Vietnam: What is the latest CIT declaration form - Form No. 05/CIT? What are the guidelines for filling out the CIT declaration applied to income from capital transfer made in Form No. 05/CIT?

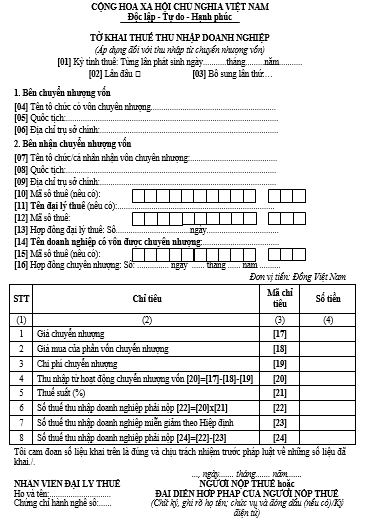

What is the latest CIT declaration form in Vietnam - Form No. 05/CIT?

The latest CIT declaration form in Vietnam - Form No. 05/CIT is specified in Circular 80/2021/TT-BTC is specified as follows:

Download the latest CIT declaration form in Vietnam - Form No. 05/CIT: here

What are the guidelines for filling out the CIT declaration applied to income from capital transfer made in Form No. 05/CIT in Vietnam?

According to information from the e-commerce portal, the General Department of Taxation in Vietnam guides the CIT declaration applied to income from capital transfer made in Form No. 05/CIT as follows:

Entry [01]: The taxpayer declares the date on which tax obligations arise by the law on CIT

Entry [02], [03]: Check "First time"; In case the taxpayer discovers that the first-time tax declaration dossier submitted to the tax authority has errors or errors, the additional declaration shall be made according to the order number of each supplement.

In case the taxpayer files an e-tax declaration, from the time the Etax System issues a Notice of Acceptance of tax declaration dossiers for the first-time tax declaration, the subsequent tax declarations of the same tax period are "supplementary tax declarations”. The taxpayer must submit supplementary tax declarations by the provisions on the supplementary declaration.

Entries [04], [05], [06]: The taxpayer shall write the name, nationality, and head office address of the organization whose transferred capital is a foreign contractor.

Entries [07], [08], [09], [10]: The taxpayer shall write the name, nationality, head office address, and TIN (if any) of the organization/individual receiving the capital transfer.

Entry [11], [12], [13]: The taxpayer writes the tax agent's name, tax agent’s TIN, and tax agent contact information in case the taxpayer declares tax through the tax agent.

Entries [14], [15]: The taxpayer shall record the name and TIN of the enterprise with the transferred capital

Entry [16]: The taxpayer records information on the capital transfer contract

Entry [17]: The taxpayer declares transfer prices according to contracts

The transfer price is determined to be the total actual value obtained by the transferor under the transfer contract.

In case the capital transfer contract provides for payment in the form of installment or deferred payment, the revenue of the transfer contract does not include installment interest or deferred payment interest according to the time limit specified in the contract.

In case the transfer contract does not stipulate the payment price or the tax authority has grounds to determine the payment price is not suitable at the market price, the tax authority has the right to inspect and fix the transfer price. If an enterprise transfers a part of contributed capital in an enterprise but the transfer price for this contributed capital is not suitable according to the market price, the tax authority may reassign the entire value of the enterprise at the time of transfer to redetermine the transfer price corresponding to the percentage of transferred contributed capital.

The basis for fixing the transfer price is based on the investigation documents of the tax authority or based on the capital transfer price of other cases at the same time, the same economic organization, or similar transfer contracts at the time of transfer. In case the valuation of the transfer price by the tax authority is not suitable, it shall be based on the appraisal price of professional valuation organizations competent to determine the transfer price at the time of transfer by regulations.

For enterprises that transfer capital to organizations or individuals, the value of the transferred capital under the transfer contract with a value of twenty million VND or more must have non-cash payment documents. In case the transfer of capital does not have non-cash payment documents, the tax authority has the right to fix the transfer price.

Entry [18]: The taxpayer declares the purchase price of the transferred capital

The purchase price of the transferred capital is determined for each case as follows:

- If the transfer of contributed capital to establish an enterprise is the value of contributed capital based on books, records, and accounting documents at the time of capital transfer and certified by the parties to the capital investment or participation in the business cooperation contract, or the audit results of an independent auditing firm for an enterprise with 100% foreign capital.

- If it is the capital portion due to acquisition, the purchase price is the value of capital at the time of purchase. The purchase price is determined based on the contract for redemption of contributed capital and payment documents.

In case the capital contributed or acquired by the enterprise is partly derived from borrowing capital, the purchase price of the transferred capital includes costs for interest payment of loans for capital investment.

In case an enterprise accounting in foreign currency (approved by the Ministry of Finance) transfers contributed capital in foreign currency, the transfer price and purchase price of the transferred capital shall be determined in foreign currency; In case an accounting enterprise in Vietnamese dong transfers contributed capital in foreign currency, the transfer price must be determined in Vietnamese dong according to the average transaction rate on the interbank foreign currency market announced by the State Bank of Vietnam at the time of transfer.

Entry [19]: The taxpayer declares transfer costs

- Transfer costs are actual costs directly related to the transfer, with legal documents and invoices. In case transfer costs arise abroad, such original documents must be certified by a notary or independent auditing agency of the country where the costs arise and the documents must be translated into Vietnamese (certified by a competent representative).

- Transfer costs include costs for carrying out legal procedures necessary for the transfer; fees payable during transfer procedures; the costs of transactions, negotiations, conclusion of transfer contracts, and other costs with supporting documents.

Entry [20]: The taxpayer declares income from capital transfer activities according to the formula [20]=[17]-[18]-[19]

Entry [21]: The taxpayer declares the CIT rate for income from capital transfer according to the time income arises (from 01/01/2016 until now, the tax rate is 20%)

Entry [22]: The taxpayer declares the amount of CIT payable according to the formula [22]=[20] x [21]

Entry [23]: The taxpayer declares the amount of CIT exemption and reduction under the Agreement if the foreign contractor applies tax exemption and reduction under the Tax Treaty. Foreign contractors must simultaneously carry out procedures for notification of the application of tax exemption and reduction under the Agreement.

Entry [24]: The taxpayer declares the amount of CIT payable after exemption and reduction according to the formula [24]=[22]-[23]

Which entities will the latest CIT declaration form in Vietnam - Form No. 05/CIT used by?

Under Article 14 of Circular 78/2014/TT-BTC as follows:

Organizations and individuals receiving capital transfers are responsible for declaring on behalf of foreign contractors to separately prepare data and tax declaration dossiers and send them to tax authorities directly managing enterprises where foreign contractors invest capital.

In case the organization or individual receiving the capital transfer is also a foreign contractor, the organization established under the law of Vietnam where the foreign contractor invests capital shall separately make a tax declaration dossier and send it to the tax authority directly managing the enterprise receiving the capital from the foreign contractor. The deadline for filing a tax declaration dossier is no later than the 10th day from the date the tax liability arises.

LawNet