Vietnam: What are the specific steps for the online PIT self-finalization in 2024? Who must directly finalize PIT with tax authorities?

What are the specific steps for the online PIT self-finalization in Vietnam?

Readers can refer to the following specific steps for the online PIT self-finalization in Vietnam in 2024:

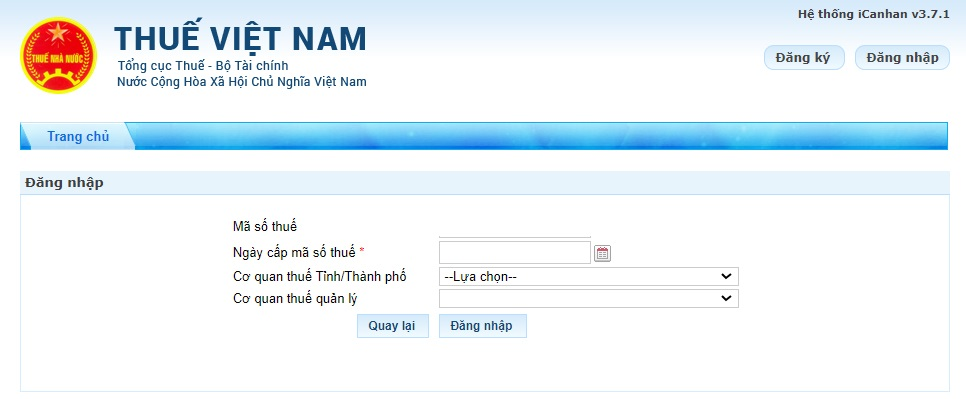

Step 1: Log in

Access the electronic tax system of the General Department of Taxation in Vietnam at https://canhan.gdt.gov.vn/ address and log in

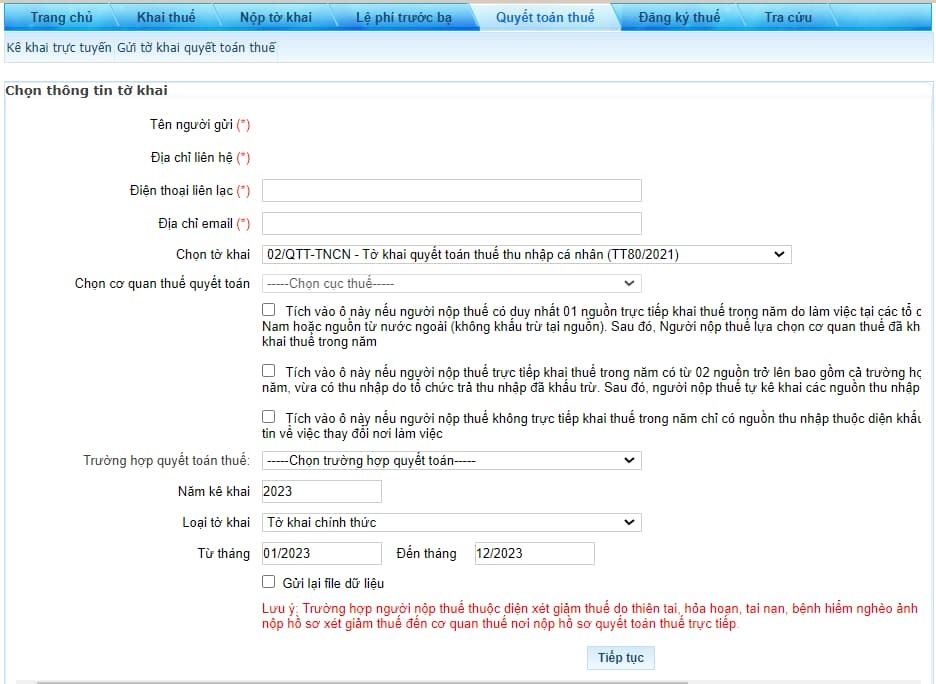

Step 2: After successful login, the taxpayer chooses [Tax finalization] ->[online declaration]

Step 3: Choose the declaration information, fill in the required information, and choose Declaration - Form No. 02/QTT-PIT.

Choose Tax Finalization Authority: enter the corresponding boxes, and tick one of 03 cases:

(1) Tick the 1st box if the taxpayer directly declares only 01 direct source of income subject to tax during the year due to working at international organizations, embassies, consulates in Vietnam, or foreign sources of income (not deducted at source). After that, the taxpayer chooses the tax authority where they directly declare tax during the year at the "Tax Department".

Then, choose the Tax Department to manage the income payer

Type of declaration: formal/supplementary declaration.

