Vietnam: What is the latest employee payroll template? Shall employers failing to provide payrolls to their employees face penalties?

What is the latest employee payroll template in Vietnam?

Currently, the law does not specifically regulate the employee payroll template when paying salaries to employees.

However, according to Article 95 of the 2019 Labor Code, there are provisions as follows:

Salary payment

1. The employer shall pay the employee on the basis of the agreed salary, productivity and work quality.

2. The salary written in the employment contract and the salary paid in reality shall be VND, unless the employee is a foreigner working in Vietnam.

3. Every time salary is paid, the employer shall provide the employee with a note specifying the salary, overtime pay, nightshift pay and deductions (if any).

Thus, the employee payroll must have full information, including: salary, overtime pay, nightshift pay, and deductions (if any.

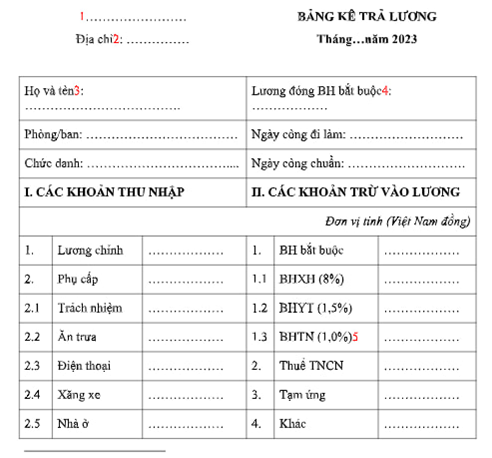

The below content is the employee payroll template (for reference):

Download the employee payroll template in Vietnam: here

Shall employers failing to provide payrolls to their employees in Vietnam face penalties?

Pursuant to Article 17 of Decree 12/2022/ND-CP regulating penalties for violations against regulations on salaries as follows:

Violations against regulations on salaries

1. A fine ranging from VND 5.000.000 to VND 10.000.000 shall be imposed upon an employer for commission of one of the following violations:

a) Failing to publicly post the pay scale, payroll, labour productivity norms and bonus regulations at the workplace;

b) Failing to establish pay scale, payroll, or labour productivity norms; failing to experiment labour productivity norms before they are officially introduced;

c) Failing to consult with the internal representative organization of employees (if any) during the establishment of the pay scale, payroll, labour productivity norms and bonus regulations;

d) Failing to provide payrolls to employees or providing payrolls to employees in breach of law;

dd) Failing to pay salaries fairly or discriminating against genders of employees who perform equal works.

Thus, employers failing to provide payrolls to their employees in Vietnam may be fined 10,000,000 VND to 20,000,000 VND.

Note: This administrative fine is the fine imposed on individual employers; for companies (organizations), the fine will be doubled.

What are the salary payment forms in Vietnam?

Pursuant to Article 96 of the 2019 Labor Code, salary payment forms in Vietnam are prescribed as follows:

Salary payment forms

1. The employer and employee shall reach an agreement on whether the salary is time-based, product-based (piece rate) or a fixed amount.

2. Salary shall be paid in cash or transferred to the employee’s personal bank account.

In case of bank transfer, the employer shall pay the costs of account opening and transfer.

3. The Government shall elaborate this Article.

Thus, salary shall be paid in cash or transferred to the employee’s personal bank account.

Specifically, the salary payment forms guided in Article 54 of Decree 145/2020/ND-CP are as follows:

(1) The form of salary payment shall be specified in the employment contract on the basis of consensus between the employer and the employee. To be specific:

- Time-based salary shall be paid to the employee monthly, weekly, daily or hourly as agreed in the employment contract. To be specific:

+ Monthly salary is the salary for a month’s work;

+ Weekly salary is the salary for a week’s work. In case monthly salary is specified in the employment contract, the weekly salary equals (=) the monthly salary multiplied by (x) 12 months and divided by (:) 52 weeks;

+ Daily salary is the salary for a days’ work. In case monthly salary is specified in the employment contract, the daily salary equals (=) the monthly salary divided by (:) the number of normal working days in a month as decided by the employer. In case weekly salary is specified in the employment contract, the daily salary equals (=) the weekly salary divided by (:) the number of working days in a week as specified in the employment contract;

+ Hourly salary is the salary for an hour’s work. In case a monthly, weekly or daily salary is specified in the employment contract, the hourly salary equals (=) the daily salary divided by (:) the number of normal working hours in a day as prescribed by Article 105 of the 2019 Labor Code.

- Piece rate pay is paid to piece workers according to the quantity and quality of products, productivity norms, and unit prices of the products.

- Fixed salary is paid according to the quantity and quality of works and time needed for completion of these works.

(2) Payment of salaries in the forms specified above shall be made and transferred to the employees’ bank accounts. In the latter case, the employers shall pay the fees for opening accounts and transferring salaries.

LawNet