Vietnam: What is the latest balance sheet template applicable to micro-enterprises paying CIT calculated according to the method of calculation of CIT based on assessable income?

- What is the latest balance sheet template applicable to micro-enterprises paying CIT calculated according to the method of calculation of CIT based on assessable income in Vietnam?

- What are the instructions for preparing entries in the balance sheets of micro-enterprises in Vietnam?

- What is the duration applicable to micro-enterprises for submitting financial statements to tax authorities in Vietnam?

What is the latest balance sheet template applicable to micro-enterprises paying CIT calculated according to the method of calculation of CIT based on assessable income in Vietnam?

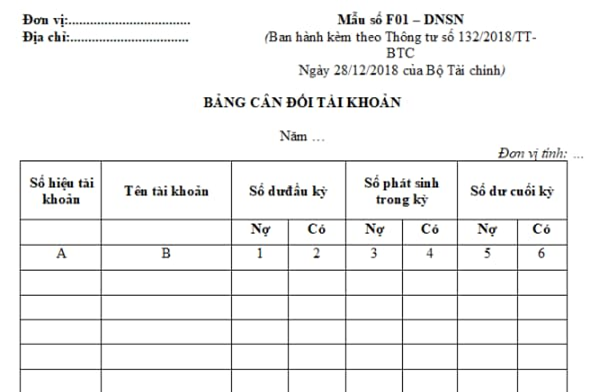

Currently, the latest balance sheet template applicable to micro-enterprises paying CIT calculated according to the method of calculation of CIT based on assessable income in Vietnam is specified in Form No. F01- DNSN issued together with Circular 132/2018/TT-BTC as follows:

Download the latest balance sheet template applicable to micro-enterprises paying CIT calculated according to the method of calculation of CIT based on assessable income in Vietnam: here.

What are the instructions for preparing entries in the balance sheets of micro-enterprises in Vietnam?

According to Form No. F01- DNSN issued together with Circular 132/2018/TT-BTC, the instructions for preparing entries in the balance sheets of micro-enterprises in Vietnam are:

The balance sheet is prepared based on the Ledger and Balance Sheet of accounts for the previous period.

Before preparing the balance sheet, detailed bookkeeping and general accounting books must be completed; data between relevant books must be checked and compared.

Data recorded in the Balance Sheet of accounts is divided into 2 types:

- The type of data reflects the balance of accounts at the beginning of the period (Columns 1 and 2 - Balance at the beginning of the year), at the end of the year (columns 5, 6 - Year-end balance), in which accounts with Debit balances are reflected in the "Debits" column, accounts with Yes balances are reflected in the "Yes" column.

- The type of data reflecting the number incurred by accounts from the beginning of the year to the end of the reporting period (columns 3, 4- Numbers arising during the year) in which the total amount arising "Debits" of the accounts is reflected in the column "Debts", the total amount arising "Yes" is reflected in the column "Yes" of each account.

- Columns A, B: Account numbers, account names of all level 1 accounts that the entity is using and some level 2 accounts that need to be analyzed.

- Columns 1, 2- Balance at the beginning of the year: Reflects the balance of the first day of the month of the first month of the year (Balance at the beginning of the reporting year). The figures for recording in these columns are based on the Monthly Balance line of the first month of the year of each respective account in the Ledger or on the "Year-end Balance" section of the previous year's Balance Sheet.

- Columns 3 and 4: Reflect the total amount of Debt incurred and the total amount incurred Yes of the accounts in the reporting year. The figures recorded in this section are based on the line "Plus arising during the year" of each respective account on the Ledger.

- Columns 5 and 6 "Year-end balance": Reflects the last day balance of the reporting year. The data to be recorded in this section is based on the month-end balance of the last month of the reporting year of each respective account on the Ledger or calculated based on the balance columns at the beginning of the year (columns 1, 2), numbers arising during the year (columns 3, 4) on this year's balance sheet. The figures in columns 5 and 6 are used to prepare the following year's balance sheet.

After recording all the relevant figures of the accounts, the total balance sheet must be made. The figures in the Balance Sheet of accounts must ensure the following mandatory balance:

Total Debt Balance (column 1) = Total Yes balance (column 2); Total Incurred Debt (column 3) = Total incurred Yes (column 4); Total Debit Balance (column 5) = Total Yes balance (column 6).

What is the duration applicable to micro-enterprises for submitting financial statements to tax authorities in Vietnam?

Pursuant to Clause 2, Article 14 of Circular 132/2018/TT-BTC as follows:

Responsibilities and duration of formulation and submission of financial reports

…

2. Financial reports and addenda thereto used by micro-enterprises must be submitted to tax authorities having direct authority over these enterprises and registration bodies not later than 90 days from the end date of a financial year, and must be deposited with these enterprises according to laws on accounting in order to serve inspection and audit activities upon the request of competent regulatory authorities.

Accordingly, micro-enterprises must submit financial statements to the regulatory tax authorities and business registration authorities within 90 days from the end of the financial year.

Note: Micro-enterprises paying CIT calculated according to the method of calculation of CIT based on the CIT-to-sales ratio (%) are not required to submit financial statements to tax authorities under Clause 1 Article 18 of Circular 132/2018/TT-BTC.

LawNet