(2) Tick the 2nd box if the taxpayer directly declares tax in the year with 02 or more sources of income, including the case of both incomes subject to direct declaration during the year and income deducted by the income payer. After that, the taxpayer self-declares the sources of income and related information according to the table.

(3) Tick the 3rd box if the taxpayer who does not directly declare tax during the year has only the source of income subject to deduction through the income payer; declare information about the change of workplace.

(3.1) The taxpayer checks this box if there is a change in workplace; then, fill in box 1 or box 2.

Box 1: At the time of finalization, the taxpayer charges personal deductions for her/himself at the income payer. If the taxpayer ticks this box, he/she continues to enter the TIN information of the income payer charging personal deduction for him/her.

Enter the TIN of the income payer where the personal deduction is registered.

Box 2: At the time of finalization, the taxpayer does not work for the income payer or does not charge personal deduction for him/her at any income payer: If the taxpayer checks this box, the taxpayer continues to choose the supervisory tax authority at his/her place of residence (temporary or permanent residence).

(3.2) The taxpayer checks this box if he/she does not change the workplace; and then, fills in box 3, box 4, or box 5.

Box 3: At the time of finalization, the taxpayer still works at the income payer: If the taxpayer checks this box, the taxpayer continues to enter the TIN information of the income payer so that the support system automatically determines the finalizing tax authority.

Box 4: At the time of finalization, the taxpayer has quit and does not work at any income payer: if the taxpayer checks this box, the taxpayer continues to choose the supervisory tax authority at his/her place of residence (temporary or permanent residence).

Box 5: At the time of finalization, the taxpayer has not charge the personal deduction for him/her at any income payer (the income payer deducts 10% tax at the source of income): if the taxpayer checks this box, the taxpayer continues to choose the supervisory tax authority at his/her place of residence (temporary or permanent residence)

Then choose Continue => Enter declaration data entries

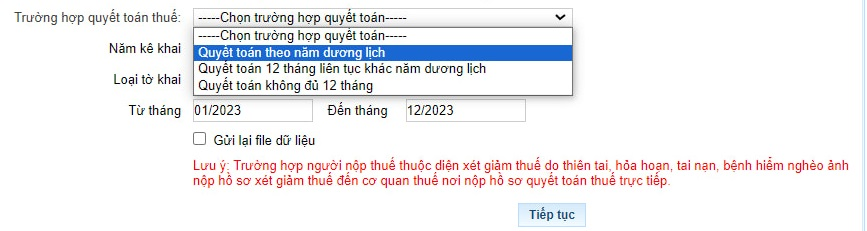

Step 4: Choose a tax finalization case.

Choose the tax declaration for 2023 (from January 2023 to December 2023, respectively).

Note: In case a taxpayer is considered for tax reduction eligible for tax reduction due to a natural disaster, fire, accident or serious illness affecting the ability to pay tax, the taxpayer shall apply tax reduction to the tax authority where the tax finalization dossier is submitted directly.

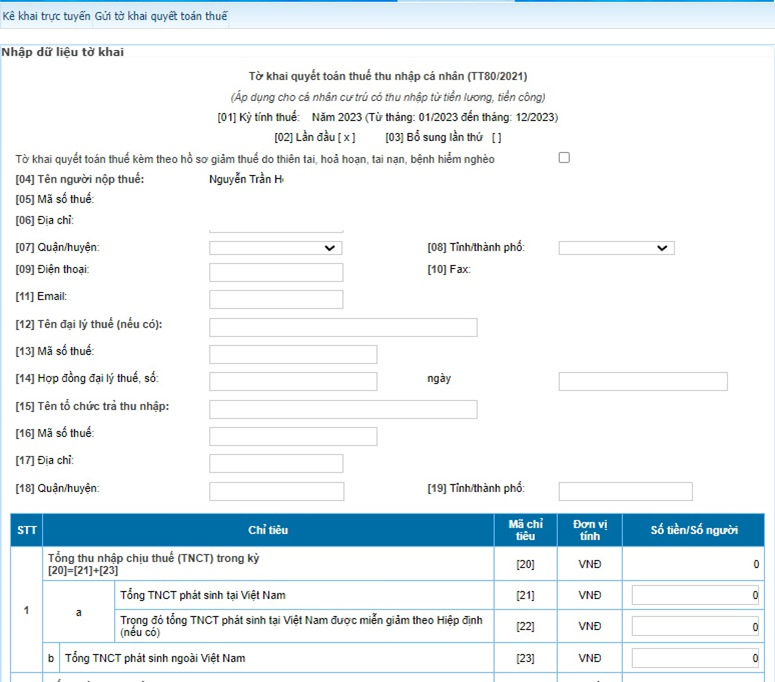

Step 5: Enter declaration data

Step 6: Choose "Complete declaration

Step 7: Apply

In case an individual has an e-tax account:

→ Click Save draft + Complete declaration → Choose XML dump → Send declaration → Choose the attached appendix → Choose the deduction document (Choose File) → Choose continue → enter the OTP authentication code (sent to your phone)→ Successfully submit the Declaration.

