vietnam;

+ Having a place of habitual residence in Vietnam, which is a registered place of permanent residence or a rented house for dwelling in Vietnam under a term rent contract.

- Non-resident means a person who does not satisfy any of the conditions specified in Clause 2 of Article 2 of the Personal Income Tax Law 2007.

What are the incomes subject to PIT in Vietnam?

Pursuant to the provisions of Article 2 of Circular 111/2013/TT-BTC, incomes subject to PIT in Vietnam include:

- Incomes from business

- Incomes from wages and remunerations

- Incomes from capital investment

- Incomes from capital transfer

- Incomes from real estate transfer

- Incomes from winning prizes

- Incomes from copyright

- Incomes from franchising

- Incomes from inheritance

- Incomes from receipt of gifts

What is the deadline for paying PIT for employees in Vietnam?

Pursuant to the provisions of Clause 1, Article 55 of the Law on Tax Administration 2019 as follows:

Tax payment deadlines

1. In case tax is calculated by the taxpayer, the tax payment deadline is the deadline for submission of the tax declaration dossier. In case of submission of supplementary tax documents, the tax payment deadline is the deadline for submission of the erroneous tax declaration dossier.

The deadline for paying corporate income tax, which is paid quarterly, is the 30th of the first month of the next quarter.

The deadline for paying resource royalty and corporate income tax on crude oil is 35 days from the date of selling domestically or the date of customs clearance in case of export.

Resource royalty and corporate income tax on natural gas shall be paid monthly.

...

Thus, in case tax is calculated by the taxpayer, the tax payment deadline is the deadline for submission of the tax declaration dossier. In case of submission of supplementary tax documents, the tax payment deadline is the deadline for submission of the erroneous tax declaration dossier.

In Clause 1, Article 44 of the Law on Tax Administration 2019, the deadline for submission of tax declaration dossiers of taxes declared monthly and quarterly is specifically specified as follows:

Deadlines for submission of tax declaration dossiers

1. Deadlines for submission of tax declaration dossiers of taxes declared monthly and quarterly:

a) For taxes declared monthly: the 20th of the month succeeding the month in which tax is incurred;

b) For taxes declared quarterly: the last day of the first month of the succeeding quarter.

Thus, the deadline for submission of tax declaration dossiers of taxes declared monthly and quarterly is specifically specified as follows:

- For taxes declared monthly: the 20th of the month succeeding the month in which tax is incurred;

- For taxes declared quarterly: the last day of the first month of the succeeding quarter.

LawNet