Vietnam: What is the fee when carrying over 5000 USD in cash and conducting customs declaration at the aerodrome?

What is the fee when carrying over 5000 USD in cash and conducting customs declaration at the aerodrome in Vietnam?

Pursuant to Article 4 of Circular 120/2015/TT-BTC on forms, printing, issuance, management, and use of customs declarations for incoming/outgoing passengers (amended and supplemented in Clauses 1 and 2, Article 1 of Circular 52/2017/TT-BTC) as follows:

Declaration

1. Passengers are requested to declare in the following cases:

a) Having unaccompanied baggage;

b) Having temporarily imported and re-exported goods or vice versa;

c) Having dutiable goods: carrying over 1.5 liters of liquor with concentration of alcohol of above 20 degrees or over 2 liters of liquor with concentration of alcohol of below 20 degrees or over 3 liters of alcoholic drinks, beer; over 200 cigarettes; over 20 cigars; over 250 grams of raw tobacco; and other items with value of over VND 10,000,000;

d) Carrying cash in foreign currencies, cash in Vietnamese currency, precious metal, gemstones, negotiable instruments, gold subject to customs declaration in accordance with Circular No. 35/2013/TT-NHNN dated December 31, 2013 and Circular No. 11/2014/TT-NHNN dated March 28, 2014 of the State bank of Vietnam, in particular:

d.1. Carrying over USD 5,000 or foreign equivalents or over VND 15,000,000;

...

dd) Incoming passengers requiring customs authentication when Carrying foreign currency with value of USD 5,000 or less (or other foreign currencies of equivalent value).

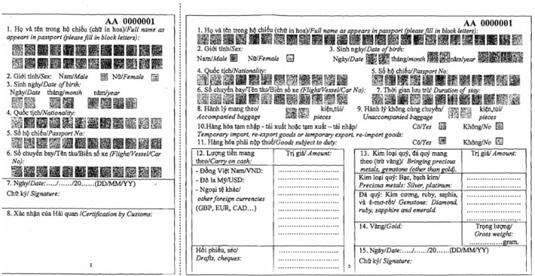

2. Before following customs procedures with customs authority at a checkpoint (for each time of entry or exit), each passenger is required insert adequate information in the pages 2 and 3 according to the guidelines in page 4 of the customs declaration form and Appendix No. 04 issued herewith. The passenger shall take legal responsibility for their declaration. The form must be declared clearly with no erasure, correction; no use of pencil or red-colored pen.

Thus, when carrying over USD 5,000 or foreign equivalents or over VND 15,000,000, it is required to declare on the customs declaration according to the above regulations, and pay VND 20,000/declaration as prescribed in Article 4 of Circular 14/2021/TT-BTC.

What is the customs declaration form for carrying over USD 5,000 in cash in Vietnam?

The customs declaration form is enclosed with the Appendix issued together with Circular 52/2017/TT-BTC as follows:

In Appendix 4 issued together with Circular 120/2015/TT-BTC on guiding the specific declaration for the carried amount as follows:

- In box 12: In case of specific declaration in the "value" box:

+ Carry over VND 15,000,000 in cash;

+ Carry over 5,000 USD;

+ Carry over 5,000 USD in cash (British pound, EURO, Canada ...);

+ In case the entrant carries foreign currency in cash equal to or lower than USD 5,000 but requires confirmation from the Customs office to deposit into the account at the Bank.

+ Carry negotiable instruments (cheques, drafts) with conversion value at the interbank exchange rate of VND 300,000,000 or more.

See full instructions for filling out a Customs Declaration Form here.

What is the fine for improperly declaring foreign currency amount in cash in Vietnam?

According to the provisions of Clauses 1, 2, and 3, Article 10 of Decree 128/2020/ND-CP on the case of improper customs declaration of foreign currency amount in cash as follows:

Offences against regulations on declaration of cash in foreign currencies, cash in Vietnamese currency, negotiable instruments, gold, other precious metals, gemstones taken along when leaving or entering Vietnam

1. Penalties for failure to declare or to correctly declare the amount of cash in foreign currencies allowed to be carried along, cash in Vietnamese currency or gold carried in excess of the legal limit by a person when leaving Vietnam using a passport or passport alternative granted by a Vietnamese competent authority, laissez-passer or bordering resident’s ID card are as follows:

a) A fine ranging from VND 1,000,000 to VND 3,000,000 shall be imposed if the exhibit is worth from VND 5,000,000 to less than VND 30,000,000;

b) A fine ranging from VND 5,000,000 to VND 15,000,000 shall be imposed if the exhibit is worth from VND 30.000.000 to less than VND 70,000,000;

c) A fine ranging from VND 15,000,000 to VND 25,000,000 shall be imposed if the exhibit is worth from VND 70,000,000 to less than VND 100,000,000;

d) A fine ranging from VND 30,000,000 to VND 50,000,000 shall be imposed if the exhibit is worth VND 100,000,000 or more but below the value that is liable to criminal prosecution.

2. Penalties for failure to declare or to correctly declare the amount of cash in foreign currencies allowed to be carried along, cash in Vietnamese currency or gold carried in excess of the legal limit by a person when entering Vietnam using a passport or passport alternative granted by a Vietnamese or foreign competent authority, laissez-passer or bordering resident’s ID card, except for the case in Clause 3 of this Article are as follows:

a) A fine ranging from VND 1,000,000 to VND 2,000,000 shall be imposed if the exhibit is worth from VND 5,000,000 to less than VND 50,000,000;

b) A fine ranging from VND 5,000,000 to VND 10,000,000 shall be imposed if the exhibit is worth from VND 50,000,000 to less than VND 100,000,000;

c) A fine ranging from VND 10,000,000 to VND 20,000,000 shall be imposed if the exhibit is worth VND 100,000,000 or more but below the value that is liable to criminal prosecution.

3. Penalties for overstating the amount of cash in foreign currencies, cash in VND or gold carried are as follows:

a) A fine ranging from VND 2,000,000 to VND 5,000,000 shall be imposed if the value of overstated amount of cash in foreign currencies, cash in VND or gold in excess of the actual amount carried is from VND 5,000,000 to less than VND 20,000,000;

b) A fine ranging from VND 5,000,000 to less than VND 15,000,000 shall be imposed if the value of overstated amount of cash in foreign currencies, cash in VND or gold in excess of the actual amount carried is from VND 20,000,000 to less than VND 100,000,000;

c) A fine ranging from VND 15,000,000 to VND 25,000,000 shall be imposed if the value of overstated amount of cash in foreign currencies, cash in VND or gold in excess of the actual amount carried is VND 100,000,000 or more but below the value that is liable to criminal prosecution.

Thus, persons entering and exiting, when improperly declaring foreign currency amount in cash in Vietnam, can face a maximum penalty of up to VND 50 million.

LawNet