Vietnam: What are the instructions for filling out the slip form for deposit made to the state budget? Where to download the deposit slip form - Form C1-02/NS?

- What is the slip form for deposit made to the state budget (deposit slip) in Vietnam? Where to download the deposit slip form - Form C1-02/NS?

- What are the instructions for preparing a deposit slip - Form C1-02/NS in Vietnam?

- What are the instructions for declaring information on Form C1-02/NS on the Web Portal of the General Department of Taxation in Vietnam?

What is the slip form for deposit made to the state budget (deposit slip) in Vietnam? Where to download the deposit slip form - Form C1-02/NS?

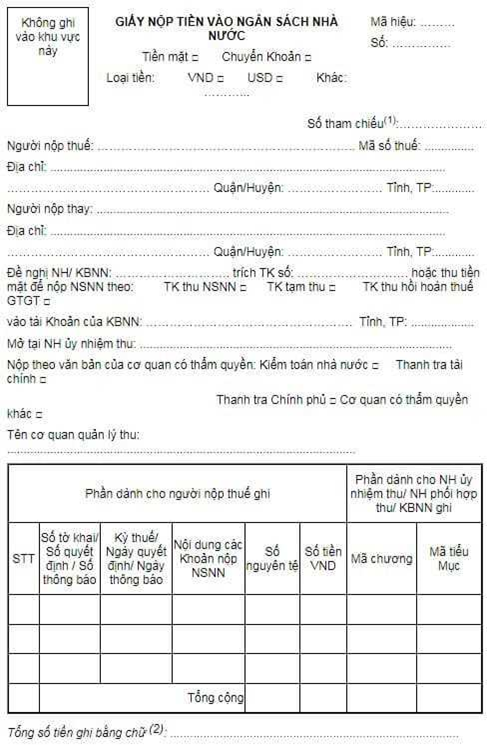

Currently, the deposit slip form in Vietnam is made according to form No. C1-02/NS issued with Circular 84/2016/TT-BTC as follows:

Download the deposit slip form - Form C1-02/NS: here

What are the instructions for preparing a deposit slip - Form C1-02/NS in Vietnam?

Payers can refer to the instructions for preparing a deposit slip - Form C1-02/NS as follows:

[1] The payer chooses the method of deposit: Cash, bank transfer, currency.

If the taxpayer chooses to pay taxes in cash, enter an X in that box.

[2] The taxpayer enters the X in the box "VND" on the payment document in case the taxpayer is obliged to pay money to the state budget in Vietnamese dong.

- The taxpayer fills in the X sign in the "USD" box or writes information of another foreign currency on the payment document in case the taxpayer is obliged to pay money to the state budget in US dollars or other foreign currencies as prescribed by law.

[3] In the information section:

Taxpayers: Write company name, company tax identification number, company address

Substitute payer: Full name, tax identification number, address (if any)

[4] Taxpayers fill in bank and account information according to the registered list for electronic tax payment.

[5] The taxpayer checks the box "State revenue account" or "VAT refund withdrawal account" as follows:

- Check the box "State revenue account" in case of payment of taxes, late payments, penalties or other payments to the state budget.

- Check the box "VAT refund withdrawal account" in case of returning to the state budget the amount of value-added tax that has been refunded according to the decision of the competent authority or the taxpayer himself detects that the refund has been wrongly compared to the regulations; excluding payment and return of the refunded value-added tax amount in case of mistaken payment or overpayment.

[6] The taxpayer chooses the name of the state treasury agency that receives the revenue on the list of state treasury agencies.

[7] Select the name of the collection mandate bank corresponding to the state treasury agency selected on the list provided by the system.

[8] - Taxpayers fill in the information submitted according to the documents of the competent authority (if any): Check one of the boxes corresponding to the issuing agency as "State Audit", "Government Inspectorate", "Financial Inspectorate", "Other competent authority".

- In case of tax payment under the decision of tax authorities at all levels, check the box "Other competent authority".

[9] The system will automatically display the name of the tax authority directly managing the taxpayer. In case the revenue is managed by another tax authority, the taxpayer shall re-select the name of the collection management agency in the list of tax authorities.

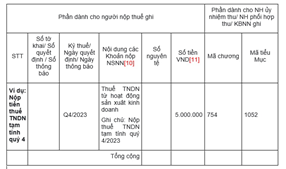

[10] The payable queries on the electronic tax filing system and selects one or several payments from the list of payments displayed on the system. Taxpayers can correct the amount information of each payment.

In case a payment is not included in the list of payables displayed on the system, the payer enters the list of "State budget payments" to select an appropriate payment and declare information about the amount of state budget payment.

In case of payment of taxes, land use levies, registration fees and other payments related to property registration, the payer shall declare additional information in the contents box of the state budget payment such as: address of the house or land plot; type of vehicle, brand, type number, paint color, frame number, engine number of aircraft, boat, automobile, motorcycle.

In case of payment according to documents of competent authorities, the payers shall declare additional information on the name of the competent authority issuing the document.

[11] The taxpayer writes according to the amount actually paid.

[12] In case of payment in VND, it shall be written according to the total amount of VND; In case of deposit in foreign currency, it shall be written in letters according to the total amount of whole currency and type of foreign currency.

[13] The applicant shall electronically sign at least 1 of the 3 positions of the payer/ chief accountant/ head of the unit and send the payment paper to the state budget on the electronic tax payment system.

What are the instructions for declaring information on Form C1-02/NS on the Web Portal of the General Department of Taxation in Vietnam?

Pursuant to Article 6 of Circular 84/2016/TT-BTC, there are instructions for declaring information on deposit slips (form C1-02/NS) as follows:

Making tax payment receipts on web portal of General Department of Taxation

The taxpayer shall log in the e-Tax payment system on the web portal of General Department of Taxation using the e-Tax account issued by the tax authority (in accordance with Circular No. 110/2015/TT-BTC dated July 28, 2015 of the Ministry of Finance on guidelines for electronic transactions in tax field) to make a tax payment receipt.

The taxpayer shall choose one of two methods of payment: “Making payment slip” or “Making authorized payment slip” and completely fill in deposit slip (using Form No. C1-02/NS issued herewith) as follows:

1. Payment currency:

- Check “VND” box if the taxpayer must pay a sum of tax or domestic revenue in VND.

- Check “USD” or another kind of currency if the taxpayer must pay a sum of tax or domestic revenue in US Dollar or other foreign currency as prescribed in law and regulations.

2. Taxpayers and authorized persons:

- If choose “Making payment slip”, the system will automatically display the taxpayer’s information including: name, TIN, and address of the taxpayer according to his/her log in account.

- If choose “Making authorized payment slip”, the system will automatically display the authorized person’s information including: name, TIN, and address of the authorized person according to his/her log in account. The authorized person must declare the taxpayer’s information including: name, TIN, and address of the taxpayer.

3. Bank/State Treasury and e-Tax account: Choose the bank and e-Tax account according to the list registered for e-Tax payment.

4. Payment to State budget

The taxpayer shall choose the box “State revenue account” or the box “VAT refund withdrawal account” as follows:

- Check the box “State revenue account” if paying taxes, late payment interests, fines or other State budget revenues.

- Check the box “VAT refund withdrawal account” if returning the refunded VAT according to a decision of the competent authority or the taxpayer found that he/she has been refunded not in accordance with regulations of law; excluding the case of returning the refunded VAT due to mistaken or excess payment.

…

Accordingly, the declaration of information on deposit slips (form C1-02/NS) on the Web Portal of the General Department of Taxation in Vietnam shall comply wwith the above regulations.

LawNet