Vietnam: What is the current registration fee rate for houses and land? What is the formula for calculating the registration fee for houses and land in 2023?

What is the current registration fee rate for houses and land in Vietnam?

Pursuant to the provisions of Article 3 of Decree 10/2022/ND-CP, houses and land are subject to registration fees in Vietnam as prescribed.

Pursuant to the provisions in Article 8 of Decree 10/2022/ND-CP as follows:

Registration fee rates (%)

1. Houses, land: 0,5%.

...

Thus, the current registration fee rate for houses and land shall be 0,5%.

What is the formula for calculating the registration fee for houses and land in Vietnam?

Pursuant to the provisions in Article 6 of Decree 10/2022/ND-CP as follows:

Factors determining registration fees

Factors for determining a registration fee include the base price and the registration fee rates (%).

Accordingly, combining the provisions in Article 8 of Decree 10/2022/ND-CP, the formula for calculating the registration fee for houses and land in Vietnam is as follows:

Registration fee for houses and land = 0.5% x base price. |

What is the base price for calculating the registration fee for houses and land in Vietnam?

Under Clause 1 Article 7 of Decree 10/2022/ND-CP as follows:

Base price

1. Base price for houses and land:

a) The base price for land is the price on the Land Price List promulgated by the People's Committee of the province or centrally affiliated city in accordance with regulations of the law on land in effect upon the declaration of registration fees.

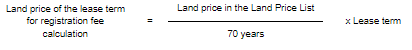

If land is leased out by the state and a lump sum land rent is payable for the entire lease term but the lease term is shorter than the term of the type of land prescribed in the Land Price List promulgated by the People's Committee of the province or centrally affiliated city, the land price of the lease term for registration fee calculation is determined as follows:

b) The base price for houses is the price imposed by the People's Committee of the province or centrally affiliated city in accordance with regulations of the law on construction in effect upon the declaration of registration fees.

c) Base price for houses and land in special cases:

- The base price for a state-owned house sold to its current lessee in accordance with regulations of law on sale of state-owned houses, including the land thereunder, is the actual selling price pursuant to a decision of the People's Committee of the province or centrally affiliated city.

- The base price for a house or land purchased at an auction or bidding in accordance with regulations of laws on auctions and bidding is the actual hammer price or winning bid specified in the sales invoice or receipt in accordance with the law or the hammer price or winning bid according to the auction or bidding winning document, or the document approving the result of the auction, bidding (if any) of competent state agencies.

- The base price for a tenement or an apartment building includes its allocated land value. The allocated land value is determined by the land price in the Land Price List issued by the People’s Committee of the province or centrally affiliated city multiplied by the allocation coefficient. The allocation coefficient is determined in accordance with regulations of Decree No. 53/2011/ND-CP dated July 1, 2011 of the Government on detailing and providing guidelines for the implementation of a number of articles of the Law on Non-agriculture Land Use Tax and amendment or replacement documents (if any).

d) If the price of a house or land in the contract for transfer of the land use right or for purchase and sale of the house is higher than the price imposed by the People's Committee of the province or centrally affiliated city, the base price is the price specified in such contract.

Thus, the base price for and houses land is the price on the Land Price List promulgated by the People's Committee of the province or centrally affiliated city in accordance with regulations of the law on land in effect upon the declaration of registration fees.

If the price of a house or land in the contract for transfer of the land use right or for purchase and sale of the house is higher than the price imposed by the People's Committee of the province or centrally affiliated city, the base price is the price specified in such contract.

Special cases:

- If land is leased out by the state and a lump sum land rent is payable for the entire lease term but the lease term is shorter than the term of the type of land prescribed in the Land Price List promulgated by the People's Committee of the province or centrally affiliated city, the land price of the lease term for registration fee calculation is determined as follows:

- The base price for a state-owned house sold to its current lessee in accordance with regulations of law on sale of state-owned houses, including the land thereunder, is the actual selling price pursuant to a decision of the People's Committee of the province or centrally affiliated city.

- The base price for a house or land purchased at an auction or bidding in accordance with regulations of laws on auctions and bidding is the actual hammer price or winning bid specified in the sales invoice or receipt in accordance with the law or the hammer price or winning bid according to the auction or bidding winning document, or the document approving the result of the auction, bidding (if any) of competent state agencies.

- The base price for a tenement or an apartment building includes its allocated land value. The allocated land value is determined by the land price in the Land Price List issued by the People’s Committee of the province or centrally affiliated city multiplied by the allocation coefficient.

The allocation coefficient is determined in accordance with regulations of Decree No. 53/2011/ND-CP and amendment or replacement documents (if any).

LawNet

.png)