In case an individual does not have an e-tax account:

- Click Save draft + Complete declaration

- Choose XML dump

The taxpayer chooses XML dump before submitting declaration => Save file.

Choose [Submit declaration] => enter the test code to verify the declaration submission and choose [Continue], after choosing [XML Dump], the system will send the declaration file in XML format to the taxpayer; use a computer with Itax viewer installed to open the declaration file in XML format>> Print >> Sign the tax preparer.

The above contents are the specific steps for the online PIT self-finalization in Vietnam.

Who must directly finalize PIT with tax authorities in Vietnam?

In subsection 1, Section 1 of Official Dispatch 2783/CTTPHCM-TTHT in 2024, individuals must directly finalize PIT with tax authorities in Vietnam as follows:

- Resident individuals earning income from salaries and remunerations from more than one source without meeting the conditions for authorization for finalizing PIT as prescribed must directly finalize PIT with tax authorities if tax is underpaid or overpaid; tax is overpaid, individual claims a refund or has it carried forward to the next period

- The individual has been present in Vietnam for fewer than 183 days in the first calendar year but more than 183 days in 12 consecutive months from the arrival date.

- Foreigners finalizing PIT before leaving Vietnam when their employment contracts in Vietnam have ended. In case an individual has not yet carried out tax finalization procedures with the tax authority, he/she shall authorize the income payer or other organization or individual to finalize tax according to the provisions on tax finalization for the individual.The income payer or other organization or individual who receives the authorization for finalization shall be responsible for the underpaid amount or overpaid amount of PIT to be refunded of the individual.

- Resident individuals whose income from salaries and remunerations are paid from abroad and resident individuals with income from salaries and remunerations paid by international organizations, embassies, and consulates that have not yet deducted tax during the year must directly finalize PIT with tax authorities if tax is underpaid or overpaid; tax is overpaid; individual claims a refund or has it carried forward to the next period

- Resident individuals earning income from salaries and remunerations and eligible for tax reduction due to a natural disaster, fire, accident or serious illness shall finalize tax themselves instead of authorizing income payers to perform this task as prescribed.

What does the PIT finalization dossier submitted by an individual directly finalizing PIT with the tax authority in Vietnam include?

In subsection 1, Section 4 of Official Dispatch 2783/CTTPHCM-TTHT in 2024, the PIT finalization dossier submitted by an individual directly finalizing PIT with the tax authority in Vietnam includes:

- Personal income tax finalization declaration made in Form No. 02/QTT-TNCN issued together with Appendix II of Circular 80/2021/TT-BTC

- Appendix showing the statement on personal deduction for dependents made in Form No. 02-1/BK-QTT-TNCN issued together with Appendix II of Circular 80/2021/TT-BTC

- Copies (photocopies) of documents proving the PIT amount deducted, provisionally paid in the year, or paid overseas (if any)

The tax authority shall consider processing the taxpayer’s PIT finalization dossier based on the database of tax authorities without requesting the taxpayer to submit a PIT deduction document if the income payer does not issue the PIT deduction document to the taxpayer because of the shutdown.

In case of an electronic PIT deduction document, the taxpayer shall submit the printed physical copy of the original electronic PIT deduction document provided by the income payer.

- A copy of the PIT deduction certificate (specifying the PIT declaration number) issued by the income payer or the copy of a bank’s notice of overseas PIT payment which must bear the taxpayer's certification in case a foreign tax authority is not required to issue a certificate of PIT payment in accordance with the domestic law of that foreign country.

- Copies of invoices proving the contributions to charity, humanitarian, or scholarship funds (if any).

- Documents proving amounts paid by overseas income payer, if the taxpayer earns income from an international organization, Embassy, Consulate and other income from abroad.

- Application for registration of dependents according to the instructions in point a, clause 3, Section III of Official Dispatch 2783/CTTPHCM-TTHT 2024 (if the taxpayer claims dependency exemptions for unregistered dependents when following PIT finalization procedures).

LawNet