Vietnam: What are the instructions for filling out the declaration form for PIT finalization - Form No. 05/QTT-TNCN? What does the PIT finalization dossier include?

- What are the instructions for filling out the declaration form for PIT finalization in Vietnam - Form No. 05/QTT-TNCN?

- What does the PIT finalization dossier submitted by income payers in Vietnam include?

- Where will income payers in Vietnam submit their PIT finalization dossiers?

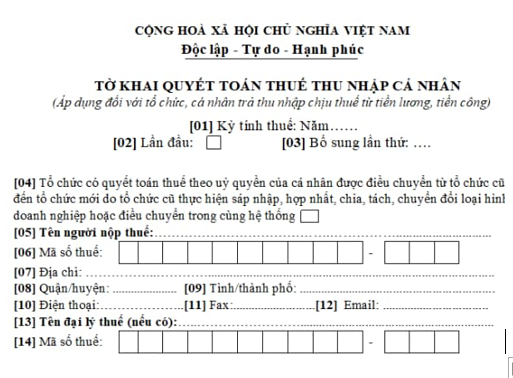

- What is the declaration form for PIT finalization applicable to income payers in Vietnam?

What are the instructions for filling out the declaration form for PIT finalization in Vietnam - Form No. 05/QTT-TNCN?

According to the instructions of the Tax Office on the website of the Hanoi Tax Department on filling out PIT declaration form for individuals with income from salaries who directly declare to tax authorities in Vietnam as follows:

* General information section:

[01] Tax period: Record according to the year of the tax declaration period. Income payers shall finalize PIT ccording to calendar years.

[02] First time: If filing a tax finalization for the first time, mark "x" in the square.

[03] Additional declaration: in case of second-time declaration, write the number of additional declarations in the blank. The number of additional declarations is indicated in digits in the sequence of natural digits (1, 2, 3, ...).

[04] The organization finalizes tax under the authorization by individuals who are transferred from the old organization to the new organization because the old organization merges, consolidates, divides, separates, converts the type of business or transfers in the same system: If any, mark "x" in the square.

[05] Name of taxpayer: Clearly and fully state the name of the organization or individual paying income according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate or Investment Certificate.

[06] TIN: Clearly and fully state the tax code of the organization or individual paying income according to the Tax Registration Certificate or Tax Code Notice.

[07] Address: Clearly and fully state the address of the head office of the organization, the business location of the individual paying income according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate or Investment Certificate.

[08] District: Records the district of the province/city of the organization, the business location of the individual paying income according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate or Investment Certificate.

[09] Province/city: Record the province/city of the organization, business location of the individual paying income according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate or Investment Certificate.

[10] Telephone: Clearly and fully state the phone number of the income payer.

[11] Fax: Clearly and fully write the fax of the organization or individual paying the income.

[12] Email: Clearly and fully state the digital email address of the income payer.

[13] Name of tax agent (if any): In case an income payer is authorized to declare tax finalization to a tax agent, it must clearly and fully state the name of the tax agent according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate.

[14] TIN: Clearly and fully state the tax code of the tax agent according to the Establishment Decision or Business Registration Certificate or Tax Registration Certificate.

[15] Tax agency contract: Clearly and fully state the number and date of the tax agency contract between the organization or individual paying income and the tax agent (ongoing contract).

* Declaration of criteria:

[16] The total number of employees: The total number of individuals receiving income from wages and wages at income payers during the period.

[17] Resident individuals with labor contracts: Is the total number of resident individuals receiving income from wages and wages under labor contracts for 03 months or more at income payers in the period. Target [17] is equal to the number of individuals declared in Appendix form No. 05-1/BK-QTT-TNCN.

[18] Total number of individuals withheld tax: Target [18] = [19] + [20].

[19] Resident individuals: Is the total number of resident individuals for whom the organization or individual paying income has withheld tax during the period. Target [19] is equal to the total number of individuals who have declared deduction (target [22]>0) in Appendix form No. 05-1/BK-QTT-TNCN and the total number of resident individuals who have declared deduction (target [10] vacant and target [15] >0) in Appendix form No. 05-2/BK-QTT-TNCN.

[20] Non-resident individuals: Is the total number of non-resident individuals whose tax-deductible income payer during the period. Target [20] is equal to the total number of non-resident individuals who have declared deduction (target [10] marked "x" and target [15] >0) in Appendix form No. 05-2/BK-QTT-TNCN.

[21] Total number of individuals eligible for tax exemption or reduction under the Double Taxation Avoidance Agreement: The total number of individuals whose taxable income is exempt or reduced from PIT under the Double Taxation Avoidance Agreement. Target [21] is equal to the total number of individuals declared with target [14] > 0 in Appendix form No. 05-1/BK-QTT-TNCN and the total number of declared individuals with target [13] > 0 in Appendix form No. 05-2/BK-QTT-TNCN.

[22] Total number of individuals with personal deduction: Is the total number of dependents for whom the personal deduction is calculated for the individual registered for the personal deduction as prescribed. Target [22] is equal to the total number of dependents on the quota [16] Appendix form No. 05-1/BK-QTT-TNCN.

[23] Gross taxable income (PIT) paid to individuals: Target [23] = [24] + [25].

