Vietnam: What is the current declaration form for severance tax finalization? What are the regulations on the declaration and finalization of severance tax on mineral extraction?

- What is the current declaration form for severance tax finalization in Vietnam?

- What are the regulations on the registration, declaration, payment, and finalization of severance tax in Vietnam?

- What are the regulations on the declaration and finalization of severance tax on mineral extraction in Vietnam?

- What are the cases of severance tax exemption in Vietnam?

What is the current declaration form for severance tax finalization in Vietnam?

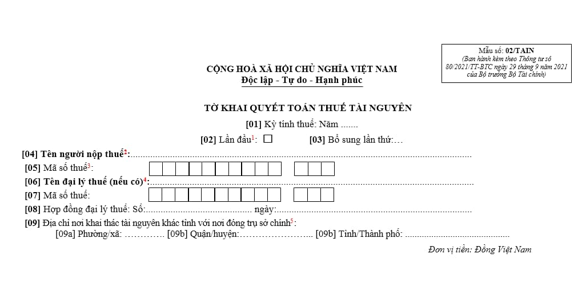

The current declaration form for severance tax finalization in Vietnam is Form 02/TAIN specified in Appendix II issued together with Circular 80/2021/TT-BTC as follows:

Download the declaration form for severance tax finalization in Vietnam: here.

What are the regulations on the registration, declaration, payment, and finalization of severance tax in Vietnam?

Pursuant to Article 8 of Circular 152/2015/TT-BTC stipulating the registration, declaration, payment, and finalization of severance tax in Vietnam as follows:

- Registration, declaration, payment, and finalization of severance tax shall comply with the Law on Tax administration, its instructional documents and amendments (if any).

- Apart from declaration, payment, and finalization of severance tax on mineral extraction must also comply with Article 9 of Circular 152/2015/TT-BTC.

What are the regulations on the declaration and finalization of severance tax on mineral extraction in Vietnam?

Pursuant to Article 9 of Circular 152/2015/TT-BTC on the declaration and finalization of severance tax on mineral extraction in Vietnam as follows:

- Organizations and business households extracting natural resources shall send a notification to tax authorities of their methods of determining taxable prices of each type of resource extracted together with the declaration of severance tax of the first month in which natural resources are extracted. If the method is changed, the supervisory tax authority must be notified within the month in which the change is made.

- Taxpayers shall make monthly declaration of tax on the entire extraction quantity in the month (regardless of quantity in stock and undergoing processing).

- When making the annual/terminal declaration, the taxpayer must enclose a list of specific extraction quantities in the year at each mine with the declaration. Severance tax depends on the tax rate, extraction quantity, and taxable price. To be specific:

+ Taxable extraction quantity is the total quantity of natural resources extracted in the year, regardless of quantity in stock and undergoing processing.

If the sale quantity includes both natural resource-derived products and industrial products, the quantity of resources in natural resource-derived products and industrial products must be converted into extraction quantity according to the norms for use of natural resources determined by taxpayers themselves.

+ Taxable price is the average selling price of a unit of natural resource-derived products, which equals (=) total revenue from the sale of resources divided by (:) quantity of resources sold in the year.

What are the cases of severance tax exemption in Vietnam?

Pursuant to Article 10 of Circular 152/2015/TT-BTC on severance tax exemption in Vietnam as follows:

- Entities extracting natural marine organisms.

- Entities extracting branches, firewood, bamboo, rattan, etc. serving everyday life.

- Entities extracting natural water for hydroelectricity generation serving the everyday life of households and individuals.

- Natural water extracted by households and individuals serving their everyday life.

- Land areas given/leased out to organizations and individuals and used on the spot; earth used for leveling, construction of security, military works, dykes.

Earth extracted and used on the spot eligible for tax exemption include sand, rock, and gravel in the earth without specific substances and is used as is for leveling or construction. If the earth is transported elsewhere for use or for sale, severance tax must be paid as prescribed.

- The Ministry of Finance shall cooperate with relevant Ministries and agencies in proposing other cases of exemption from severance tax to the government, which will be considered and decided by the Standing Committee of the National Assembly.

LawNet