Vietnam: What are the latest forms of goods-received notes and goods dispatch notes applicable to micro-enterprises?

- What is the latest form of goods-received notes applicable to micro-enterprises in Vietnam?

- What is the latest form of goods dispatch notes applicable to micro-enterprises in Vietnam?

- What are the requirements for micro-enterprises in making their own design forms, charts, and templates of accounting documents in Vietnam?

What is the latest form of goods-received notes applicable to micro-enterprises in Vietnam?

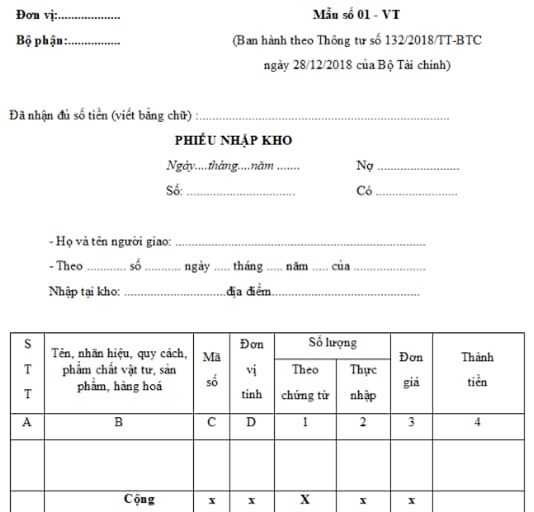

The latest form of goods-received notes applicable to micro-enterprises in Vietnam is specified in Form No. 01-VT issued together with Circular 132/2018/TT-BTC as follows:

Download the latest form of goods-received notes applicable to micro-enterprises in Vietnam: here

The latest instructions for making goods-received notes applicable to micro-enterprises in Vietnam are:

- The upper left corner of the goods-received note must clearly state the name of the goods-received department or unit (or stamp the unit). Goods-received notes apply in cases of receiving raw materials, tools, products, goods purchased outsourced, self-produced, outsourced for processing, receiving a capital contribution, or excess discovered in inventory.

- When making a goods-received note, it must clearly state the number of the entry note, the date, month, and year of making the note, the full name of the person delivering materials, tools, products, or goods, the invoice number or goods-received order, the name of the warehouse, and the location of the warehouse.

- Columns A, B, C, and D: Record order numbers, names, trademarks, specifications, qualities, codes, and units of calculation of raw materials, tools, products, and goods.

- Column 1: Write the quantity according to the document (invoice or import order).

- Column 2: The storekeeper records the actual quantity entered into the warehouse.

- Columns 3 and 4: The accountant records the unit price and calculates the amount of each imported material, tool, product or commodity.

- Plus line: Record the total amount of materials, tools, products, goods imported with a goods-received note.

- The line "Total amount written in words": Write the total amount on the goods-received note in words.

What is the latest form of goods dispatch notes applicable to micro-enterprises in Vietnam?

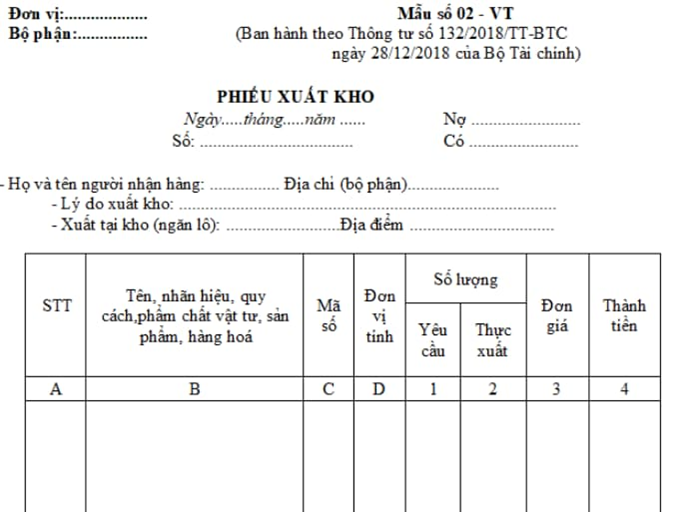

The latest form of goods dispatch notes applicable to micro-enterprises in Vietnam is specified in Form No. 02-VT issued together with Circular 132/2018/TT-BTC:

Download the latest form of goods dispatch notes applicable to micro-enterprises in Vietnam: here

The latest instructions for making goods dispatch notes applicable to micro-enterprises in Vietnam are:

- The left corner of the goods dispatch note must clearly state the name of the goods dispatch department or unit (or stamp the unit). A goods dispatch note for one or more materials, tools, products or goods of the same warehouse for an object of cost accounting or the same purpose.

- When making a goods dispatch note, it must specify the full name of the consignee, name, unit (department), number and date, month and year of making the note, reasons for discharge, and name of warehouse for export of raw materials, tools, products, and goods.

- Columns A, B, C, and D: Record the order number, name, trademark, specification, quality, code, and unit of calculation of raw materials, tools, products, and goods.

- Column 1: Record the quantity of raw materials, tools, products, and goods according to the goods dispatch requirements of the user (using the department).

- Column 2: The storekeeper records the actual quantity dispatched (the actual quantity dispatched can only be equal to or less than the required quantity).

- Columns 3 and 4: The accountant writes the unit price and calculates the cost of each type of raw materials, tools, products, and goods dispatched from the warehouse (column 4 = column 2 x column 3).

- Plus line: Record the total amount of materials, tools, products, and goods actually shipped out.

- The line "Total amount written in words": Write the total amount on the goods dispatch note in words.

- Storekeepers may only dispatch materials, tools, products, and goods after the goods dispatch note is fully signed by the preparer, approver, and related persons as prescribed on the accounting document form.

What are the requirements for micro-enterprises in making their own design forms, charts, and templates of accounting documents in Vietnam?

Pursuant to Article 4 of Circular 132/2018/TT-BTC as follows:

Accounting documents

1. Contents of accounting documents, formulation and signing of accounting documents of micro-enterprises shall be subject to provisions laid down in Article 16, Article 17, Article 18 and Article 19 of the Law on Accounting and specific instructions given herein.

2. Contents and forms of invoices, procedures for formulation, management and use of invoices (including electronic invoices) shall be subject to laws on taxes.

3. Micro-enterprises may design forms, charts and templates of accounting documents appropriate of their own accord for their business activities provided that they ensure clarity, transparency, and are easily checked or controlled (except for sales invoices). In case where micro-enterprises do not autonomously design these forms, charts or templates for their own use, they may use those and methods of design of accounting documents according to the instructions given in the Appendix 1 hereto.

Accordingly, micro-enterprises may design forms, charts, and templates of accounting documents appropriate of their own accord for their business activities provided that they ensure clarity, and transparency, and are easily checked or controlled (except for sales invoices).

LawNet