Vietnam: What are the latest instructions for filling out the PIT declaration form submitted by individuals with income from capital investment who directly declare to tax authorities?

- What are the instructions for filling out the PIT declaration form submitted by individuals with income from capital investment who directly declare to tax authorities in Vietnam?

- What does the PIT declaration dossier submitted by individuals with income from capital investment who directly declare to tax authorities in Vietnam include?

- Where will individuals with income from capital investment who directly declare to tax authorities in Vietnam submit their PIT declaration dossiers?

What are the instructions for filling out the PIT declaration form submitted by individuals with income from capital investment who directly declare to tax authorities in Vietnam?

According to the instructions of tax authorities on the website of the Hanoi Tax Department on filling out PIT declaration form submitted by individuals with income from capital investment who directly declare to tax authorities as follows:

* General information section:

[01] Tax period:

[01a] In case of tax declaration according to each occurrence, the date, month, and year the tax declaration is made.

[01b] In case of tax declaration by month/quarter - year, record the month/quarter - year the tax declaration is made.

[02] First time: in case of first-time tax declaration, mark the "x" in the box.

[03] Additional declaration: in case of second-time declaration, write the number of additional declarations in the blank. The number of additional declarations is indicated in digits in the sequence of natural digits (1, 2, 3, ...).

[04] Name of the taxpayer: In case an individual self-declares tax/Organization declares on behalf of an individual: Clearly and fully state the full name according to tax registration or ID card/citizen ID card/Passport of the individual earning income from capital investment by receiving dividends in securities, securities as bonus existing shareholders, reinvested profits.

[05] Tax code: Clearly and fully state the tax code of individuals with income from capital investment due to receiving dividends in securities, bonus securities for existing shareholders, income recorded for capital gains according to the Tax Registration Certificate or Tax Code Notice or Tax Code Card issued by tax authorities.

[06] Address: Clearly and fully state the address of the house and commune of the place of residence of the individual whose income from capital investment is due to receiving dividends in securities, securities as bonus existing shareholders, reinvested profits

[07] District: List the district of the province/city where the individual resides with income from capital investment due to receiving dividends in securities, securities as bonus existing shareholders, and reinvested profits.

[08] Province/city: Record the province/city where the individual resides with income from capital investment as a result of receiving dividends in securities, securities as bonus existing shareholders, reinvested profits

[09] Telephone: Clearly and fully record the phone of an individual whose income from capital investment is due to receiving dividends in securities, securities as bonus existing shareholders, and reinvested profits.

[10] Fax: Clearly and fully write the fax number of the individual whose income from capital investment by receiving dividends in securities, securities as bonus existing shareholders, and reinvested profits.

[11] Email: Clearly and fully state the email address of the individual whose income from capital investment due to receiving dividends in securities, securities as bonus existing shareholders, reinvested profits

Note: In case of checking the box of the authorized organization many individuals, the target [04] to [11] is not written.

[12] Name of the authorized organization or individual (if any): Clearly and fully state the name of the authorized organization (according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate) in case the organization declares tax on behalf of or pays tax on behalf of an individual with income from capital investment due to receiving dividends in securities, Securities reward existing shareholders, income on capital gains. Or write the full name of the individual who declares tax on behalf of, pays tax instead according to tax registration or ID card/citizen ID card/Passport.

[13] Tax code: Clearly and fully state the tax code of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[14] Address: Clearly and fully state the address of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[15] District: Clearly and fully state the name of the district/district of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[16] Province/city: Clearly and fully state the name of the province/city of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[17] Telephone: Clearly and fully record the phone of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[18] Fax: Clearly and fully write the fax number of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[19] Email: Clearly and fully state the email address of the organization/individual declaring tax on behalf of or paying tax instead (if there is a target declaration [12]).

[20] Name of tax agent (if any): In case an individual or organization declares on behalf of/an individual with income from capital investment due to receiving dividends in securities, bonus securities for existing shareholders, income from recording capital increase authorized to authorize tax declaration to a tax agent, it must clearly state, full name of the Tax Agent according to the Establishment Decision or Business Registration Certificate of the Tax Agent.

[21] TIN: Clearly and fully state the agent's TIN (if there is a quota declaration [20]).

[22] Tax agency contract: Clearly and fully write the number and date of the tax agency contract between the individual and the tax agent (ongoing contract) (if there is a quota declaration [20]).

* Declaration of criteria:

[23] No.: small to large numbering

[24] Issuer: Clearly and fully state the name and tax identification number of the securities issuer, the enterprise with contributed capital (according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate).

[25] Stock code: Clearly and fully state the code of securities paid in lieu of dividends, the code of securities to reward existing shareholders.

[26] The number of securities: Records the number of securities paid in lieu of dividends and bonus securities to existing shareholders.

[27] The par value of securities: is the par value of securities paid in lieu of dividends, securities rewarded to existing shareholders specified in the enterprise.

