Vietnam: What are the instructions for filling out the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities?

- What are the instructions for filling out the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam?

- What is the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam?

- What is the deadline for submitting PIT finalization dossiers in case individuals directly declare to tax authorities in Vietnam?

What are the instructions for filling out the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam?

According to the instructions of tax authorities on the website of the Hanoi Tax Department on filling out PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam as follows:

* General information section:

[01] Tax period: Record by month/quarter-year of the tax declaration period. In case an individual declares tax quarterly but not a full quarter, he must declare full information from the month ... to month ... in the quarter of the tax declaration period.

(According to the provisions of Points a and b, Clause 2, Article 9 of Decree 126/2020/ND-CP, individuals can choose to monthly or quarterly declare tax and stabilize the end of the calendar year at each tax authority. Particularly in case the individual has chosen to file a quarterly tax declaration, the tax declaration can be adjusted by month of the year if the individual changes their selection).

[02] First time: in case of first-time tax declaration, mark the "x" in the box.

[03] Additional declaration: in case of second-time declaration, write the number of additional declarations in the blank. The number of additional declarations is indicated in digits in the sequence of natural digits (1, 2, 3, ...).

[04] Taxpayer's name: Clearly and fully state the individual's name according to the TIN registration form or the individual's ID card/citizen ID card/passport.

[05] TIN: Clearly and fully state the individual's TIN according to the Tax Registration Certificate or TIN Notice or TIN Card issued by tax authorities.

[06] Address: Clearly and fully state the address of the house and commune number where the individual resides.

[07] District: Records the district of the province/city where the individual resides.

[08] Province/city: Indicates the province/city where the individual resides.

[09] Telephone: Clearly and fully record the individual's phone.

[10] Fax: Clearly and fully state the individual's fax number.

[11] Email: Clearly and fully state the individual's email address.

[12] Name of income-paying organization: Clearly and fully state the name of the income-paying organization (according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate) where the individual receives taxable income.

[13] TIN: Clearly and fully state the tax identification number of the income-paying organization where the individual receives taxable income (if there is a declaration at Entry [12]).

[14] Address: Clearly and fully state the address of the income-paying organization where the individual receives taxable income (if there is a declaration at Entry [12]).

[15] District: Clearly and fully state the name of the district/district of the income-paying organization where the individual receives taxable income (if there is a declaration at entry [12]).

[16] Province/city: Clearly and fully state the name of the province/city of the income-paying organization where the individual receives taxable income (if there is a declaration at Entry [12]).

[17] Name of tax agent (if any): In case an individual authorizes tax declaration for a tax agent, it must clearly and fully state the name of the tax agent according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate.

[18] TIN: Write down the tax agent's full TIN (if there is a declaration at entry [17]).

[19] Tax agency contract: Clearly state the number and date of the tax agency contract between the individual and the tax agent (the contract is performed) (if there is a declaration at entry [17]).

* Declaration of criteria:

Case: Resident individuals with income from salary

[20] Total taxable income arising during the period: Is the sum of taxable incomes from wages, wages and other taxable incomes of the nature of wages and wages received by individuals during the period, including income exempt under the Double Taxation Avoidance Agreement (if any).

[21] Where: Taxable income exempt under the Agreement: Is the sum of taxable incomes from wages, wages and other taxable incomes of the nature of wages and wages exempt from tax under the Double Taxation Avoidance Agreement (if any).

[22] Total deductions: Entry [22] = [23] + [24] + [25] + [26] + [27]

[23] For self: A deduction for yourself as defined by the tax period.

(In case an individual files a tax declaration at many different tax authoritys in a tax period, the individual chooses to calculate the family deduction for themselves at one place).

[24] For dependents: A deduction for dependents as defined in the tax period.

[25] Charitable, humanitarian, and educational promotion: According to the actual number of charitable, humanitarian, and educational contributions during the tax period.