[24] Resident individuals: Target [24] is equal to the total PIT at the target [12] minus (-) the total PIT at the organization before the transfer declared in the target [13] on the Appendix of form No. 05-1/BK-QTT-TNCN and the total PIT declared at the target [11] corresponding to the target [10] vacant on the Appendix of form No. 05-2/BK-QTT-TNCN.

[25] Non-resident individuals: Target [25] is equal to the total PIT in target [11] corresponding to target [10] marked "x" on Appendix form No. 05-2/BK-QTT-TNCN.

[26] Total taxable income from premiums for life insurance and other optional insurance of insurance enterprises not established in Vietnam for employees: Is the amount of money that income payers to purchase life insurance or other optional insurance with accrual of premiums of insurance enterprises not established in Vietnam for workers.

Target [26] is equal to the total PIT in target [12] on Appendix form No. 05-2/BK-QTT-TNCN.

[27] In which the total taxable income exempted under the provisions of the Petroleum Contract: Is the total taxable income exempted under the provisions of the Petroleum Contract (if any). Target [27] is equal to the total PIT at the target [14] on the Appendix of form No. 05-1/BK-QTT-TNCN and the total PIT at the target [14] on the Appendix of form No. 05-2/BK-QTT-TNCN.

[28] Total PIT paid to individuals subject to tax deduction: Target [28] = [29] + [30].

[29] Residents: Target [29] is equal to the total PIT at the target [12] corresponding to the target [22] >0 on the Appendix to form No. 05-1/BK-QTT-TNCN and the total PIT at the target [11] corresponding to the target [10] vacant and has the target [15] >0 on the Appendix to form No. 05-2/BK-QTT-TNCN.

[30] Non-resident individuals: Target [30] is equal to the total PIT at expenditure [11] corresponding to target [10] marked "x" and has target [15] > 0 on Appendix Form No. 05-2/BK-QTT-TNCN > 0.

[31] Total Personal Income Tax (PIT) deducted: Target [31] = [32] + [33].

[32] Resident individual: Is the amount of PIT that the organization or individual pays the withheld income of the individual residing in the period. Target [32] is equal to the total PIT at target [22] minus the total PIT at target [23] on Appendix form No. 05-1/BK-QTT-TNCN and total PIT at target [15] > 0 corresponding to target [10] vacant on Appendix form No. 05-2/BK-QTT-TNCN.

[33] Non-resident individuals: Target [33] is equal to the total PIT at target [15] corresponding to target [10] marked "x" on Appendix Form No. 05-2/BK-QTT-TNCN.

[34] Total PIT deducted on life insurance premiums and other optional insurance of insurance enterprises not established in Vietnam for employees: Target [34] is equal to the total amount of PIT in target [16] on Appendix form No. 05-2/BK-QTT-TNCN or equal to [26] on declaration 05/QTT- PIT multiplied by (x) 10%

[35] The total number of individuals authorizing organizations and individuals to pay settlement income instead of: Target [35] is equal to the total number of individuals in Target [10] marked "x" on Appendix Form No. 05-1/BK-QTT-TNCN.

[36] Total PIT deducted: Target [36] is equal to the total tax in target [22] corresponding to target [10] marked "x" on Appendix form No. 05-1/BK-QTT-PIT.

[37] In which: Personal income tax amount deducted at the organization before transfer: equal to the total tax amount at target [23] corresponding to target [10] marked "x" on Appendix form No. 05-1/BK-QTT-TNCN

[38] Total PIT payable: equal to the total tax in target [24] corresponding to target [10] marked "x" on Appendix form No. 05-1/BK-QTT-PIT

[39] The total amount of personal income tax exempted by individuals whose tax is still payable after the finalization authorization is VND 50,000 or less: equal to the total tax in target [26] corresponding to target [27] marked "x" on Appendix form No. 05-1/BK-QTT-PIT.

[40] Total PIT payable to the state budget: Is the total amount of tax still payable by individuals authorizing organizations or individuals to pay income to settle on their behalf. Target [40] = ([38] - [36]-[39]) >= 0

What does the PIT finalization dossier submitted by income payers in Vietnam include?

Pursuant to Clause b, Subsection 9.9, Section 9 of Appendix I promulgated together with Decree 126/2020/ND-CP, the PIT finalization dossier submitted by income payers in Vietnam includes”

- Declaration form for PIT finalization made according to form 05/QTT-PIT.

- Appendix to the detailed list of individuals subject to tax calculation according to the partial progressive schedule according to form No. 05-1/BK-QTT-PIT.

- Appendix to thedetailed list of individuals subject to tax calculation at the full tax rate according to form No. 05-2/BK-QTT-PIT.

- Appendix to the detailed list of dependents for personal deduction according to form No. 05-3/BK-QTT-TNCN.

.png)

Where will income payers in Vietnam submit their PIT finalization dossiers?

Pursuant to Clause 1, Article 45 of the Law on Tax Administration 2019, income payers in Vietnam shall submit their PIT finalization dossiers to directly managing tax authorities.

What is the declaration form for PIT finalization applicable to income payers in Vietnam?

Currently, the declaration form for PIT finalization applicable to income payers in Vietnam is specified in Form No. 05/QTT-TNCN issued together with Circular 80/2021/TT-BTC as follows:

Download the declaration form for PIT finalization applicable to income payers in Vietnam: here

LawNet