[28] The total value of dividends (or income) is distributed at face value:

- For securities paid in lieu of dividends, securities rewarding existing shareholders: target [28] = [27] x [26]

- For recorded income on capital gain: is the value of income recorded for capital gain at the decision of the enterprise.

[29] Total value at book price (or market price):

- For securities paid in lieu of dividends, securities rewarding existing shareholders:

+ If the transfer price of securities paid instead of dividends or bonus securities to existing shareholders is higher than or equal to par value, the target [29] is the total value of shares according to accounting books. If an individual chooses to pay tax from capital investment at face value, he or she is not required to declare the target [29].

+ If the transfer price of securities paid instead of dividends or bonus securities to existing shareholders is lower than par value, the criterion [29] is the market price. If an individual chooses to pay tax from capital investment at face value, he or she is not required to declare the target [29].

- For reinvested profits: is the value of capital gain recorded income at the accounting book price corresponding to the ratio of capital gain recorded profit / total value of transferred capital at the time of transfer. If an individual chooses to pay tax from capital investment according to the value of income recorded on the capital gain on the decision of the enterprise, he is not required to declare the target [29].

[30] Payable taxes:

- For securities paid in lieu of dividends, securities rewarding existing shareholders:

+ In case an individual chooses to pay tax based on face value, the amount of tax payable = [28] x 5%.

+ In case an individual chooses to pay tax based on the price stated on the accounting books (or market price), the amount of tax payable = [29] x 5%.

- For capital gains written income:

+ In case an individual chooses to pay tax based on the value of dividends recorded for capital gains according to the capital increase recording decision of the enterprise, the amount of tax payable = [28] x 5%.

+ In case an individual chooses to pay tax based on the value of contributed capital according to accounting books, the amount of tax payable = [29] x 5%.

(I) Securities paid in lieu of dividends

[31], [32], [33]: write the corresponding total value of the target column [28], [29], [30] from capital investment income due to receipt of securities paid instead of dividends.

In case the organization declares on behalf of many individuals, the target [31] is equal to the target [19] form No. 04-1/DTV-TNCN, the target [32] is equal to the indicator [20] form No. 04-1/DTV-TNCN, the target [33] is equal to the indicator [21] form No. 04-1/DTV-TNCN

(II) Securities as bonus for existing shareholders

[34], [35], [36]: write the corresponding total value of targets [28], [29], [30] from capital investment income rewarded by securities to existing shareholders.

In case the organization declares on behalf of many individuals, the target [34] is equal to the indicator [24] form No. 04-1/DTV-TNCN, the target [35] is equal to the indicator [25] form No. 04-1/DTV-TNCN, the target [36] is equal to the indicator [26] form No. 04-1/DTV-TNCN

(III) Reinvested profits

[37], [38], [39]: write the corresponding total value of the target [28], [29], [30] from capital investment income due to the receipt of capital gain written income.

In case the organization declares on behalf of many individuals, the target [37] is equal to the target [28] form No. 04-1/DTV-TNCN, the target [38] is equal to the indicator [29] form No. 04-1/DTV-TNCN, the target [39] is equal to the indicator [30] form No. 04-1/DTV-TNCN

[40]: write the corresponding sum of the indicator column [28]: [40]=[31]+[34]+[37]

[41]: write the corresponding sum of the indicator column [29]: [41]=[32]+[35]+[38]

[42]: write the corresponding sum of the indicator column [30]: [42]=[33]+[36]+[39]

What does the PIT declaration dossier submitted by individuals with income from capital investment who directly declare to tax authorities in Vietnam include?

Pursuant to Subsection a, Section 9.6 promulgated together with Decree 126/2020/ND-CP, the PIT declaration dossier submitted by individuals with income from capital investment who directly declare to tax authorities in Vietnam includes:

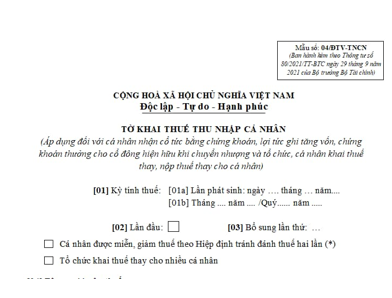

PIT declaration form (applicable to individuals receiving dividends in securities, capital gains, bonus securities for existing shareholders upon transfer and organizations and individuals declaring and paying tax on behalf of individuals) is form No. 04/DTV-TNCN specified in Appendix II of Circular 80/2021/TT-BTC:

Download Form No. 04/DTV-TNCN Here

Where will individuals with income from capital investment who directly declare to tax authorities in Vietnam submit their PIT declaration dossiers?

Pursuant to Point dd, Clause 6, Article 11 of Decree 126/2020/ND-CP, individuals that have income from capital investment and declare tax directly with tax authorities shall submit tax declaration dossiers to the supervisory tax authorities of the issuers.

LawNet