[26] Deductible insurance contributions: Social insurance, health insurance, unemployment insurance, and professional liability insurance for a number of industries that must participate in compulsory insurance as prescribed in the tax period.

[27] Deductible voluntary pension fund contributions: The total amount of contributions to the voluntary pension fund actually incurred does not exceed one (01) million VND/month in the tax period.

[28] Total taxable income: Entry [28] = [20]-[21]-[22]

[29] Total PIT incurred during the period: Entry [29] = [28] x Tax rate according to the Partial Progressive Tariff.

Case: Non-resident individuals with income from salary:

[30] Gross taxable income: is the sum of incomes from wages, wages, and other taxable incomes of a wage nature received by non-resident individuals during the period.

[31] Tax rate: 20%.

[32] Total PIT payable: Entry [32] = [30] x Tax rate of 20%.

What is the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam?

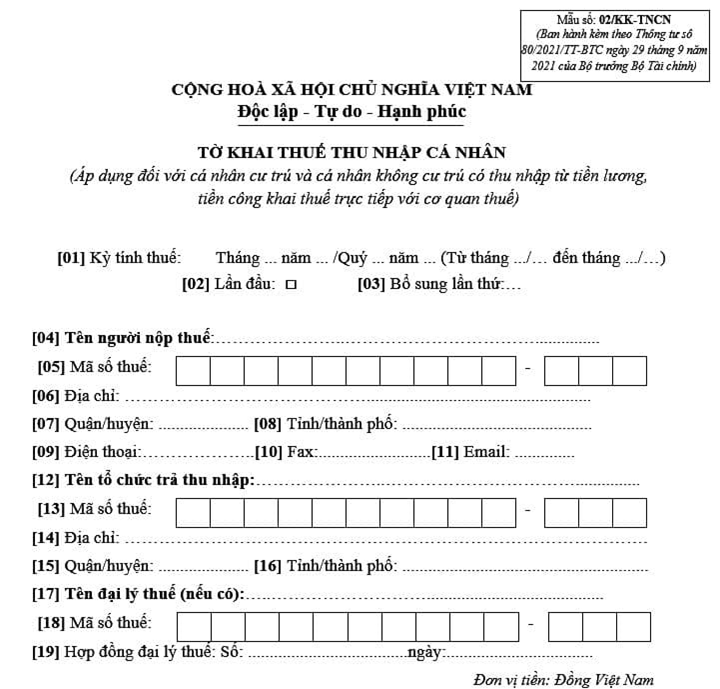

The PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam is Form No. 02/KK-TNCN specified in Appendix II issued together with Circular 80/2021/TT-BTC as follows:

Download the PIT declaration form submitted by individuals with income from salary who directly declare to tax authorities in Vietnam: Here.

.png)

What is the deadline for submitting PIT finalization dossiers in case individuals directly declare to tax authorities in Vietnam?

Pursuant to Section V of Official Dispatch 636/TCT-DNNCN in 2021 as follows:

DEADLINE FOR SUBMISSION OF TAX FINALIZATION DECLARATION

Pursuant to the provisions of Points a and b, Clause 2, Article 44 of the Law on Tax Administration No. 38/2019/QH14 of the National Assembly on the deadline for declaration and submission of PIT finalization dossiers as follows:

- For income-paying organizations: The deadline for submission of PIT finalization dossiers is at least the last day of the 3rd month from the end of the calendar year or fiscal year.

- For individuals directly declaring taxes: The deadline for submitting tax finalization dossiers is at least the last day of the 4th month from the end of the calendar year. In case the deadline for submitting tax finalization dossiers coincides with the prescribed holidays, the deadline for submitting tax finalization dossiers is the next working day. In case an individual incurs a PIT refund but delays in submitting the tax finalization declaration as prescribed, no fine shall be imposed for administrative violations of overdue tax finalization declaration.

Thus, according to the above regulations, the deadline for submitting PIT finalization dossiers in case individuals directly declare to tax authorities in Vietnam is the last day of the 4th month from the end of the calendar year.

LawNet