Vietnam: What are the form of an inspection record of accounting service business activities and the general report form on results therefor?

- What do the documents guiding periodic direct inspection of accounting service business activities in Vietnam include?

- What is the form of an inspection record of accounting service business activities in Vietnam?

- What is the general report form on inspection results of accounting service business activities in Vietnam?

- What is the time limit for conducting a periodic direct inspection of accounting service business activities in Vietnam?

What do the documents guiding periodic direct inspection of accounting service business activities in Vietnam include?

Pursuant to Article 16 of Circular 09/2021/TT-BTC as follows:

Instruction manuals for periodic direct inspection

Instruction manuals for periodic direct inspection, including:

1. Table of criteria for assessment of the inspectee’s conformance to professional standards, accounting regimes, and relevant accounting legislation during the period of provision of accounting services, which is given in Appendix III hereto.

2. The inspection record, given in Appendix IV hereto.

3. The general report on inspection results of accounting service business activities, given in Appendix V hereto.

Accordingly, documents guiding periodic direct inspection of accounting service business activities in Vietnam include:

- Table of criteria for assessment of the inspectee’s conformance to professional standards, accounting regimes, and relevant accounting legislation during the period of provision of accounting services

- The inspection record of accounting service business activities

- The general report on inspection results of accounting service business activities

.png)

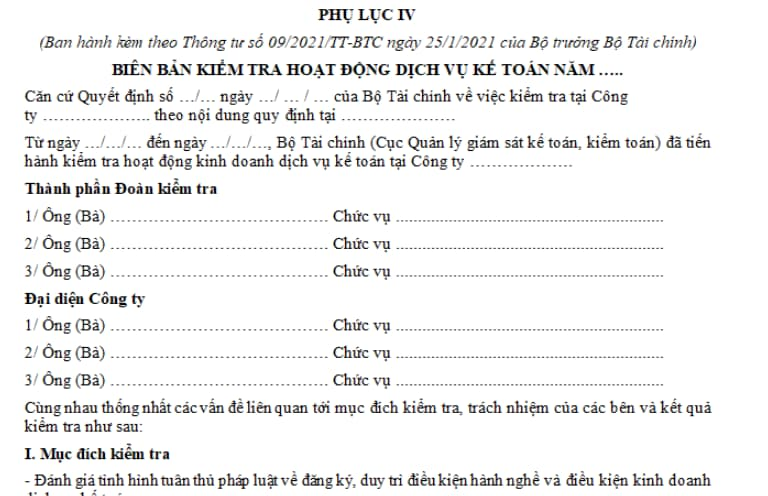

What is the form of an inspection record of accounting service business activities in Vietnam?

Currently, the form of an inspection record of accounting service business activities in Vietnam is specified in Appendix IV enclosed with Circular 09/2021/TT-BTC as follows:

Download the form of an inspection record of accounting service business activities in Vietnam: here.

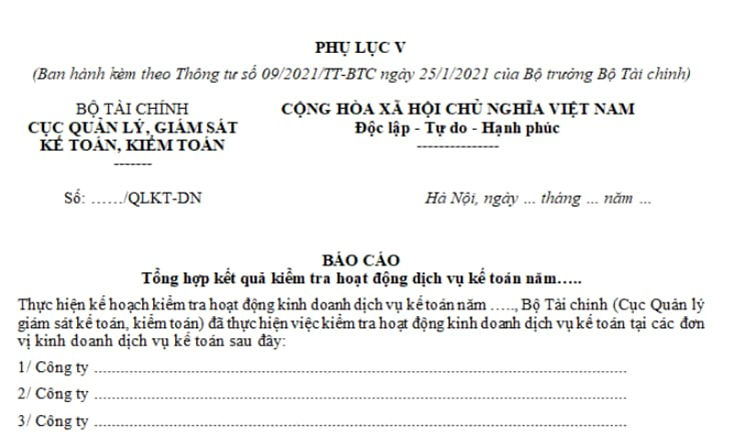

What is the general report form on inspection results of accounting service business activities in Vietnam?

Currently, the general report form on inspection results of accounting service business activities in Vietnam is specified in Appendix V enclosed with Circular 09/2021/TT-BTC as follows:

Download the general report form on inspection results of accounting service business activities in Vietnam: here.

What is the time limit for conducting a periodic direct inspection of accounting service business activities in Vietnam?

Pursuant to Article 7 of Circular 09/2021/TT-BTC as follows:

Time limits for a periodic inspection

1. Time limits

a) A direct inspection shall be conducted every 3 years. This regulation on such time limit is applied to any accounting service provider that, in the 3 consecutive years before the time of inspection, have gained revenue from accounting services each year as stated in their financial statement if their revenue is 20 billion dong or more, and have served at least 100 clients. Revenue earned from accounting services must include revenue gained from accountant services; chief accountant services; services of preparation and representation of financial statements and accounting consulting services;

b) A direct inspection shall be conducted at least every 5 years. This regulation on such time limit shall be applied to any accounting service provider other than those prescribed in point a of clause 1 of this Article.

2. If a conclusion in the minutes on the periodic direct inspection of accounting service business activities of an accounting service provider states that there is any professional error or any violation against accounting standards or professional ethics that causes serious consequences or, in fact, is likely to cause serious consequences, the accounting service provider should be re-inspected 1 or 2 year(s) later.

3. In case where an accounting service provider has already been subjected to an ad-hoc accounting inspection or audit, they shall not be classified as the inspectee of the periodic inspection of accounting service business activities in that year.

Accordingly, the time limit for conducting a periodic direct inspection of accounting service business activities in Vietnam is as follows:

- A direct inspection shall be conducted every 3 years. This regulation on such time limit is applied to any accounting service provider that, in the 3 consecutive years before the time of inspection, has gained revenue from accounting services each year as stated in their financial statement if their revenue is 20 billion dongs or more, and have served at least 100 clients.

- A direct inspection shall be conducted at least every 5 years for accounting service providers not subject to the above regulations.

LawNet